Kauffman launching Capital Access Lab investment pipeline for underserved entrepreneurs

February 13, 2019 | Elyssa Bezner

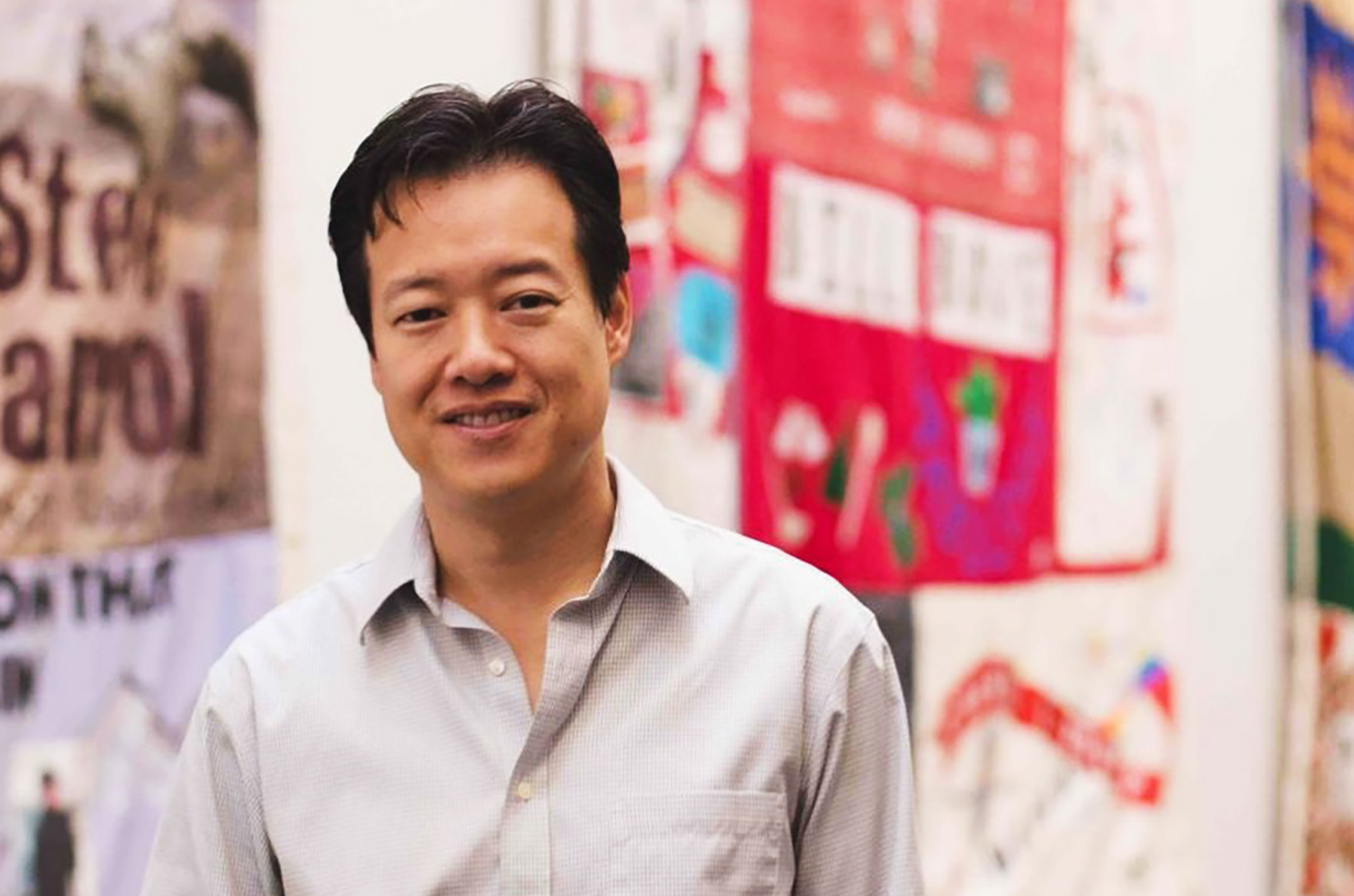

Every new business should have a fighting chance at success — regardless of the entrepreneur’s background, said Victor Hwang, announcing a new Capital Access Lab to address opportunity gaps in Kansas City and across the U.S.

“It is up to us to collectively break down systematic barriers to entry that adversely impact people of color, women, and entrepreneurs with limited wealth,” said Hwang, vice president of entrepreneurship for the Ewing Marion Kauffman Foundation. “The Kauffman Foundation is taking a proactive step in the creation of the Capital Access Lab to build a pipeline to fund investments for underserved entrepreneurs.”

The national program is fueled by a $3 million allocation, which is expected to be distributed to three to five investment funds targeting underserved entrepreneurs in injection sizes of $250,000 to $1 million, according to a press release.

Eighty-three percent of entrepreneurs are underserved or ignored by traditional funding sources, Hwang told a crowd gathered Tuesday for a Fountain Innovation Fund dinner, citing a new Kauffman Foundation report.

“[This report shows] that we should either expand the other pieces to get that 17 percent wider access or to implement alternative ways to get capital to those people,” he said. “[At the Capital Access Lab,] we’re going to look at how we can create new capital models.”

Additional statistics from the Kauffman report:

- Almost 65 percent of entrepreneurs rely on personal and family savings for startup capital.

- Only about 9 percent of proposals submitted to angel investors came from women entrepreneurs.

- Black entrepreneurs’ loan requests are three times less likely to be approved than white entrepreneurs.

Click here to read the executive summary of the report — “State of Access to Capital for Entrepreneurs: From Barriers to Potential” — which expected to be released later in 2019.

The Kansas City entrepreneurial community already has “stepped on the gas” in terms of capital assets since 2015, Hwang said, citing an increase of capital for entrepreneurs by 290 percent in equity funding.

“If you look at the rankings, [Kansas City] is still 24th out of 30 in terms of major cities with access to adequate financing for the growth of businesses,” he said. “There’s still quite a ways to go.”

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Startup synergy: Native Hemp Co opening retail store in former downtown MADE flagship store

A grand adventure awaits Kansas City-baked Native Hemp Co., as the cannabis company reaches new heights and sets up shop with its first retail location. “I have a family all across the world now and it’s been so much fun,” Rich Dunfield, founder of Native Hemp Co., said of the company’s trajectory and success ahead…

Railroad remedy: Fishtech-backed app could bring added efficiency to local transit system

What started out as a joke between coworkers at Fishtech Group, could solve a community-wide pain point in Martin City — and beyond, explained Michael Wilson. “Every single day there’d be a train come by, blowing its horn, interrupting us on conference calls and they would also make a lot of people late for meetings,”…

Q&A: Startup life isn’t all risk-taking and sexy, big-name investors, Kelly Sievers says

Investing doesn’t just hinge a dollar amount, said Kelly Sievers. “It’s also about finding the right kind of funding for your business,” the Women’s Capital Connection managing director told 26 small business owners at a recent Kansas City SCORE mentoring event. Sievers, an entrepreneurial advisor for the Women’s Business Center, has owned, operated and sold…