Kauffman launching Capital Access Lab investment pipeline for underserved entrepreneurs

February 13, 2019 | Elyssa Bezner

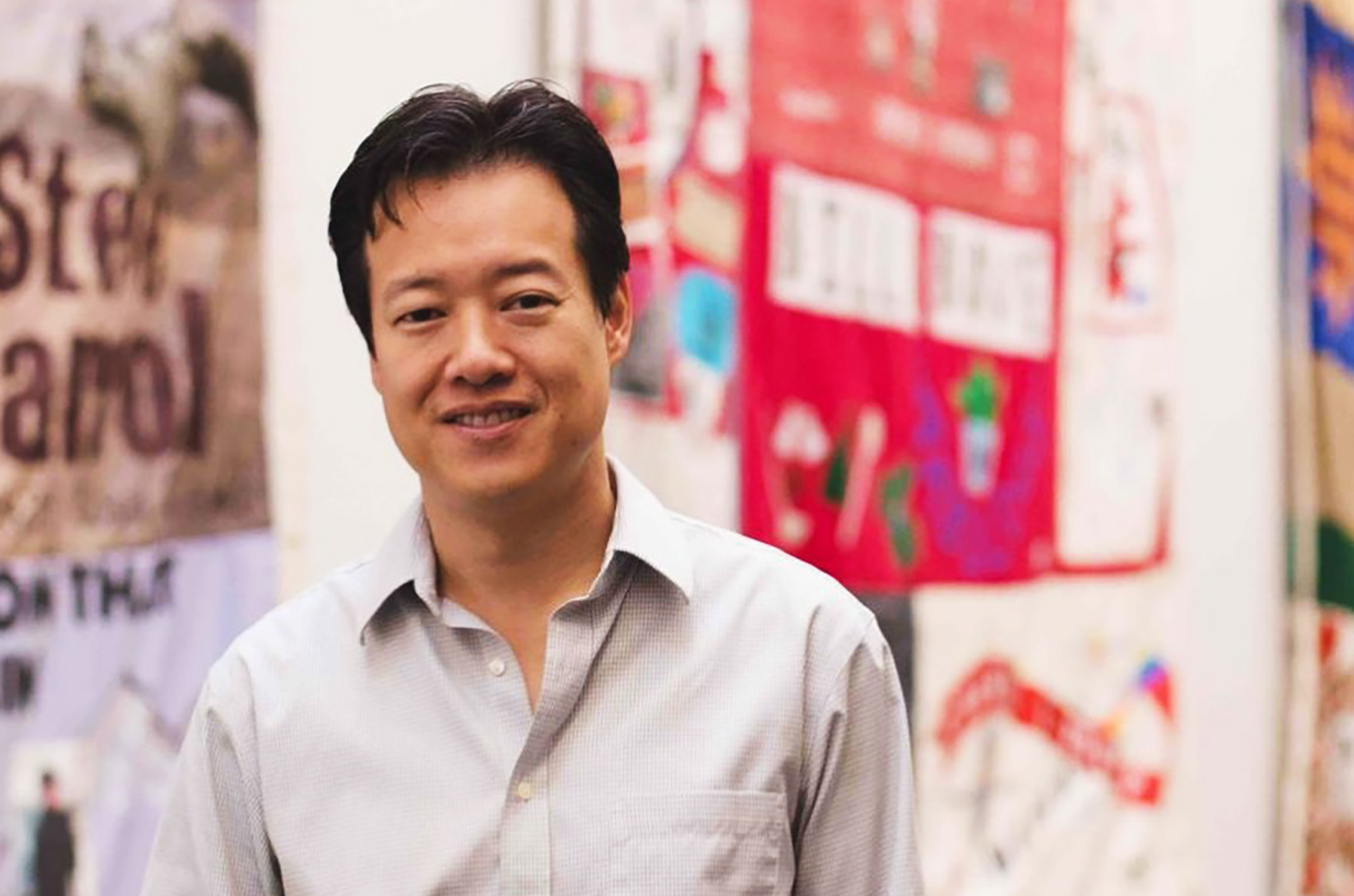

Every new business should have a fighting chance at success — regardless of the entrepreneur’s background, said Victor Hwang, announcing a new Capital Access Lab to address opportunity gaps in Kansas City and across the U.S.

“It is up to us to collectively break down systematic barriers to entry that adversely impact people of color, women, and entrepreneurs with limited wealth,” said Hwang, vice president of entrepreneurship for the Ewing Marion Kauffman Foundation. “The Kauffman Foundation is taking a proactive step in the creation of the Capital Access Lab to build a pipeline to fund investments for underserved entrepreneurs.”

The national program is fueled by a $3 million allocation, which is expected to be distributed to three to five investment funds targeting underserved entrepreneurs in injection sizes of $250,000 to $1 million, according to a press release.

Eighty-three percent of entrepreneurs are underserved or ignored by traditional funding sources, Hwang told a crowd gathered Tuesday for a Fountain Innovation Fund dinner, citing a new Kauffman Foundation report.

“[This report shows] that we should either expand the other pieces to get that 17 percent wider access or to implement alternative ways to get capital to those people,” he said. “[At the Capital Access Lab,] we’re going to look at how we can create new capital models.”

Additional statistics from the Kauffman report:

- Almost 65 percent of entrepreneurs rely on personal and family savings for startup capital.

- Only about 9 percent of proposals submitted to angel investors came from women entrepreneurs.

- Black entrepreneurs’ loan requests are three times less likely to be approved than white entrepreneurs.

Click here to read the executive summary of the report — “State of Access to Capital for Entrepreneurs: From Barriers to Potential” — which expected to be released later in 2019.

The Kansas City entrepreneurial community already has “stepped on the gas” in terms of capital assets since 2015, Hwang said, citing an increase of capital for entrepreneurs by 290 percent in equity funding.

“If you look at the rankings, [Kansas City] is still 24th out of 30 in terms of major cities with access to adequate financing for the growth of businesses,” he said. “There’s still quite a ways to go.”

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Why these Big Jay collectibles are a nod to bobblehead hall of fame’s love of KC-area sports

A cross-country childhood trip to the Negro Leagues Baseball Museum inspired a young baseball fan and rookie sports collector to keep Kansas City on his map — later incorporating an array of local major league and collegiate teams into his entrepreneurial venture: a national hall of fame for bobbleheads. The most recent additions to his…

Federal ban on noncompetes would ‘unleash’ entrepreneurs, open door to more startups, advocate says

A proposed rule change that would stop employers from imposing and enforcing contract clauses to limit their workers’ ability to change jobs within their fields is being hailed as a “vital step on the path to expanding economic growth in the United States,” according to one Kansas City-based advocate for entrepreneurs. Earlier this month, the…

Ice Cream Bae returns to the Country Club Plaza with its own storefront, more flavors

Adison and Jackie Sichampanakhone have a soft spot for the Country Club Plaza, they shared. It’s where the journey with their soft-serve ice cream shop began. “We’re excited to be back. We had so many great customers down here before, so we’re happy to be able to serve them again,” said Adison, who co-founded Ice…