Prestio founder dissolves headaches of business closings, pivots with Liquify Group

March 5, 2019 | Austin Barnes

Closing a brick-and-mortar space is difficult enough, said Glen Dakan. Why should entrepreneurs be forced to endure the pains of offloading expensive equipment too?

Such a predicament prompted Dakan and his partners to create a remedy for the common pain point: Liquify Group, a newly launched service that helps businesses liquidate their assets through a simple, online or offline process. Sellers are connected with buyers via the platform, said Dakan, co-founder of Liquify Group and CEO of Prestio, an internet car sales startup.

Click here to learn how Prestio is innovating the internet car buying space.

“[Liquify Group] helps the business owners not have to worry about a big headache. And it also helps the people looking to start their next business or their next restaurant [buy equipment at about] 50 percent off of retail,” he explained, noting the solution to what he called a “triple pain point.”

It’s pain he’s experienced first hand, Dakan said. He reached out to a friend for help a few years ago when it was time to close his luxury Crossroads car dealership, Dakan explained.

The two combined forces to form Liquify Group, which is operated by Dakan’s wife, Kelli, who serves as CEO.

“We had unique skill sets to make this model happen and, through word of mouth, more business owners came to us and said, ‘Hey, you know, I’m really in a bind here, can you help me out?’ And it just kinda grew from there.’”

With unlimited opportunity, Liquify Group also helps businesses that have scaled and are looking to relocate, Dakan added, noting that the community resource startup isn’t limited to assisting only bankrupt of failed ventures.

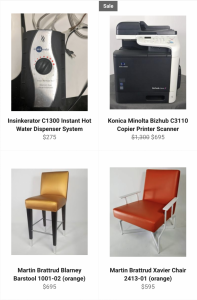

Click here to browse Liquify Group’s current listings.

Officially launched in January, Liquify Group held its first office liquidation sale last month. Such an event aims to increase exposure of Liquify Group’s efforts, an effort the company is heavily focused on as they look to build clients in “lean startup mode,” Dakan said.

Offering a much-needed community resource, Dakan said, he believes Liquify Group can save Kansas City small businesses money and enable local entrepreneurs to make more efficient use of their time.

2019 Startups to Watch

stats here

Related Posts on Startland News

C2FO launches empowerment grants to boost Black-owned businesses, entrepreneurs

A new grant program from one of Kansas City’s most high profile scaleups is expected to empower — and help fund — three nonprofit organizations serving Black-owned businesses and entrepreneurs, said Jessie Fields. “We know small business owners, and especially diverse business owners, face so many challenges,” said Fields, director of talent development and DEI…

Cassie Taylor is just getting queerer and weirder (and thanks to a wild 72 hours, she’s now a Playboy Bunny)

Be your authentic self, said Cassie Taylor, even if that means losing people along the way. “The biggest thing I’ve learned in the music industry is that if you’re not authentic, it is not sustainable — you’ll burn out fast. During the pandemic, I lost a lot of friends because I was very vocal about…

Pitch contest winners salute PHKC as fourth cohort wraps; $15K in prizes awarded to small businesses

A winning night at The Porter House KC’s pitch event this week expands opportunity for more than just the company taking home the biggest check, said Taylor Burris. AI Hub — led by Burris and her husband, James Spikes — earned first place and $8,000 in the competition, which also marked the completion of PHKC’s…

KCRise Fund closes $34M Fund III with ‘hyper-local’ focus; Here are its first four investments

A third venture capital fund — expected to invest $34 million in 20 more tech startups across the Kansas City region — builds on KCRise Fund’s thesis that high-growth local companies are the key to investor success, said Ed Frindt. It’s a competitive advantage that swells with each wave of funding, he added, announcing the…