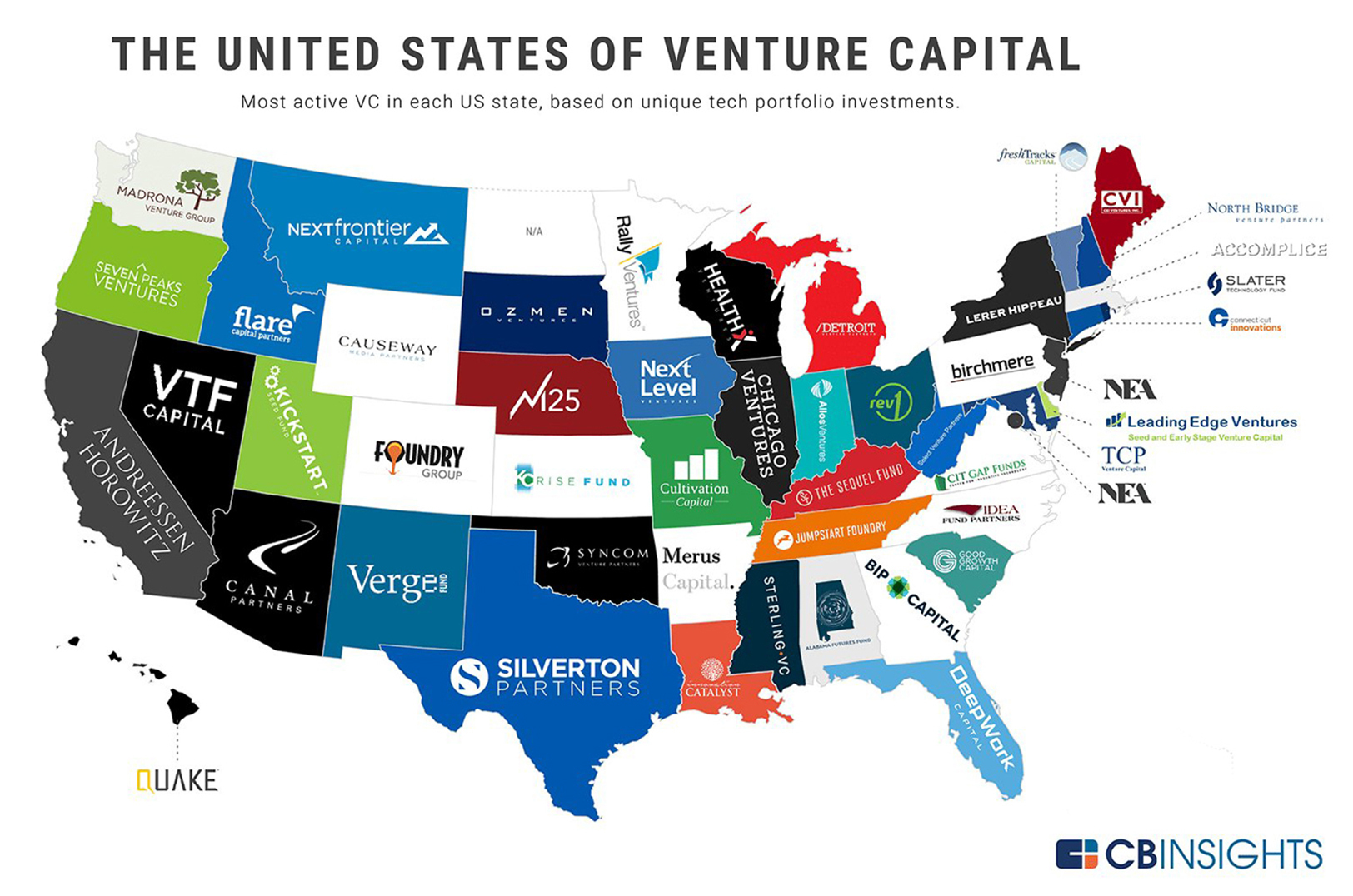

CB Insights calls KCRise most active VC in Kansas; Fund credits work of small team, innovative portfolio startups

February 7, 2019 | Austin Barnes

Kansans don’t fear hard work, said Darcy Howe.

An investment in such a mindset has come with big returns for the KCRise Fund, newly proclaimed the most active venture capital fund in the Sunflower State, according to CB Insights.

Darcy Howe, KCRise Fund

“Perhaps overused but Margaret Mead’s quote, ‘Never doubt that a small group of thoughtful, committed citizens can change the world,’” Howe said in response to the distinction.

Deposited into Kansas City’s startup scene in 2016, the KCRise Fund was born when civic leaders came together in attempt to solve economic malaise in the metro, calling for more support behind the KC Rising initiative — a 20 year vision plan for Kansas City prosperity and economic growth, launched in 2014 — Howe explained.

“They asked business and civic folks to come problem solve together,” she said of what sets the KCRise Fund and Kansas City apart from other VC matching firms.

Notable KCRise portfolio companies in Kansas include: ShotTracker, SquareOffs, and Life Equals –– all companies that earned spots on Startland’s list of 12 Kansas City Startups to Watch in 2019, based largely on their likelihood of big news this year.

Click here to read more about Startups to Watch in 2019, which also included the fund’s portfolio firm Pepper IoT on the Missouri side of the state line.

“Promising entrepreneurs are coming to us every day with disruptive ideas in sectors like transportation, logistics, agriculture tech and IoT – verticals where KC already has a national reputation. We know KCRise can continue to be a conduit to capital nationwide and open doors for the next generation of KC startups,” added Ed Frindt, KCRise fund principal.

KCRise Fund additionally boasts such KCMO success stories as Backlot Cars — which posted an $8 million Series A funding round in late 2018 — and PayIt, named a GovTech 100 company three years running, the fund said.

“This is not only a testament to KCRise Fund, but to the many innovative companies being built by inspiring entrepreneurs in the KC region,” said Chad Feather, KCRise Fund analyst. “I am excited not only about the future of KCRise Fund, but the future of the entire KC entrepreneurial ecosystem.”

St. Louis-based Cultivation Capital was named the most active fund in Missouri, the report said.

2019 Startups to Watch

stats here

Related Posts on Startland News

For one night only, KCI’s new terminal became the city’s premier event venue; Here’s how they pulled it off

Transforming an airport terminal into a high-profile, elegant celebration and then back to an airport terminal within 48 hours is no easy feat, Whitney Butler said, but the women-led PlatinumXP team was up for the challenge. “We were creating within a venue that will never be able to be used as an event venue again.…

WeCode KC founder earns women’s achievement honor; adds national STEM figure to her org’s leadership

Only a few days into March, 2023 is already proving to be a big year for WeCode KC, noted co-founder and CEO Tammy Buckner. The organization — which operates with a mission is to give youth, especially those in the urban core, the opportunity to learn technology concepts and leadership skills and create a pipeline…

‘Shark Tank’ sets stage for Bryght Labs’ new smart play product rollout amid MO funding uptick

Fresh off a successful appearance on “Shark Tank,” Olathe-based connected gaming startup Bryght Labs hopes to capitalize on that exposure to build momentum, said founder and CEO Jeff Wigh. Wigh and co-founder Adam Roush were featured on an episode that aired in December, pitching their product ChessUp, a patented chess board that uses AI technology…

C2FO: $10M investment from Starbucks CEO will unlock $100M in loans to small, diverse businesses

One of Kansas City’s most successful scaling startups announced Tuesday a new initiative — funded by Sheri Schultz and Starbucks CEO Howard Schultz — to provide access to $100 million in working capital for small and diverse businesses. The partnership — designed to use Leawood-based C2FO’s innovative lending approach to deliver flexible, equitable access to…