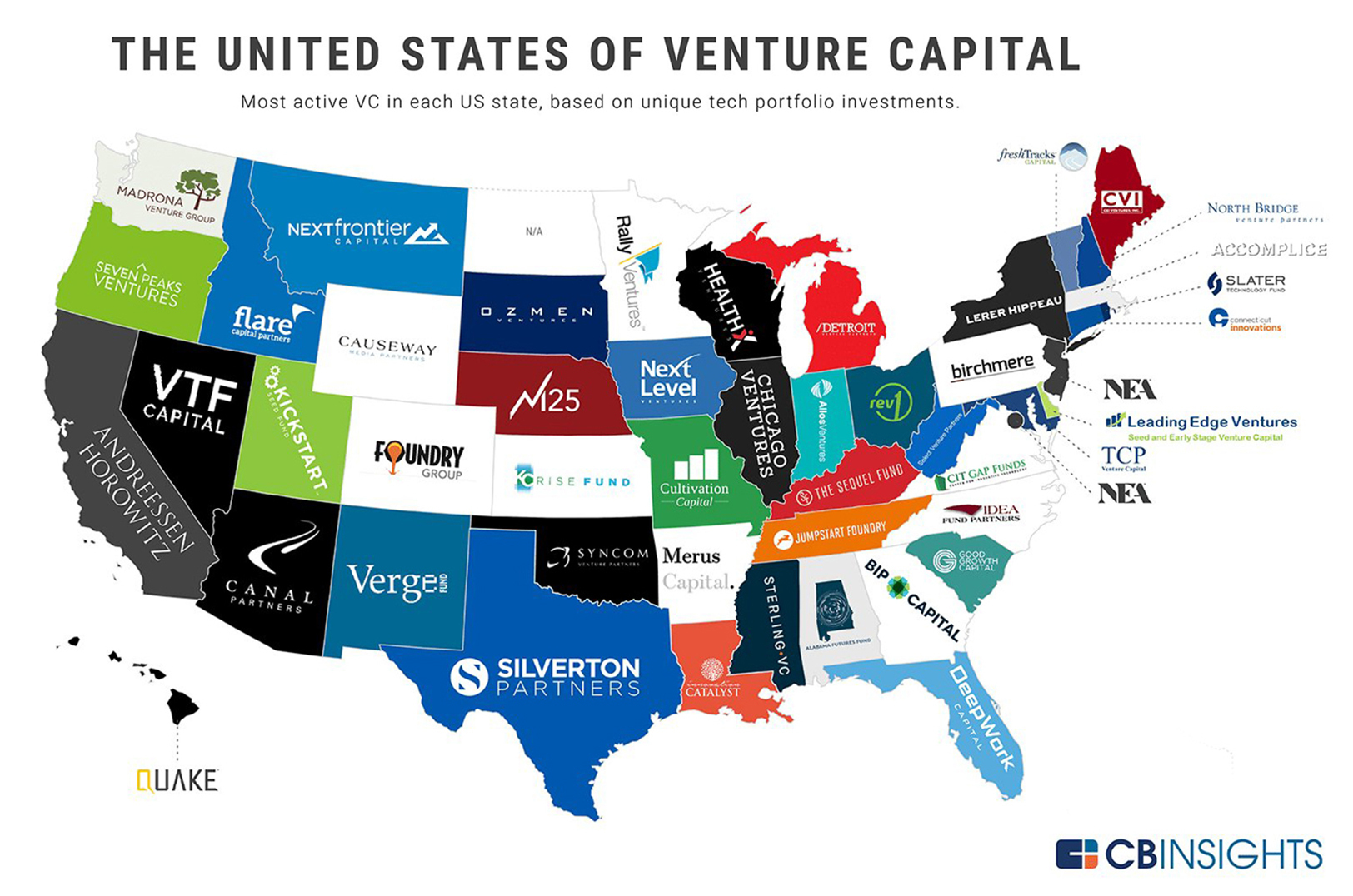

CB Insights calls KCRise most active VC in Kansas; Fund credits work of small team, innovative portfolio startups

February 7, 2019 | Austin Barnes

Kansans don’t fear hard work, said Darcy Howe.

An investment in such a mindset has come with big returns for the KCRise Fund, newly proclaimed the most active venture capital fund in the Sunflower State, according to CB Insights.

Darcy Howe, KCRise Fund

“Perhaps overused but Margaret Mead’s quote, ‘Never doubt that a small group of thoughtful, committed citizens can change the world,’” Howe said in response to the distinction.

Deposited into Kansas City’s startup scene in 2016, the KCRise Fund was born when civic leaders came together in attempt to solve economic malaise in the metro, calling for more support behind the KC Rising initiative — a 20 year vision plan for Kansas City prosperity and economic growth, launched in 2014 — Howe explained.

“They asked business and civic folks to come problem solve together,” she said of what sets the KCRise Fund and Kansas City apart from other VC matching firms.

Notable KCRise portfolio companies in Kansas include: ShotTracker, SquareOffs, and Life Equals –– all companies that earned spots on Startland’s list of 12 Kansas City Startups to Watch in 2019, based largely on their likelihood of big news this year.

Click here to read more about Startups to Watch in 2019, which also included the fund’s portfolio firm Pepper IoT on the Missouri side of the state line.

“Promising entrepreneurs are coming to us every day with disruptive ideas in sectors like transportation, logistics, agriculture tech and IoT – verticals where KC already has a national reputation. We know KCRise can continue to be a conduit to capital nationwide and open doors for the next generation of KC startups,” added Ed Frindt, KCRise fund principal.

KCRise Fund additionally boasts such KCMO success stories as Backlot Cars — which posted an $8 million Series A funding round in late 2018 — and PayIt, named a GovTech 100 company three years running, the fund said.

“This is not only a testament to KCRise Fund, but to the many innovative companies being built by inspiring entrepreneurs in the KC region,” said Chad Feather, KCRise Fund analyst. “I am excited not only about the future of KCRise Fund, but the future of the entire KC entrepreneurial ecosystem.”

St. Louis-based Cultivation Capital was named the most active fund in Missouri, the report said.

2019 Startups to Watch

stats here

Related Posts on Startland News

Kinship Cafe owner paves plans to take ownership of his coffee shop (with a little help from his community)

In April, TJ Roberts was at risk of losing his coffee shop to a parking lot. Now, Roberts is standing his ground, with the help of his community, to purchase the building that houses Kinship Cafe. “It was a very dark couple of weeks, but now there’s light at the end of the tunnel. Purchasing…

Betty Rae’s sells to Shatto: Why the ice cream brand’s young steward is stepping away from the scoop (for now)

An announcement this week that Betty Rae’s Ice Cream could open new shops and push its popular products into grocery stores is exciting growth to envision, agreed Alec Rodgers, the brand’s steward since 2021 when he bought and reopened its two storefronts amid challenges of the ongoing pandemic. Rodgers just won’t be the man behind…

Entrepreneur meets with VP Harris; surprised DC already knew about KC’s first Black-owned brewery

Word travels. A roundtable discussion this week with Vice President Kamala Harris gave Kemet Coleman an opportunity to put his city, and specifically the 18th and Vine neighborhood, on an elevated platform, the Kansas City entrepreneur and musician said. Coleman — one of three co-founders of the soon-to-be-opened Vine Street Brewing, Missouri’s first Black-owned brewery…