Kauffman launching Capital Access Lab investment pipeline for underserved entrepreneurs

February 13, 2019 | Elyssa Bezner

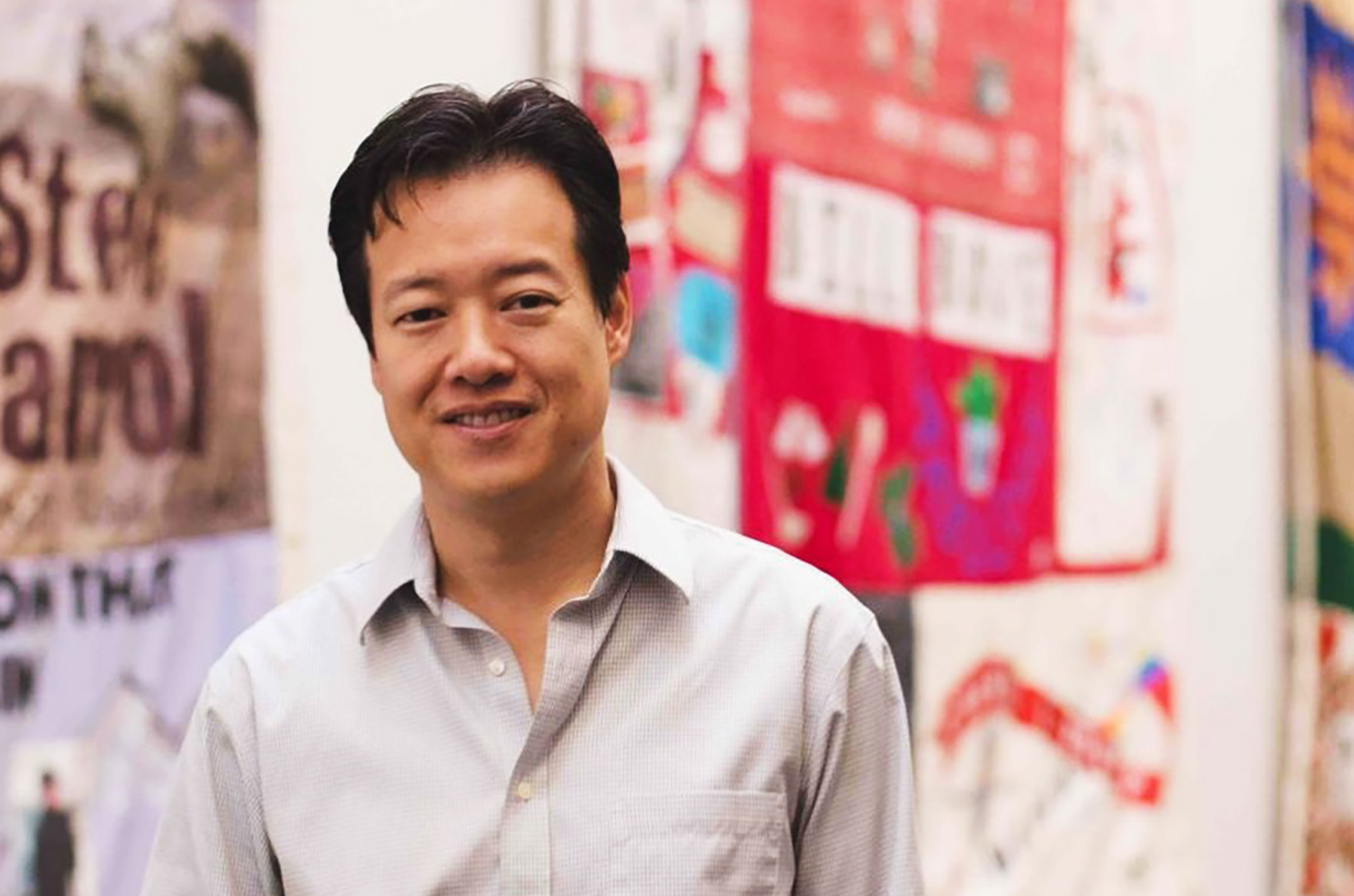

Every new business should have a fighting chance at success — regardless of the entrepreneur’s background, said Victor Hwang, announcing a new Capital Access Lab to address opportunity gaps in Kansas City and across the U.S.

“It is up to us to collectively break down systematic barriers to entry that adversely impact people of color, women, and entrepreneurs with limited wealth,” said Hwang, vice president of entrepreneurship for the Ewing Marion Kauffman Foundation. “The Kauffman Foundation is taking a proactive step in the creation of the Capital Access Lab to build a pipeline to fund investments for underserved entrepreneurs.”

The national program is fueled by a $3 million allocation, which is expected to be distributed to three to five investment funds targeting underserved entrepreneurs in injection sizes of $250,000 to $1 million, according to a press release.

Eighty-three percent of entrepreneurs are underserved or ignored by traditional funding sources, Hwang told a crowd gathered Tuesday for a Fountain Innovation Fund dinner, citing a new Kauffman Foundation report.

“[This report shows] that we should either expand the other pieces to get that 17 percent wider access or to implement alternative ways to get capital to those people,” he said. “[At the Capital Access Lab,] we’re going to look at how we can create new capital models.”

Additional statistics from the Kauffman report:

- Almost 65 percent of entrepreneurs rely on personal and family savings for startup capital.

- Only about 9 percent of proposals submitted to angel investors came from women entrepreneurs.

- Black entrepreneurs’ loan requests are three times less likely to be approved than white entrepreneurs.

Click here to read the executive summary of the report — “State of Access to Capital for Entrepreneurs: From Barriers to Potential” — which expected to be released later in 2019.

The Kansas City entrepreneurial community already has “stepped on the gas” in terms of capital assets since 2015, Hwang said, citing an increase of capital for entrepreneurs by 290 percent in equity funding.

“If you look at the rankings, [Kansas City] is still 24th out of 30 in terms of major cities with access to adequate financing for the growth of businesses,” he said. “There’s still quite a ways to go.”

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Filling a capital void: AltCap builds capacity, momentum after its busiest year to date

Editor’s note: The following story is sponsored by Academy Bank, a Kansas City based community bank, and is part of a series of features spotlighting some of the bank’s startup and small business partners. The past 18 months have been a critical turning point for AltCap, said Ruben Alonso, as the nonprofit has grown to…

MO tech jobs pay double the state’s average wage, fueling economic growth, new report says

Missouri’s tech industry remains a driving economic force despite widespread job loss and economic turmoil caused by COVID-19, according to a new report that details how the Show Me State is outpacing national tech growth. Among the report’s key takeaways: Average earnings for all jobs in Missouri was $64,000 in 2020, while the average earnings of…

Why a KC real estate icon is letting urban artists spray paint his high-profile Plaza building (again)

A massive, five-story mural project launched on the Country Club Plaza in late 2020 will grow even bigger over the next week, painting the potential for more representation in an otherwise traditional — and earth tone — Kansas City shopping district and neighborhood. “It adds a lot of conversation and excitement — and it shows an opportunity…