New $750K investment round for Lula comes with partner in apartment management

February 5, 2019 | Elyssa Bezner

Closing a $750,000 seed round is even more impactful with a strategic partner like Worcester Investments, said Lula founder Bo Lais.

“We did have three other private investors, that were minority investors with two of them local, but it’s [become] more than just investment with [with Worcester],” said Lais, CEO of the Overland Park-based home services tech startup. “When you’re raising money, [it’s crucial to] find investors that really believe in what you’re trying to do and share your vision.”

Click here to read about Lula’s partnership with Platinum Realty.

Worcester — a KC-based real estate investment company — approached Lais in October with an idea to add property managment tools to the single family-focused platform, he said, explaining the integration of Lula into the firm’s beta-stage resident and landlord communication tool, Super Renter.

Through Super Renter, residents get immediate answers to questions and can pay rent, Lais added, noting the integration of Lula is expected to provide the ability to request maintenance repairs as well.

“Until this point, we’ve really been focused on the single family homes in that [business-to-consumer] model in which we’ve got traction,” said Lais, explaining Lula’s position before Worcester. “We were seeing revenue growth month over month, but it had been slower than we had hoped.”

Lula is now onboarding 250 of the 3,500 apartments managed by Worcester with plans to take the full amount by the end of 2019, said Lais, noting the multi-family space is expected to produce a new revenue stream through a cost per unit per month model.

“Once we work out the kinks and we feel like our product is ready to roll, we plan on selling our platform to other partners and selling this type to other property managers by the end of 2019,” he said. “We expect by that by the end of 2019 and especially in 2020, to really ramp up our revenue numbers significantly.”

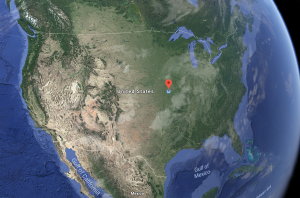

Single-family consumers are still very much a significant piece to Lula’s base, he added, noting the expectation to enter into at least five additional markets by the end of 2019 to effectively “capture the Midwest.”

Finally executing on platform roll out in St. Louis and Arkansas is top of mind, Lais explained, with further plans to move Lula into Wichita, Tulsa, Chicago, and Austin markets.

“We’re actually hiring more people so we can accomplish that quicker,” he said.

2019 Startups to Watch

stats here

Related Posts on Startland News

Nearly $5M remains in Kansas angel tax credits as Aug 31 deadline looms; startups urged to apply

The clock is ticking for Kansas angel tax credits to be awarded to growing startups in 2018, said Rachèll Rowand. “We are looking for innovative businesses in Kansas that are under five years old,” said Rowand, program manager for the Kansas Department of Commerce, which administers the state’s angel tax program. “The biotechnology industry is…

Startland list reflects big wins across KC — but don’t get comfortable, warns founder

Kansas City has traction, said Davyeon Ross, but the city and its support network must keep the ball moving. “It’s impressive how much these startups and companies are contributing to the community and the economy,” said Ross co-founder and COO of ShotTracker, reacting to data within Startland’s 2018 list of Top Venture Capital-Backed Companies in…

Think globally, invest locally: Are KC dollars worth more than outside capital?

Hometown capital is validating, said Darcy Howe, but it isn’t everything. Half of the firms in Startland’s 2018 list of Top Venture Capital-Backed Companies in Kansas City received 50 percent or more of their funding from KC investors — a promising indicator of local support that suggests to outside investors that a company is ready…