BacklotCars parks another $25 million in Series B round led by NY-based investor

April 15, 2019 | Startland News Staff

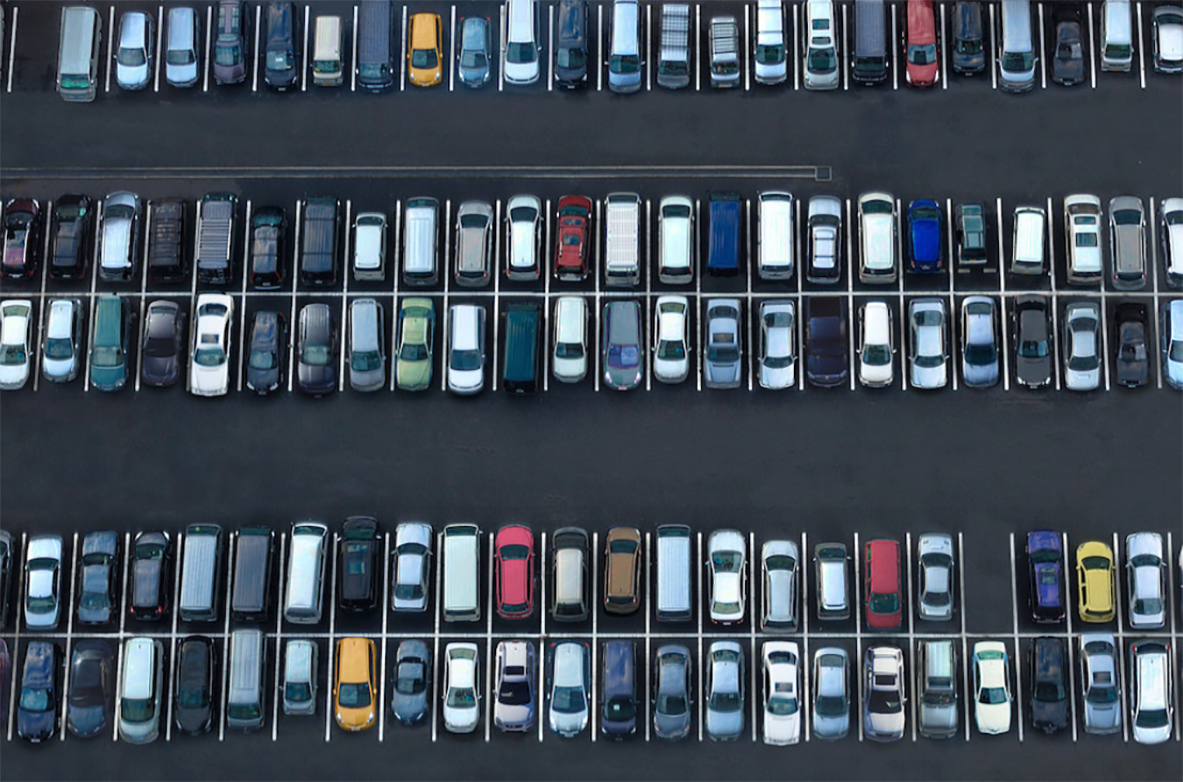

KC-fueled BacklotCars will further its mission to disrupt the wholesale automotive space, thanks to the close of a $25 million Series B funding round, the company announced Monday.

Led by New York-based growth equity firm, Stripes, the round brings BacklotCars — which seeks to ease pain points for automotive wholesalers — to $38 million in funding total since it was founded in 2014.

“We’re excited to have Stripes partnering with us on this next round of funding, as well as the continued support from existing investors,” said Justin Davis, CEO of BacklotCars. “Stripes’ experience with guiding high-growth, tech-driven marketplaces will be helpful as we double down on our mission of making wholesale easy.”

Backlot Cars’ latest round saw continued support from KCRise Fund, the company said, in addition to another seven existing investors that included: Origin Ventures, Pritzker Group Venture Capital, Revolution’s Rise of the Rest Seed Fund, Royal Street Ventures, and Chaifetz Group.

“We are thrilled to be joining the BacklotCars team,” said Saagar Kulkarni, Principal at Stripes. “The BacklotCars marketplace, combined with its transportation and financing products, is a complete solution for dealers. We believe their tremendous growth is proving that car dealers want a digital marketplace for buying and selling inventory. We look forward to partnering with Justin and the team as they continue to expand their footprint and create value for dealers nationwide.”

Rapidly raising, the Crossroads-based company closed on an $8 million Series A round in December 2018.

Click here to read about the previous funding round.

“We have a talented team of problem solvers here that gets things done,” Nathan Sterner, growth and marketing manager, said of the company’s growth mindset at the time.

With it latest cash infusion, BacklotCars will continue its expansion, promising to enhance current products, expand inventory, and create additional resources focused on dealer success, Davis said.

“We’re focused on building one platform for all dealers to transact efficiently, not just a new version of the same old auction,” he said.

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Education network CAPS snags $145K from Kauffman Foundation

A homegrown education innovation network announced Wednesday it was awarded a $145,000 grant to expand its programming across the nation, courtesy of the Ewing Marion Kauffman Foundation. The Center for Advanced Professional Studies (CAPS) program began in the Blue Valley School District in 2009 and is now expanded to 33 programs encompassing 69 school districts…

Pioneering KCI airport vote should help land top talent, startup leaders say

Capping a six-year journey fraught with turbulence, delays and political drama, voters overwhelmingly ratified plans to build a new $1.3 billion airport terminal, which would replace the existing Kansas City International Airport (KCI). “Kansas City has never been about being just mediocre,” said Michael Wilson, founder of luxury watch brand Niall and a frequent traveler…

WillCo Tech’s sale allows founder guilt-free $200K investment in smart grid startup

Selling a majority stake in his IT consulting firm will allow Kevin Williams to focus on and expand his startup venture, the Kansas City tech entrepreneur said. Although the exact amount was undisclosed, the acquisition by Ohio-based Metisentry earlier this month provided a big enough payoff to fund Williams’ and his wife’s future retirement, as…

After $2.95M round, corporate deal ensures word-of-mouth marketing for RiskGenius

RiskGenius’ $2.95 million series A extension funding round is worth more than its face value, said CEO Chris Cheatham. The round was led by QBE Ventures, an Australia-based firm known as being among the world’s top 20 insurance companies. In addition to the funds, QBE North America will be the first division to fully implement…