Kauffman launching Capital Access Lab investment pipeline for underserved entrepreneurs

February 13, 2019 | Elyssa Bezner

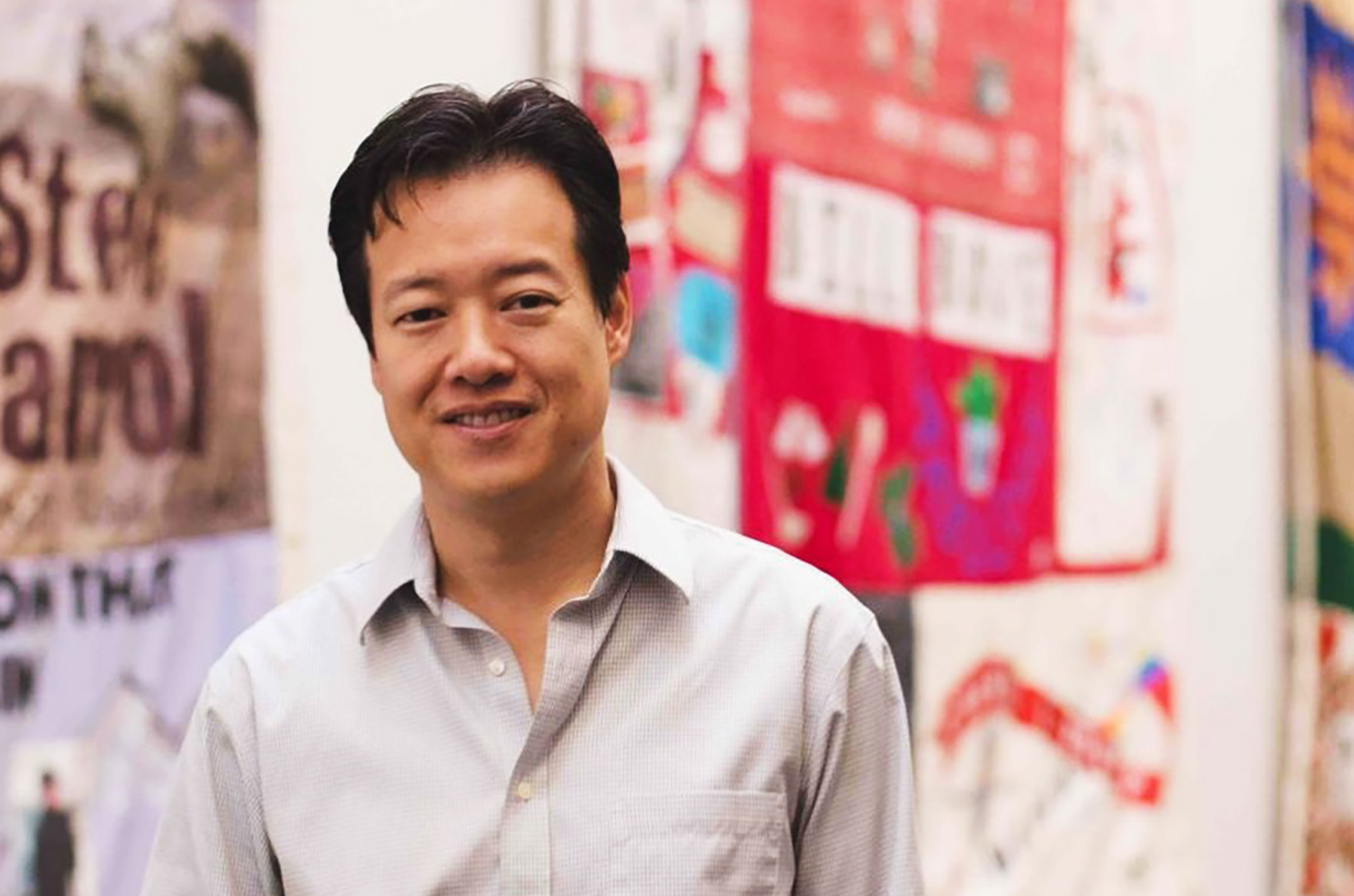

Every new business should have a fighting chance at success — regardless of the entrepreneur’s background, said Victor Hwang, announcing a new Capital Access Lab to address opportunity gaps in Kansas City and across the U.S.

“It is up to us to collectively break down systematic barriers to entry that adversely impact people of color, women, and entrepreneurs with limited wealth,” said Hwang, vice president of entrepreneurship for the Ewing Marion Kauffman Foundation. “The Kauffman Foundation is taking a proactive step in the creation of the Capital Access Lab to build a pipeline to fund investments for underserved entrepreneurs.”

The national program is fueled by a $3 million allocation, which is expected to be distributed to three to five investment funds targeting underserved entrepreneurs in injection sizes of $250,000 to $1 million, according to a press release.

Eighty-three percent of entrepreneurs are underserved or ignored by traditional funding sources, Hwang told a crowd gathered Tuesday for a Fountain Innovation Fund dinner, citing a new Kauffman Foundation report.

“[This report shows] that we should either expand the other pieces to get that 17 percent wider access or to implement alternative ways to get capital to those people,” he said. “[At the Capital Access Lab,] we’re going to look at how we can create new capital models.”

Additional statistics from the Kauffman report:

- Almost 65 percent of entrepreneurs rely on personal and family savings for startup capital.

- Only about 9 percent of proposals submitted to angel investors came from women entrepreneurs.

- Black entrepreneurs’ loan requests are three times less likely to be approved than white entrepreneurs.

Click here to read the executive summary of the report — “State of Access to Capital for Entrepreneurs: From Barriers to Potential” — which expected to be released later in 2019.

The Kansas City entrepreneurial community already has “stepped on the gas” in terms of capital assets since 2015, Hwang said, citing an increase of capital for entrepreneurs by 290 percent in equity funding.

“If you look at the rankings, [Kansas City] is still 24th out of 30 in terms of major cities with access to adequate financing for the growth of businesses,” he said. “There’s still quite a ways to go.”

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

Engineering KC: Global talent builds success for Taliaferro & Browne

Editor’s note: The following feature on Taliaferro & Browne is part of a three-part series on the potential for immigrant or foreign-born entrepreneurs to help reshape Kansas City’s startup ecosystem. Read more about how a Kansas senator’s Startup Act legislation could reduce barriers here. Check out a warning from a leading Kansas City tech CEO…

Coming to Leawood: Blade & Timber hopes to stick another win with second axe throwing space

Kansas City comes first, said Matt Baysinger. And that means providing cutting-edge experiences like Blade & Timber to folks across the metro. “As we were looking at expansion — and obviously we’re looking at cities outside of the metro and outside of Kansas — it made so much sense for us to say, ‘This is…

App snaps pics of items to ease moving process, MovinHouz founders say

What started as a couple of bad moving experiences developed into a mobile app to simplify the relocation process, said MovinHouz co-founders. Dominic Klobe and Chris Perrin, co-founders of Olathe-based MovinHouz, a tech startup incubated at Digital Sandbox KC, are building an app that connects moving companies to customers in need of their services, Klobe…

Student investors hope to make inroads with KC founders through pitch day

A group of student investors in the Kansas City University Venture Program are working to jump start deal flow and create relationships with Kansas City entrepreneurs. Launched in 2017, the student-led fund is hosting a pitch event to start a dialogue with area startups in hopes of finding their newest investment deals, said Nate Crosser, a…