Kauffman launching Capital Access Lab investment pipeline for underserved entrepreneurs

February 13, 2019 | Elyssa Bezner

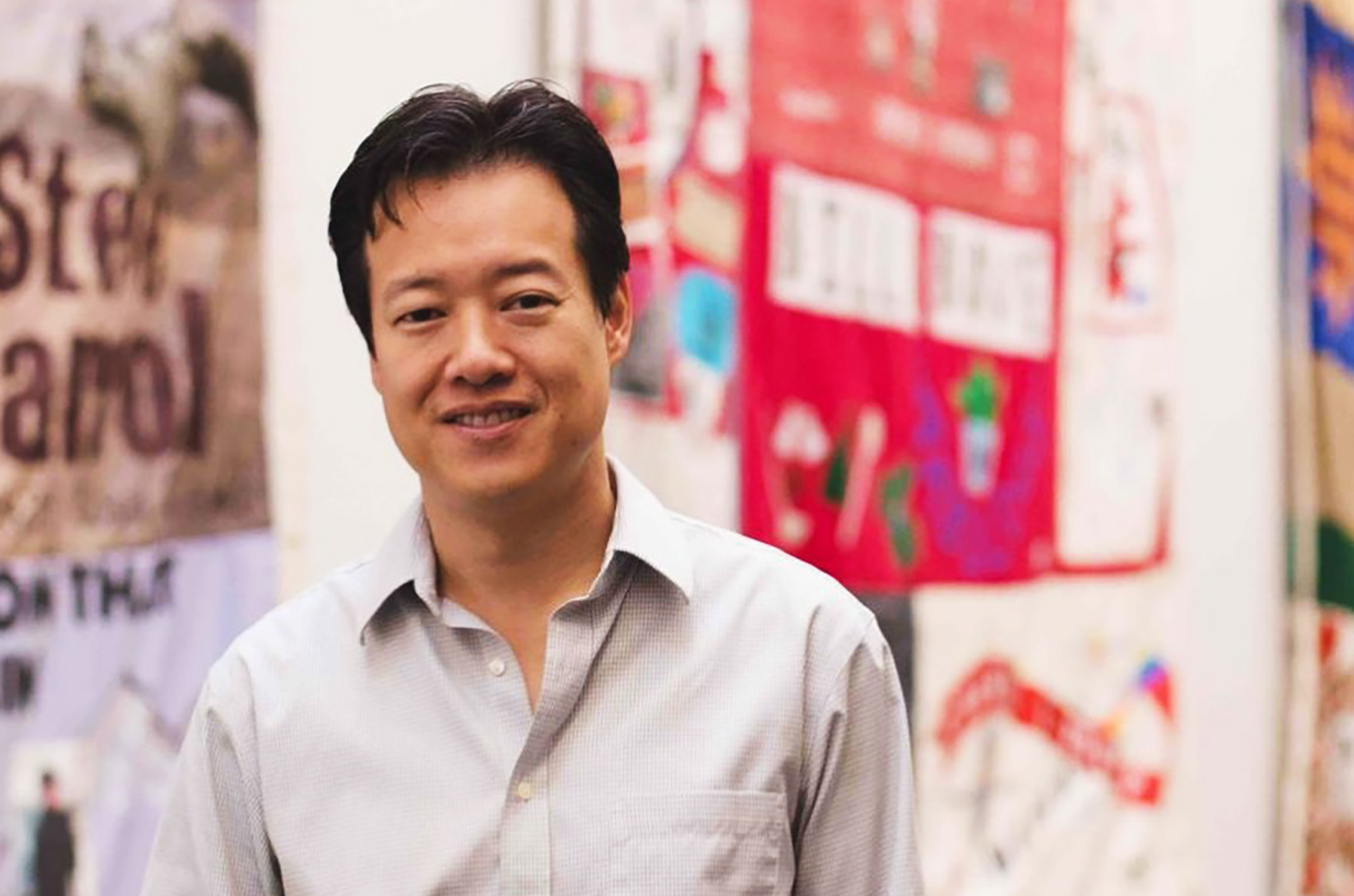

Every new business should have a fighting chance at success — regardless of the entrepreneur’s background, said Victor Hwang, announcing a new Capital Access Lab to address opportunity gaps in Kansas City and across the U.S.

“It is up to us to collectively break down systematic barriers to entry that adversely impact people of color, women, and entrepreneurs with limited wealth,” said Hwang, vice president of entrepreneurship for the Ewing Marion Kauffman Foundation. “The Kauffman Foundation is taking a proactive step in the creation of the Capital Access Lab to build a pipeline to fund investments for underserved entrepreneurs.”

The national program is fueled by a $3 million allocation, which is expected to be distributed to three to five investment funds targeting underserved entrepreneurs in injection sizes of $250,000 to $1 million, according to a press release.

Eighty-three percent of entrepreneurs are underserved or ignored by traditional funding sources, Hwang told a crowd gathered Tuesday for a Fountain Innovation Fund dinner, citing a new Kauffman Foundation report.

“[This report shows] that we should either expand the other pieces to get that 17 percent wider access or to implement alternative ways to get capital to those people,” he said. “[At the Capital Access Lab,] we’re going to look at how we can create new capital models.”

Additional statistics from the Kauffman report:

- Almost 65 percent of entrepreneurs rely on personal and family savings for startup capital.

- Only about 9 percent of proposals submitted to angel investors came from women entrepreneurs.

- Black entrepreneurs’ loan requests are three times less likely to be approved than white entrepreneurs.

Click here to read the executive summary of the report — “State of Access to Capital for Entrepreneurs: From Barriers to Potential” — which expected to be released later in 2019.

The Kansas City entrepreneurial community already has “stepped on the gas” in terms of capital assets since 2015, Hwang said, citing an increase of capital for entrepreneurs by 290 percent in equity funding.

“If you look at the rankings, [Kansas City] is still 24th out of 30 in terms of major cities with access to adequate financing for the growth of businesses,” he said. “There’s still quite a ways to go.”

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

The problem with asking customers what they want? They lie (but not to this KC data duo)

For years, Diana Kander has researched how to interview customers — specifically how to get the truth from them, she said. It’s been key to helping her work with companies to innovate and grow. But in early 2021 the consultant and author of “All In Startup” and “The Curiosity Muscle” was perplexed by a problem…

Their diagnoses were just the beginning: How tech app, community tap into co-founders’ own chronic illnesses

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro. This series is possible thanks to the Ewing Marion Kauffman Foundation, which leads a collaborative, nationwide effort to identify and remove large and small barriers to new business creation. WICHITA…

Just funded: Digital Sandbox KC starts new year with six new startups on its roster

Digital Sandbox KC’s latest round of startup funding reflects the emergence of more Kansas City-built, scalable tech in the new year, said Jill Meyer, announcing the fourth-quarter roster of companies bringing innovative ideas to life in the region. “These six companies demonstrate the creativity and diversity of our region’s technology founders and problem solvers,” said…

Merger alert: ‘Shark Tank’ star teams with Gary Fish, Fishtech to form new cybersecurity powerhouse

A merger announced today between award-winning cybersecurity solutions providers Fishtech Group and Herjavec Group will unite the companies as a single entity under a new brand to be announced in early 2022. The deal — backed by funds advised by Apax Partners LLP (The Apax Funds), which will hold a majority stake in the new…