Kauffman launching Capital Access Lab investment pipeline for underserved entrepreneurs

February 13, 2019 | Elyssa Bezner

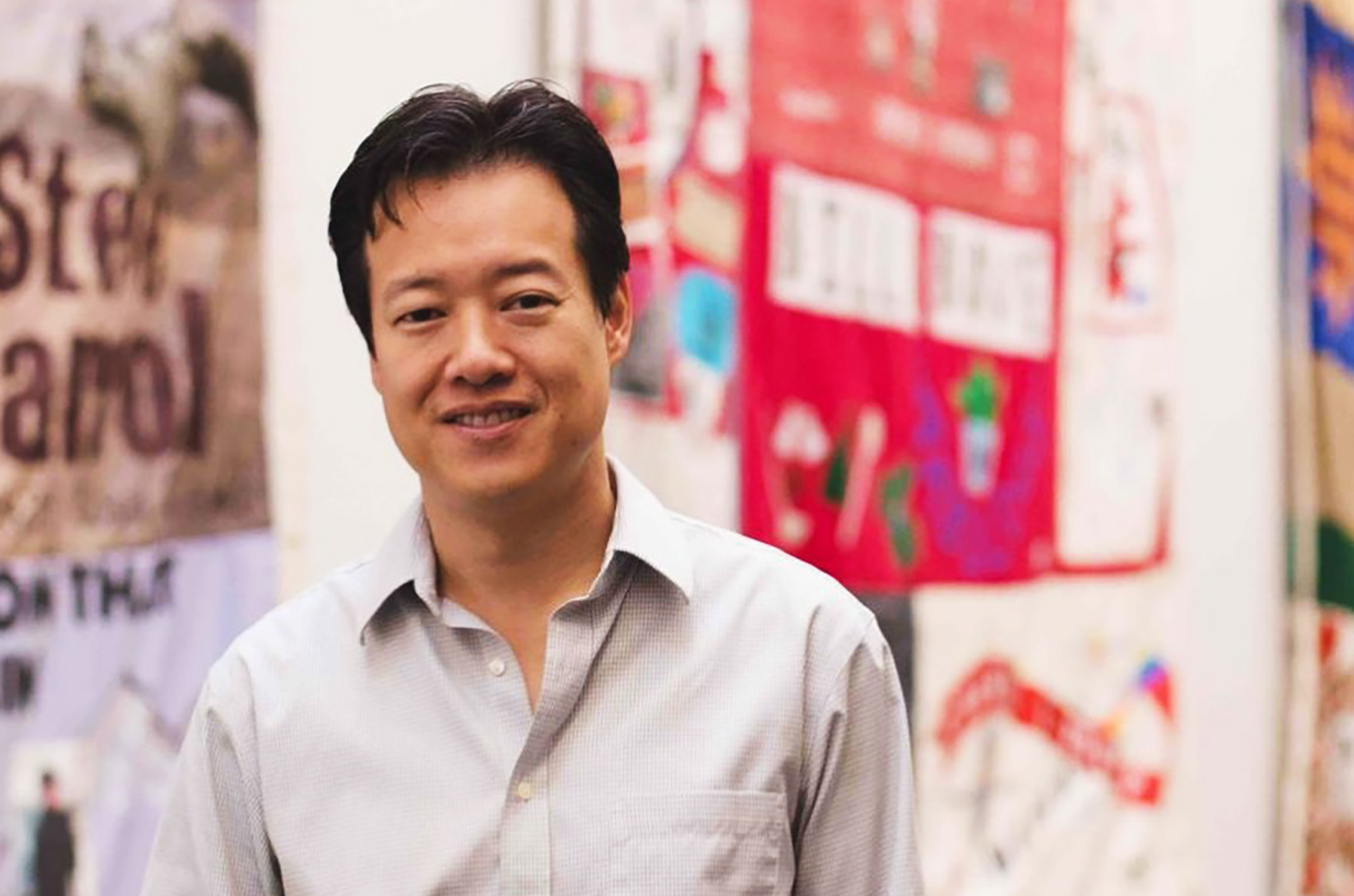

Every new business should have a fighting chance at success — regardless of the entrepreneur’s background, said Victor Hwang, announcing a new Capital Access Lab to address opportunity gaps in Kansas City and across the U.S.

“It is up to us to collectively break down systematic barriers to entry that adversely impact people of color, women, and entrepreneurs with limited wealth,” said Hwang, vice president of entrepreneurship for the Ewing Marion Kauffman Foundation. “The Kauffman Foundation is taking a proactive step in the creation of the Capital Access Lab to build a pipeline to fund investments for underserved entrepreneurs.”

The national program is fueled by a $3 million allocation, which is expected to be distributed to three to five investment funds targeting underserved entrepreneurs in injection sizes of $250,000 to $1 million, according to a press release.

Eighty-three percent of entrepreneurs are underserved or ignored by traditional funding sources, Hwang told a crowd gathered Tuesday for a Fountain Innovation Fund dinner, citing a new Kauffman Foundation report.

“[This report shows] that we should either expand the other pieces to get that 17 percent wider access or to implement alternative ways to get capital to those people,” he said. “[At the Capital Access Lab,] we’re going to look at how we can create new capital models.”

Additional statistics from the Kauffman report:

- Almost 65 percent of entrepreneurs rely on personal and family savings for startup capital.

- Only about 9 percent of proposals submitted to angel investors came from women entrepreneurs.

- Black entrepreneurs’ loan requests are three times less likely to be approved than white entrepreneurs.

Click here to read the executive summary of the report — “State of Access to Capital for Entrepreneurs: From Barriers to Potential” — which expected to be released later in 2019.

The Kansas City entrepreneurial community already has “stepped on the gas” in terms of capital assets since 2015, Hwang said, citing an increase of capital for entrepreneurs by 290 percent in equity funding.

“If you look at the rankings, [Kansas City] is still 24th out of 30 in terms of major cities with access to adequate financing for the growth of businesses,” he said. “There’s still quite a ways to go.”

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

DevOpsDays brings two-day grassroots tech conference back to Kansas City

DevOpsDays KC is returning this week with an open spaces concept wherein audience members at the two-day conference vote on the topics to cover in real time, said Ryan McNair. Topics with the most votes create zones in the space in which the audience can flow freely from each area. “If you don’t like it,…

Privacy in practice: Responding to daily cyber threats sharpens Polsinelli tech team

Editor’s note: The following content is sponsored by Polsinelli PC but independently produced by Startland News. We see the fallout nearly every day. Another company, government or celebrity that’s been technologically compromised, prompting officials to scramble on how to best calm customers, citizens and stakeholders. And when you lead one of the nation’s top cybersecurity…

Pint-sized perspective: KC’s Little Hoots takes nostalgia-capturing tech to MIT

From the cute and comedic to the whimsical and wise, every parent can pinpoint a Little Hoots moment that relates to their personal adventure in child-rearing, said Lacey Ellis, founder and CEO of the Kansas City-birthed mobile app that recently turned heads at MIT. “If a picture is worth a thousand words, a hoot is…

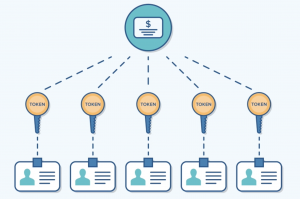

LaunchKC winner bringing cryptocurrency into the investment game with Liquifi

A blockchain-enabled solution from Venture360, called Liquifi, aims to unfreeze startups paralyzed by a lack of access to capital, Rachael Qualls said with excitement. “The main reason more people don’t invest in private companies is there is no way to get money out,” said Qualls, CEO of Venture360. “On average money is tied up for…