Kauffman launching Capital Access Lab investment pipeline for underserved entrepreneurs

February 13, 2019 | Elyssa Bezner

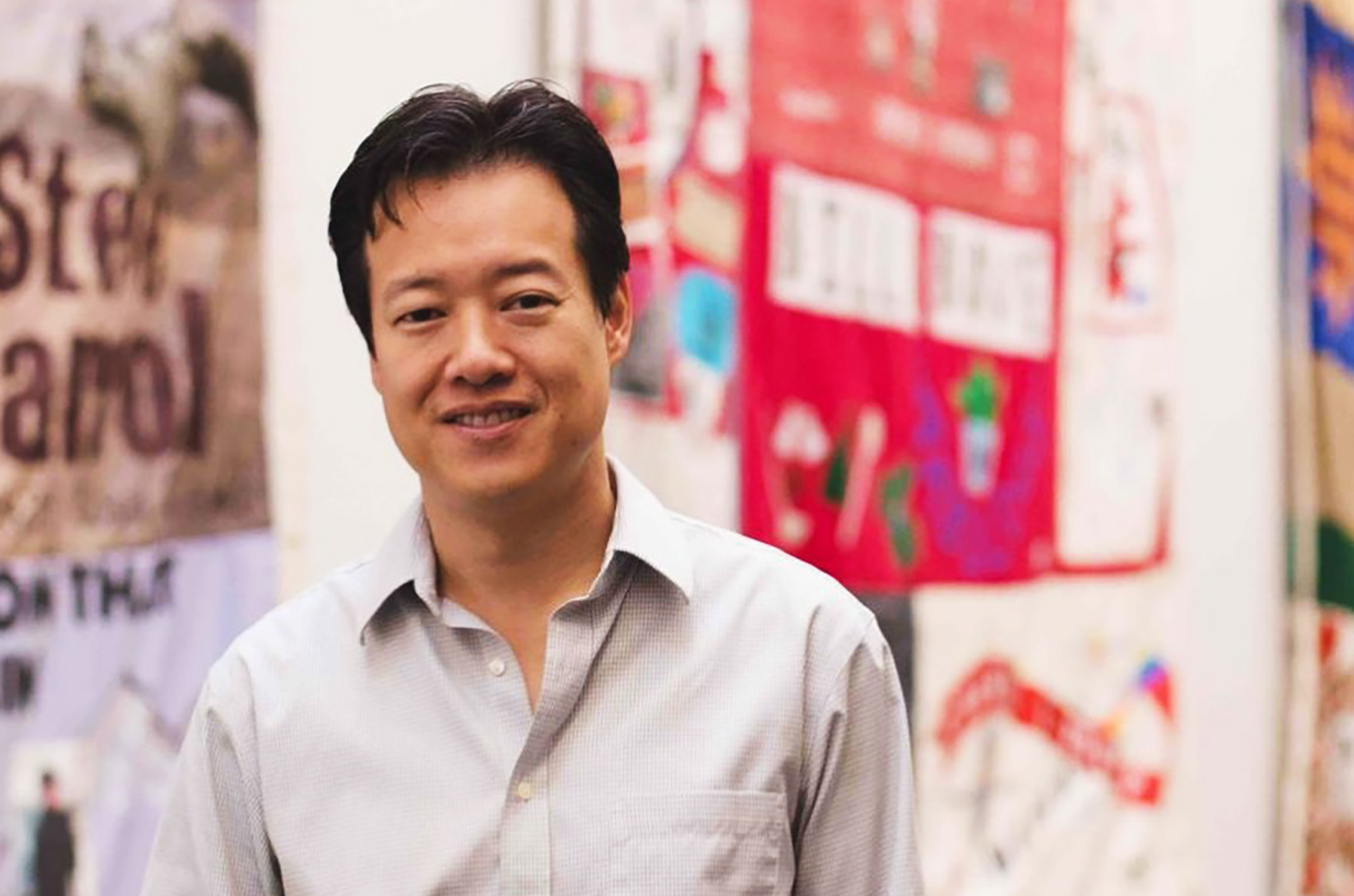

Every new business should have a fighting chance at success — regardless of the entrepreneur’s background, said Victor Hwang, announcing a new Capital Access Lab to address opportunity gaps in Kansas City and across the U.S.

“It is up to us to collectively break down systematic barriers to entry that adversely impact people of color, women, and entrepreneurs with limited wealth,” said Hwang, vice president of entrepreneurship for the Ewing Marion Kauffman Foundation. “The Kauffman Foundation is taking a proactive step in the creation of the Capital Access Lab to build a pipeline to fund investments for underserved entrepreneurs.”

The national program is fueled by a $3 million allocation, which is expected to be distributed to three to five investment funds targeting underserved entrepreneurs in injection sizes of $250,000 to $1 million, according to a press release.

Eighty-three percent of entrepreneurs are underserved or ignored by traditional funding sources, Hwang told a crowd gathered Tuesday for a Fountain Innovation Fund dinner, citing a new Kauffman Foundation report.

“[This report shows] that we should either expand the other pieces to get that 17 percent wider access or to implement alternative ways to get capital to those people,” he said. “[At the Capital Access Lab,] we’re going to look at how we can create new capital models.”

Additional statistics from the Kauffman report:

- Almost 65 percent of entrepreneurs rely on personal and family savings for startup capital.

- Only about 9 percent of proposals submitted to angel investors came from women entrepreneurs.

- Black entrepreneurs’ loan requests are three times less likely to be approved than white entrepreneurs.

Click here to read the executive summary of the report — “State of Access to Capital for Entrepreneurs: From Barriers to Potential” — which expected to be released later in 2019.

The Kansas City entrepreneurial community already has “stepped on the gas” in terms of capital assets since 2015, Hwang said, citing an increase of capital for entrepreneurs by 290 percent in equity funding.

“If you look at the rankings, [Kansas City] is still 24th out of 30 in terms of major cities with access to adequate financing for the growth of businesses,” he said. “There’s still quite a ways to go.”

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

After his eye-catching KCI installation took flight, Willie Cole had 100+ horns leftover; He kept building

Willie Cole didn’t choose to be an artist. It’s always been part of him. “I think I was an artist in a previous life,” said the contemporary American sculptor, printer and perceptual engineer. “When I was 3 years old, my mom found me drawing in the kitchen, and since then, my family always said I…

Lawrence cybersecurity startup raises $1.85M pre-seed round led by KC’s Flyover Capital

A startup focused on detecting hidden malware and preventing costly ransomware attacks announced a power-packed pre-seed funding round to push its pending launch — with the backing of a trio of high-profile regional investors. The investment in cybersecurity pioneer Invary was led by Flyover Capital, with additional participation from NetWork Kansas GROWKS Equity program, and…

Pickle and Suede: Sporty new line plays on jewelry brand’s versatility, flexes creative muscle

Nickel and Suede is hitting the court this summer, served co-founder Kilee Nickels. The Liberty-based jewelry brand — which just celebrated its ninth birthday — has released a pickleball paddle in collaboration with Recess Pickleball, along with a line of “just the right” accessories to coordinate. “It’s kind of our stamp of approval,” Nickels said.…

Fund Me, KC: Zanago founders seek support to close funding gap for real estate transparency platform

Startland News is continuing its “Fund Me, KC” series to highlight area entrepreneurs’ efforts to accelerate their businesses or lend a helping hand to others. This is an opportunity for business owners and innovators — like Louis Byrd and Arlene Byrd from the social impact tech company Zanago — to share their crowdfunding stories and potentially…