BacklotCars parks another $25 million in Series B round led by NY-based investor

April 15, 2019 | Startland News Staff

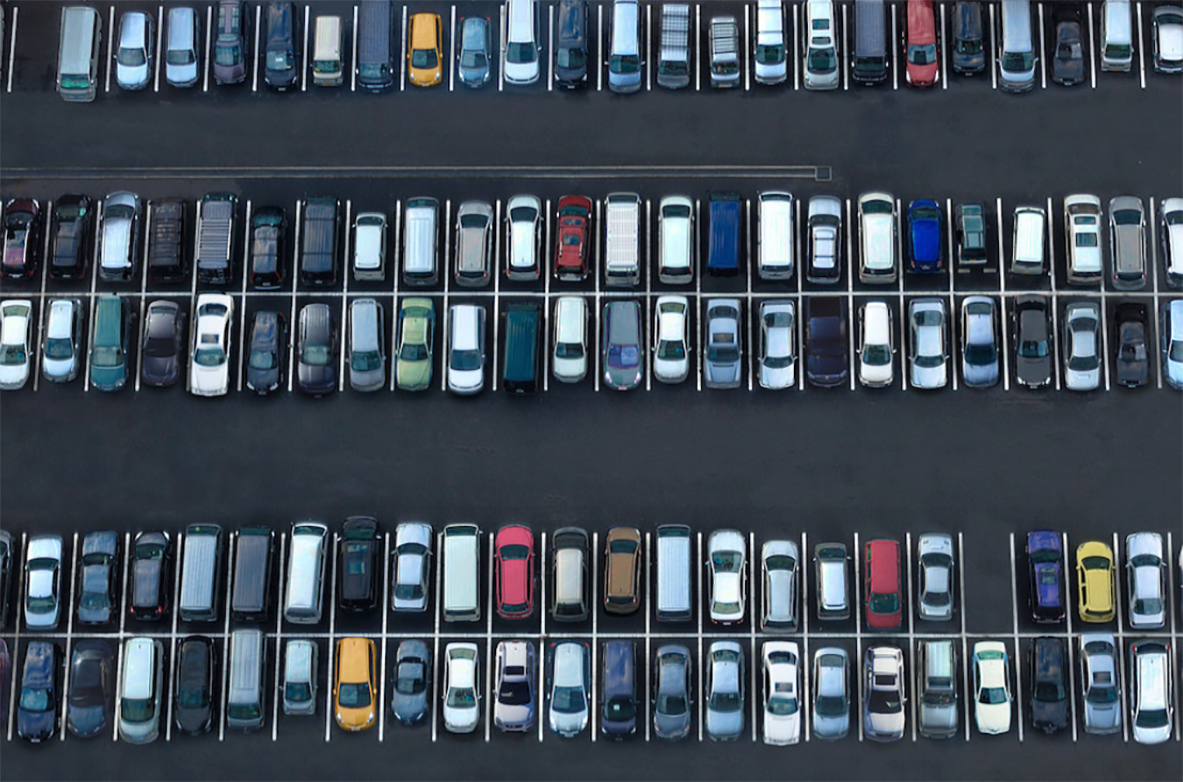

KC-fueled BacklotCars will further its mission to disrupt the wholesale automotive space, thanks to the close of a $25 million Series B funding round, the company announced Monday.

Led by New York-based growth equity firm, Stripes, the round brings BacklotCars — which seeks to ease pain points for automotive wholesalers — to $38 million in funding total since it was founded in 2014.

“We’re excited to have Stripes partnering with us on this next round of funding, as well as the continued support from existing investors,” said Justin Davis, CEO of BacklotCars. “Stripes’ experience with guiding high-growth, tech-driven marketplaces will be helpful as we double down on our mission of making wholesale easy.”

Backlot Cars’ latest round saw continued support from KCRise Fund, the company said, in addition to another seven existing investors that included: Origin Ventures, Pritzker Group Venture Capital, Revolution’s Rise of the Rest Seed Fund, Royal Street Ventures, and Chaifetz Group.

“We are thrilled to be joining the BacklotCars team,” said Saagar Kulkarni, Principal at Stripes. “The BacklotCars marketplace, combined with its transportation and financing products, is a complete solution for dealers. We believe their tremendous growth is proving that car dealers want a digital marketplace for buying and selling inventory. We look forward to partnering with Justin and the team as they continue to expand their footprint and create value for dealers nationwide.”

Rapidly raising, the Crossroads-based company closed on an $8 million Series A round in December 2018.

Click here to read about the previous funding round.

“We have a talented team of problem solvers here that gets things done,” Nathan Sterner, growth and marketing manager, said of the company’s growth mindset at the time.

With it latest cash infusion, BacklotCars will continue its expansion, promising to enhance current products, expand inventory, and create additional resources focused on dealer success, Davis said.

“We’re focused on building one platform for all dealers to transact efficiently, not just a new version of the same old auction,” he said.

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

KC Tech Council: ‘No Coast’ aims to prove landlocked doesn’t mean limited for local tech industry

Kansas City has been “punching above its weight” since the days of covered wagons, said Ryan Weber, noting the tech industry specifically has an impact of almost $11 billion a year on KC’s local economy. “Nationally, our profile has risen so much,” said Weber, president of the KC Tech Council which works to support the…

KC angels pile in with $2.74M funding raise for Matt Watson’s Stackify

A team of six local angel investors has pushed Kansas City-sourced Stackify past the $2 million mark in the company’s latest funding raise, Matt Watson announced Wednesday. “We are using the funds to continue our aggressive growth plans,” Watson, founder and CEO, said of the raise. Uploaded onto the startup scene in 2012, Stackify has…

Smart strategy generates wins for Evergy Ventures — KC’s quiet investment powerhouse

Editor’s note: The following content is sponsored by Evergy Ventures but independently produced by Startland News. As two long-standing utility companies merge, they’re creating a new kind of energy for GXP Investments — now known as Evergy Ventures — said Dennis Odell, announcing a rebrand of the investment firm. “GXP Investments — GXP — it…