CB Insights calls KCRise most active VC in Kansas; Fund credits work of small team, innovative portfolio startups

February 7, 2019 | Austin Barnes

Kansans don’t fear hard work, said Darcy Howe.

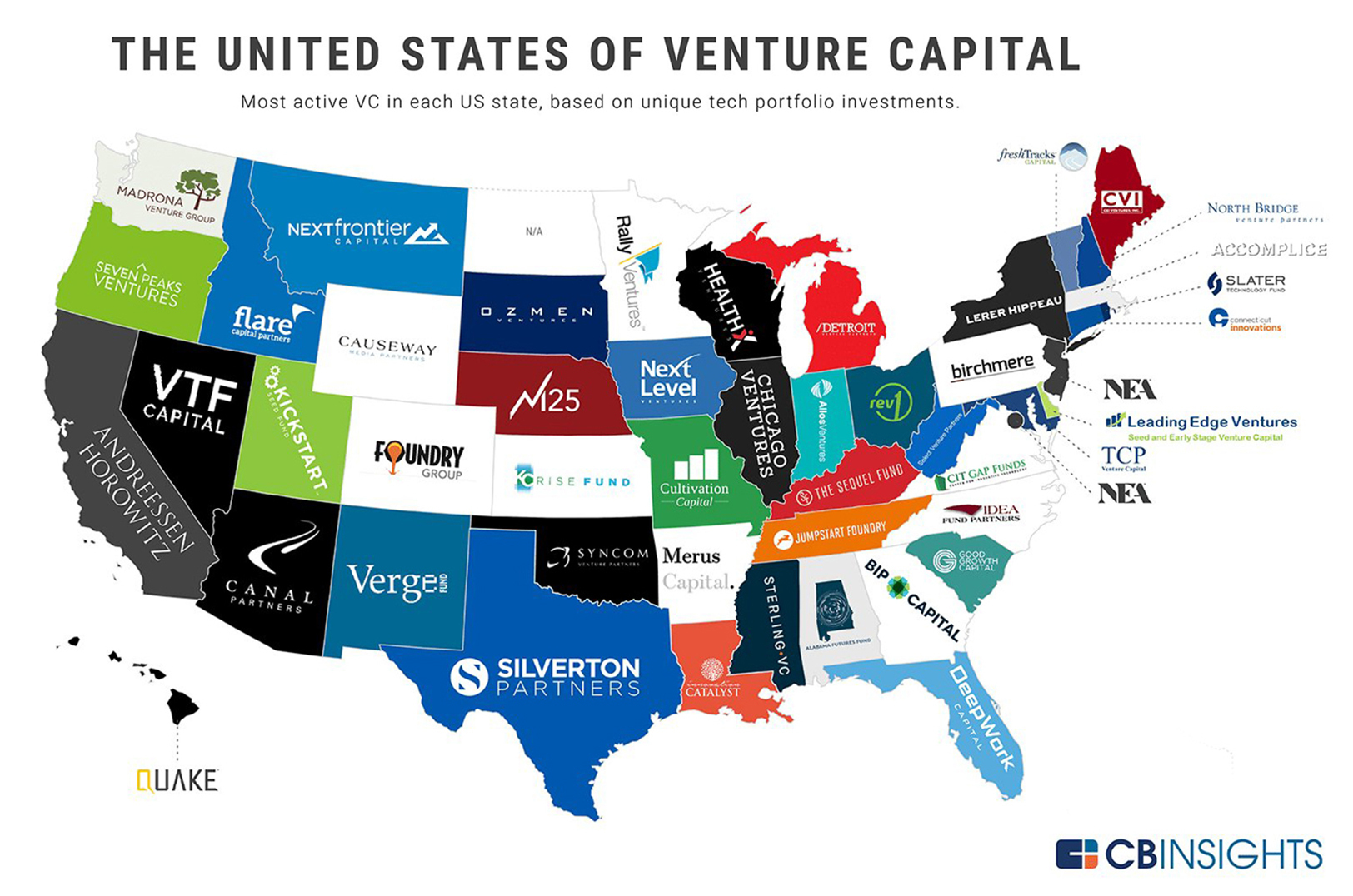

An investment in such a mindset has come with big returns for the KCRise Fund, newly proclaimed the most active venture capital fund in the Sunflower State, according to CB Insights.

Darcy Howe, KCRise Fund

“Perhaps overused but Margaret Mead’s quote, ‘Never doubt that a small group of thoughtful, committed citizens can change the world,’” Howe said in response to the distinction.

Deposited into Kansas City’s startup scene in 2016, the KCRise Fund was born when civic leaders came together in attempt to solve economic malaise in the metro, calling for more support behind the KC Rising initiative — a 20 year vision plan for Kansas City prosperity and economic growth, launched in 2014 — Howe explained.

“They asked business and civic folks to come problem solve together,” she said of what sets the KCRise Fund and Kansas City apart from other VC matching firms.

Notable KCRise portfolio companies in Kansas include: ShotTracker, SquareOffs, and Life Equals –– all companies that earned spots on Startland’s list of 12 Kansas City Startups to Watch in 2019, based largely on their likelihood of big news this year.

Click here to read more about Startups to Watch in 2019, which also included the fund’s portfolio firm Pepper IoT on the Missouri side of the state line.

“Promising entrepreneurs are coming to us every day with disruptive ideas in sectors like transportation, logistics, agriculture tech and IoT – verticals where KC already has a national reputation. We know KCRise can continue to be a conduit to capital nationwide and open doors for the next generation of KC startups,” added Ed Frindt, KCRise fund principal.

KCRise Fund additionally boasts such KCMO success stories as Backlot Cars — which posted an $8 million Series A funding round in late 2018 — and PayIt, named a GovTech 100 company three years running, the fund said.

“This is not only a testament to KCRise Fund, but to the many innovative companies being built by inspiring entrepreneurs in the KC region,” said Chad Feather, KCRise Fund analyst. “I am excited not only about the future of KCRise Fund, but the future of the entire KC entrepreneurial ecosystem.”

St. Louis-based Cultivation Capital was named the most active fund in Missouri, the report said.

2019 Startups to Watch

stats here

Related Posts on Startland News

Bean around the block: How this Westport coffee shop is cherry picking roasts from its own farm in the Andes

A hemisphere away from Brett Janssen’s former job at General Motors in Kansas City’s Northland, the now-budding Westport coffee shop owner found a fresh batch of opportunities: his wife, business partner and a transcontinental farm-to-cup Columbian coffee operation. Janssen’s House Coffee — the fruit of Janssen and his fiancée Genisis Mejia’s passion for coffee —…

Attic with global ambitions: Luxury brand builds from humble origins to Material Opulence

Renauld Shelton II sees power stitched into the seams of fashion, the Kansas City designer said, detailing the dynamic pairing of apparel and pride that grounds his luxury clothing brand. “It’s a confidence builder. When you look good, you feel good,” said Shelton, founder and CEO of Material Opulence. “It sets you up for success.”…

How reactivating history can drive economic growth more sustainably than a new build

Editor’s note: The following is part of an ongoing feature series exploring impacts of initiatives within the Economic Development Corporation of Kansas City through a paid partnership with EDCKC. Hotel owners wanted charm that can’t be built in today’s economy; Kansas City history booked them the bones to do it A one-of-a-kind, limestone-clad building at 906…