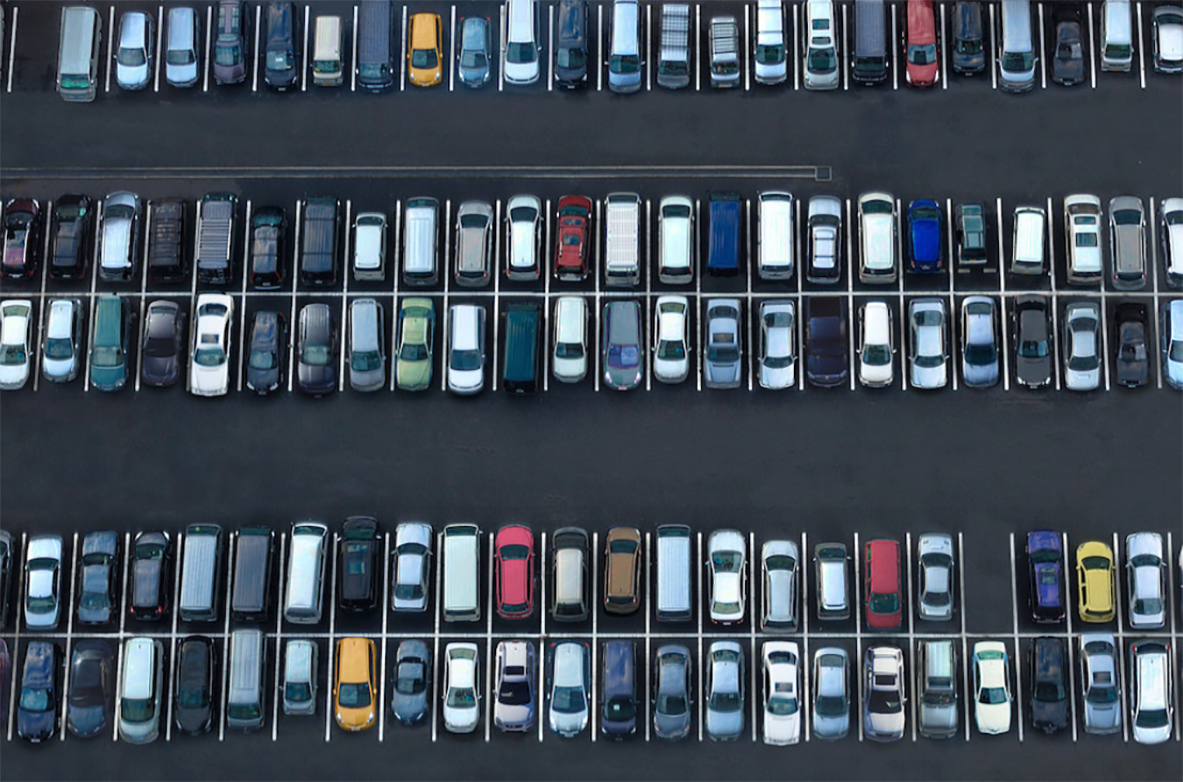

BacklotCars parks another $25 million in Series B round led by NY-based investor

April 15, 2019 | Startland News Staff

KC-fueled BacklotCars will further its mission to disrupt the wholesale automotive space, thanks to the close of a $25 million Series B funding round, the company announced Monday.

Led by New York-based growth equity firm, Stripes, the round brings BacklotCars — which seeks to ease pain points for automotive wholesalers — to $38 million in funding total since it was founded in 2014.

“We’re excited to have Stripes partnering with us on this next round of funding, as well as the continued support from existing investors,” said Justin Davis, CEO of BacklotCars. “Stripes’ experience with guiding high-growth, tech-driven marketplaces will be helpful as we double down on our mission of making wholesale easy.”

Backlot Cars’ latest round saw continued support from KCRise Fund, the company said, in addition to another seven existing investors that included: Origin Ventures, Pritzker Group Venture Capital, Revolution’s Rise of the Rest Seed Fund, Royal Street Ventures, and Chaifetz Group.

“We are thrilled to be joining the BacklotCars team,” said Saagar Kulkarni, Principal at Stripes. “The BacklotCars marketplace, combined with its transportation and financing products, is a complete solution for dealers. We believe their tremendous growth is proving that car dealers want a digital marketplace for buying and selling inventory. We look forward to partnering with Justin and the team as they continue to expand their footprint and create value for dealers nationwide.”

Rapidly raising, the Crossroads-based company closed on an $8 million Series A round in December 2018.

Click here to read about the previous funding round.

“We have a talented team of problem solvers here that gets things done,” Nathan Sterner, growth and marketing manager, said of the company’s growth mindset at the time.

With it latest cash infusion, BacklotCars will continue its expansion, promising to enhance current products, expand inventory, and create additional resources focused on dealer success, Davis said.

“We’re focused on building one platform for all dealers to transact efficiently, not just a new version of the same old auction,” he said.

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Troost coffee shop ‘broken into pieces’ by collision; caffeinated supporters jump to action

A community of customers and neighbors is rallying behind Anchor Island Coffee this week after a pickup truck barreled into the front entrance of the tropical-themed breakfast spot at 41st and Troost. Fortunately no one was injured in the after-hours incident, said co-owner Armando Vasquez, who noted he was the last person to leave the…

KC innovator’s anti-itch spray so natural it was discovered on a front porch lab

Homindy founder Ronan Molloy discovered the benefits of his company’s itch relief spray somewhat by accident. During the summer of 2020, Molloy volunteered to participate in a clinical study for a tea with all-natural ingredients that was supposed to reduce inflammation in his right knee. At that time, he was president of the Innovation Stockyard,…

KC capital implants cattle tech startup with fuel to scale, expanding IVF labs, headcount

Livestock production has seen a remarkable transformation since Kerryann Kocher was growing up on her family’s sixth-generation farm in northeast Iowa, the Vytelle CEO said. Instead of just selecting the cow that looks best and bringing in the neighbor’s bull for breeding, as she remembers it, Kocher and Vytelle — a Kansas City-based precision livestock…

Venture experts: Getting your first check in KC is too difficult, but a record influx of coastal investors isn’t a bad substitute

A new report on Kansas City’s venture-backed companies showed year-over-year growth in multiple areas — impressing industry experts who identified key investment trends in the data. More companies with venture capital backing; higher employee counts; a 58 percent boost in fundraising. Yet growth was not universal. Despite gains in top-line figures, the number of Kansas City-based…