Kauffman launching Capital Access Lab investment pipeline for underserved entrepreneurs

February 13, 2019 | Elyssa Bezner

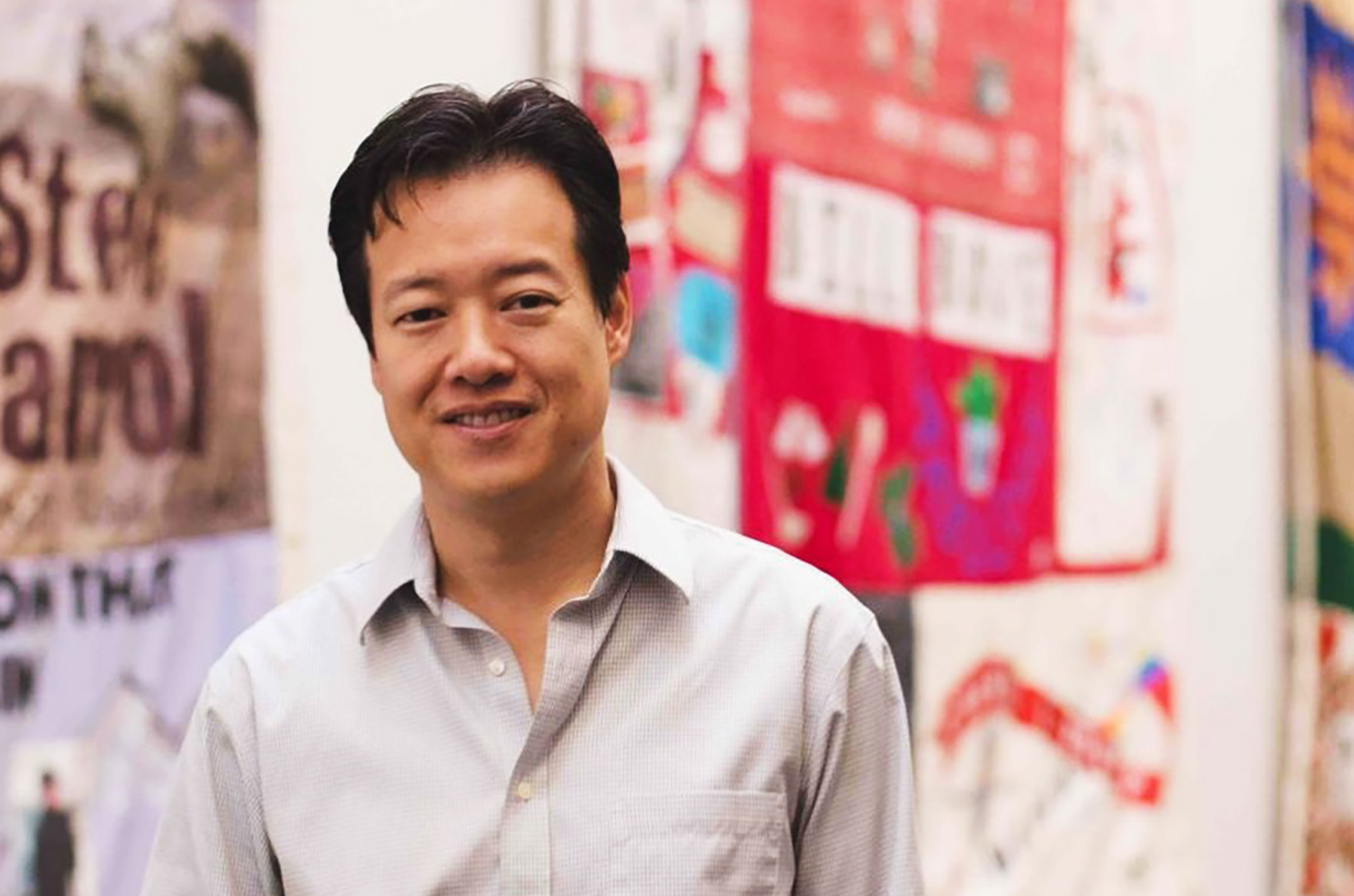

Every new business should have a fighting chance at success — regardless of the entrepreneur’s background, said Victor Hwang, announcing a new Capital Access Lab to address opportunity gaps in Kansas City and across the U.S.

“It is up to us to collectively break down systematic barriers to entry that adversely impact people of color, women, and entrepreneurs with limited wealth,” said Hwang, vice president of entrepreneurship for the Ewing Marion Kauffman Foundation. “The Kauffman Foundation is taking a proactive step in the creation of the Capital Access Lab to build a pipeline to fund investments for underserved entrepreneurs.”

The national program is fueled by a $3 million allocation, which is expected to be distributed to three to five investment funds targeting underserved entrepreneurs in injection sizes of $250,000 to $1 million, according to a press release.

Eighty-three percent of entrepreneurs are underserved or ignored by traditional funding sources, Hwang told a crowd gathered Tuesday for a Fountain Innovation Fund dinner, citing a new Kauffman Foundation report.

“[This report shows] that we should either expand the other pieces to get that 17 percent wider access or to implement alternative ways to get capital to those people,” he said. “[At the Capital Access Lab,] we’re going to look at how we can create new capital models.”

Additional statistics from the Kauffman report:

- Almost 65 percent of entrepreneurs rely on personal and family savings for startup capital.

- Only about 9 percent of proposals submitted to angel investors came from women entrepreneurs.

- Black entrepreneurs’ loan requests are three times less likely to be approved than white entrepreneurs.

Click here to read the executive summary of the report — “State of Access to Capital for Entrepreneurs: From Barriers to Potential” — which expected to be released later in 2019.

The Kansas City entrepreneurial community already has “stepped on the gas” in terms of capital assets since 2015, Hwang said, citing an increase of capital for entrepreneurs by 290 percent in equity funding.

“If you look at the rankings, [Kansas City] is still 24th out of 30 in terms of major cities with access to adequate financing for the growth of businesses,” he said. “There’s still quite a ways to go.”

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Comeback KC Ventures adds 9 more fellows to accelerate rapid-response health innovations

A global pandemic exposed both new challenges and the potential for disruptive solutions — putting Kansas City entrepreneurs at the forefront of rapid-fire change in the wake of an ongoing health crisis, said organizers of Comeback KC Ventures. Nine additional Kansas City tech startups are joining the fellowship program, its leaders said Wednesday, expanding upon…

Leanlab launches edtech certification with focus on accountability to classrooms

A new product certification from Leanlab Education means increased transparency for edtech companies — as well as added credibility for their work within schools. “We want to give teachers and school administrators a quick way to understand if an edtech product reflects the insights of educators, students, and parents — the true end users in education — and…

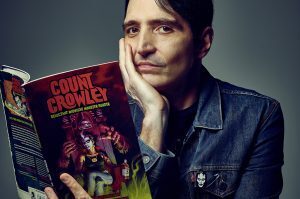

Actor David Dastmalchian fought his own demons; now the KC native is sending ’80s-inspired monsters to you

Growing up in Kansas City, David Dastmalchian was enamored with his hometown’s most shadowy corners: its fabled haunted houses, the shelves of Clint’s Comics, “Crematia Mortem’s Friday” on local TV, and even his Overland Park neighborhood’s mystical-seeming creeks and forests. Each of these childhood haunts planted a seed for the Hollywood actor’s latest project —…

MoodSpark buys defunct startup’s IP, minds focused on disrupting elderly veterans’ depression

A slew of new patents and tools are now in the hands of a KCK-rooted startup that aims to protect aging military veterans that suffer from loneliness, anxiety and depression. MoodSpark has acquired assets previously held by California-based Dthera Sciences — an early leader of the digital therapeutics space, known for its innovative quality of life…