CB Insights calls KCRise most active VC in Kansas; Fund credits work of small team, innovative portfolio startups

February 7, 2019 | Austin Barnes

Kansans don’t fear hard work, said Darcy Howe.

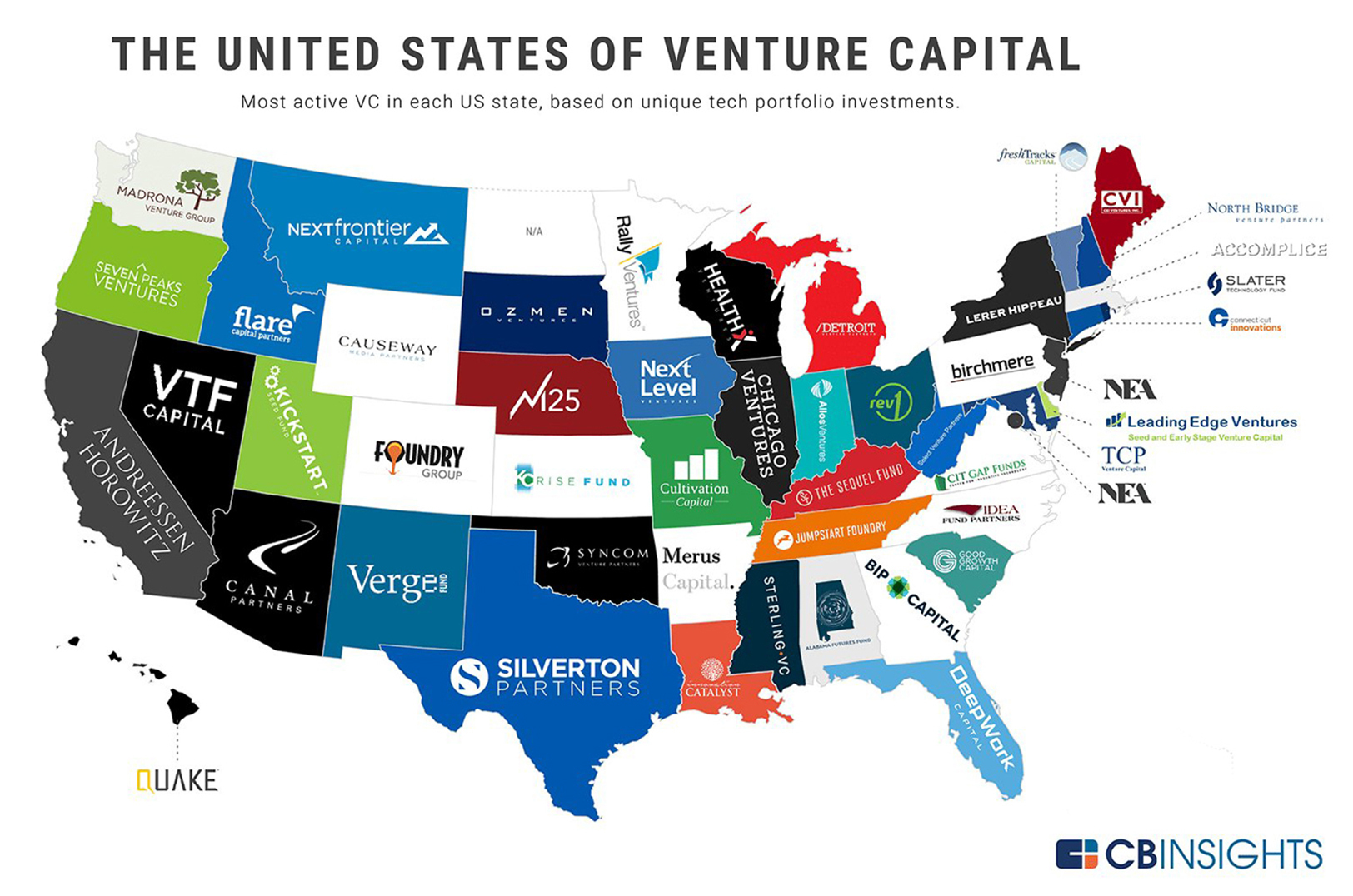

An investment in such a mindset has come with big returns for the KCRise Fund, newly proclaimed the most active venture capital fund in the Sunflower State, according to CB Insights.

Darcy Howe, KCRise Fund

“Perhaps overused but Margaret Mead’s quote, ‘Never doubt that a small group of thoughtful, committed citizens can change the world,’” Howe said in response to the distinction.

Deposited into Kansas City’s startup scene in 2016, the KCRise Fund was born when civic leaders came together in attempt to solve economic malaise in the metro, calling for more support behind the KC Rising initiative — a 20 year vision plan for Kansas City prosperity and economic growth, launched in 2014 — Howe explained.

“They asked business and civic folks to come problem solve together,” she said of what sets the KCRise Fund and Kansas City apart from other VC matching firms.

Notable KCRise portfolio companies in Kansas include: ShotTracker, SquareOffs, and Life Equals –– all companies that earned spots on Startland’s list of 12 Kansas City Startups to Watch in 2019, based largely on their likelihood of big news this year.

Click here to read more about Startups to Watch in 2019, which also included the fund’s portfolio firm Pepper IoT on the Missouri side of the state line.

“Promising entrepreneurs are coming to us every day with disruptive ideas in sectors like transportation, logistics, agriculture tech and IoT – verticals where KC already has a national reputation. We know KCRise can continue to be a conduit to capital nationwide and open doors for the next generation of KC startups,” added Ed Frindt, KCRise fund principal.

KCRise Fund additionally boasts such KCMO success stories as Backlot Cars — which posted an $8 million Series A funding round in late 2018 — and PayIt, named a GovTech 100 company three years running, the fund said.

“This is not only a testament to KCRise Fund, but to the many innovative companies being built by inspiring entrepreneurs in the KC region,” said Chad Feather, KCRise Fund analyst. “I am excited not only about the future of KCRise Fund, but the future of the entire KC entrepreneurial ecosystem.”

St. Louis-based Cultivation Capital was named the most active fund in Missouri, the report said.

2019 Startups to Watch

stats here

Related Posts on Startland News

Fund Me, KC: Her startup has outgrown its puppy phase; now’s your chance to feed its potential

Startland News is continuing its “Fund Me, KC” series to highlight area entrepreneurs’ efforts to accelerate their businesses or lend a helping hand to others. This is an opportunity for business owners and innovators — like Jonaie Johnson’s effort to publicly launch the highly-anticipated PlayTach smart dog crate attachment by Interplay — to share their…

KC startup earns $100K from Google initiative, funding its ‘food as medicine’ tech solution for chronic illnesses, healthy food inequity

Kansas City-based startup Free From Market will receive $100,000 in non-dilutive funding from Google as part of the tech giant’s initiative to support Black-led startups. Free From Market is a digital health platform that unites the key components needed for people with chronic conditions to make lasting dietary changes: personalized food selection, nutritional education and…

2000 Vine: Brewed under pressure, KC’s first Black-owned brewery puts more than reputations on the vine

Editor’s note: This story is part of a series from Startland News highlighting entrepreneurs, businesses, and creators leading revitalization and redevelopment efforts in and around the historic 18th and Vine Jazz District. Click here to read additional stories from this series. A brewery under construction at 2000 Vine on Kansas City’s East Side comes from…

Newly merged Cyderes boasts 63-percent growth rate, beating timeline, expectations

Editor’s note: Cyderes is a financial supporter of Startland News’ nonprofit newsroom. Merging two cybersecurity powerhouses was a monumental task unto itself, said Robert Herjavec, but the newly formed Cyderes has exceeded expectations and more than overcome the challenges associated with blending the strengths of Herjavec Group and Fishtech Group. “Not only is our merger…