Kauffman launching Capital Access Lab investment pipeline for underserved entrepreneurs

February 13, 2019 | Elyssa Bezner

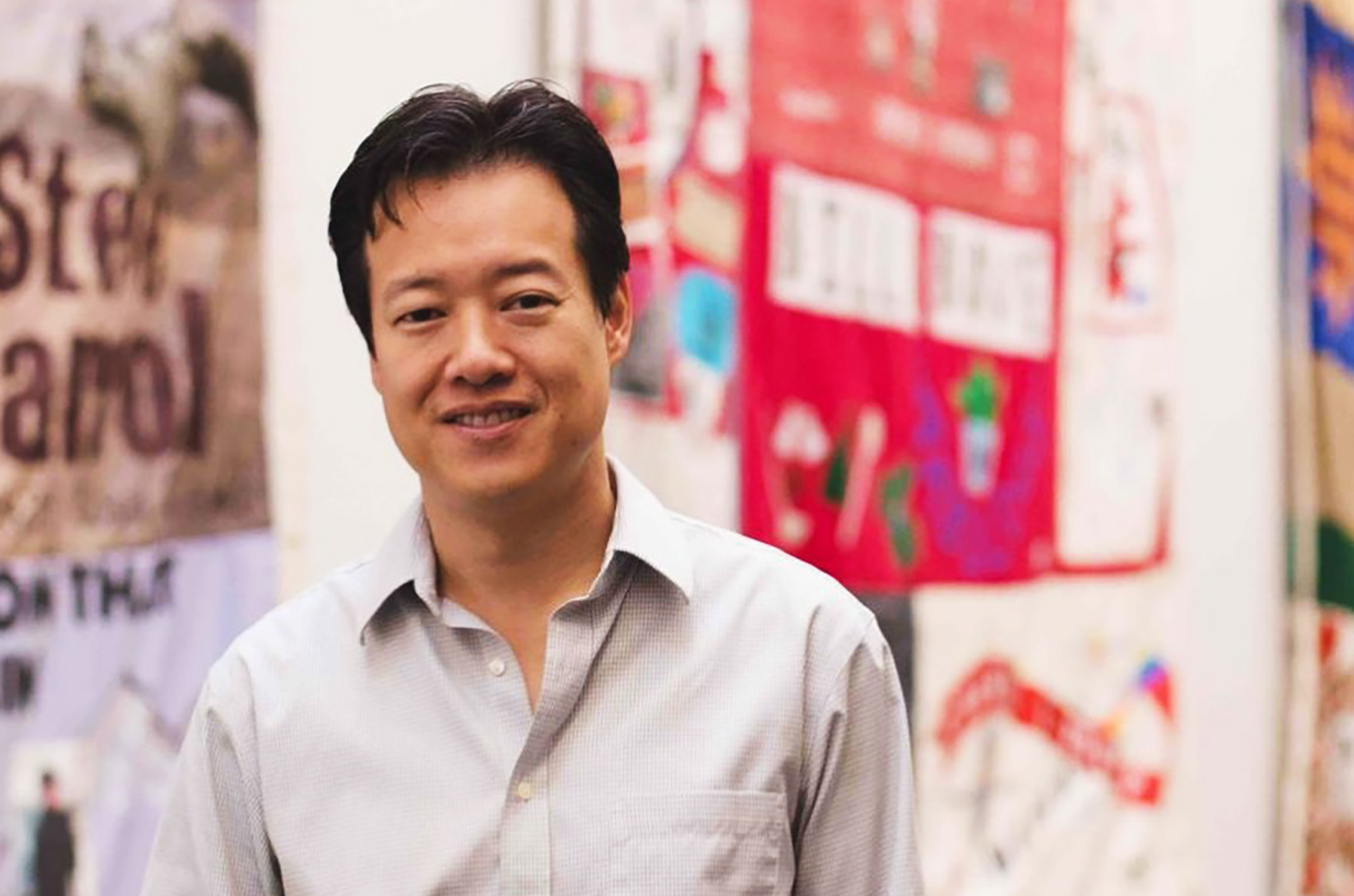

Every new business should have a fighting chance at success — regardless of the entrepreneur’s background, said Victor Hwang, announcing a new Capital Access Lab to address opportunity gaps in Kansas City and across the U.S.

“It is up to us to collectively break down systematic barriers to entry that adversely impact people of color, women, and entrepreneurs with limited wealth,” said Hwang, vice president of entrepreneurship for the Ewing Marion Kauffman Foundation. “The Kauffman Foundation is taking a proactive step in the creation of the Capital Access Lab to build a pipeline to fund investments for underserved entrepreneurs.”

The national program is fueled by a $3 million allocation, which is expected to be distributed to three to five investment funds targeting underserved entrepreneurs in injection sizes of $250,000 to $1 million, according to a press release.

Eighty-three percent of entrepreneurs are underserved or ignored by traditional funding sources, Hwang told a crowd gathered Tuesday for a Fountain Innovation Fund dinner, citing a new Kauffman Foundation report.

“[This report shows] that we should either expand the other pieces to get that 17 percent wider access or to implement alternative ways to get capital to those people,” he said. “[At the Capital Access Lab,] we’re going to look at how we can create new capital models.”

Additional statistics from the Kauffman report:

- Almost 65 percent of entrepreneurs rely on personal and family savings for startup capital.

- Only about 9 percent of proposals submitted to angel investors came from women entrepreneurs.

- Black entrepreneurs’ loan requests are three times less likely to be approved than white entrepreneurs.

Click here to read the executive summary of the report — “State of Access to Capital for Entrepreneurs: From Barriers to Potential” — which expected to be released later in 2019.

The Kansas City entrepreneurial community already has “stepped on the gas” in terms of capital assets since 2015, Hwang said, citing an increase of capital for entrepreneurs by 290 percent in equity funding.

“If you look at the rankings, [Kansas City] is still 24th out of 30 in terms of major cities with access to adequate financing for the growth of businesses,” he said. “There’s still quite a ways to go.”

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Her henna art goes far beyond copy and paste; how one Kansan’s craft (and kindness) went TikTok viral

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro. This series is possible thanks to Go Topeka, which seeks economic success for all companies and citizens across Shawnee County through implementation of an aggressive economic development strategy that capitalizes…

Votes are in: ‘Fan favorite’ winners bake in support at KC Chamber showcase; Top 10 coming April 21

Editor’s note: The Greater Kansas City Chamber of Commerce is a non-financial partner of Startland News, which serves as the media partner for the Small Business Superstars program. Two Black- and women-owned ventures were named “fan favorites” Tuesday in a public vote that followed this week’s Small Business Showcase at Union Station. The honors are…

New Frontier diagnoses need, expands its imaging solution to rural, underserved patients

A hands-on Kansas City healthtech company is extending its diagnostic imaging services to support clinics across Kansas and Missouri with a focus on rural health centers and “lookalike” clinics serving patients in underserved communities and healthcare deserts. New Frontier Mobile Diagnostics was founded to improve access to imaging care for patients regardless of race, gender,…

AltCap launches Heartland expansion to aid more small biz typically overlooked by lenders

An expanded geographic footprint for AltCap will see the Kansas City-based small business lender make capital more accessible for entrepreneurs in Missouri, Kansas, Texas, and Colorado. The mission-driven Community Development Financial Institution (CDFI) finances small businesses and community-driven real estate development projects that create more economically-inclusive communities. “AltCap’s expansion has better positioned us for long…