CB Insights calls KCRise most active VC in Kansas; Fund credits work of small team, innovative portfolio startups

February 7, 2019 | Austin Barnes

Kansans don’t fear hard work, said Darcy Howe.

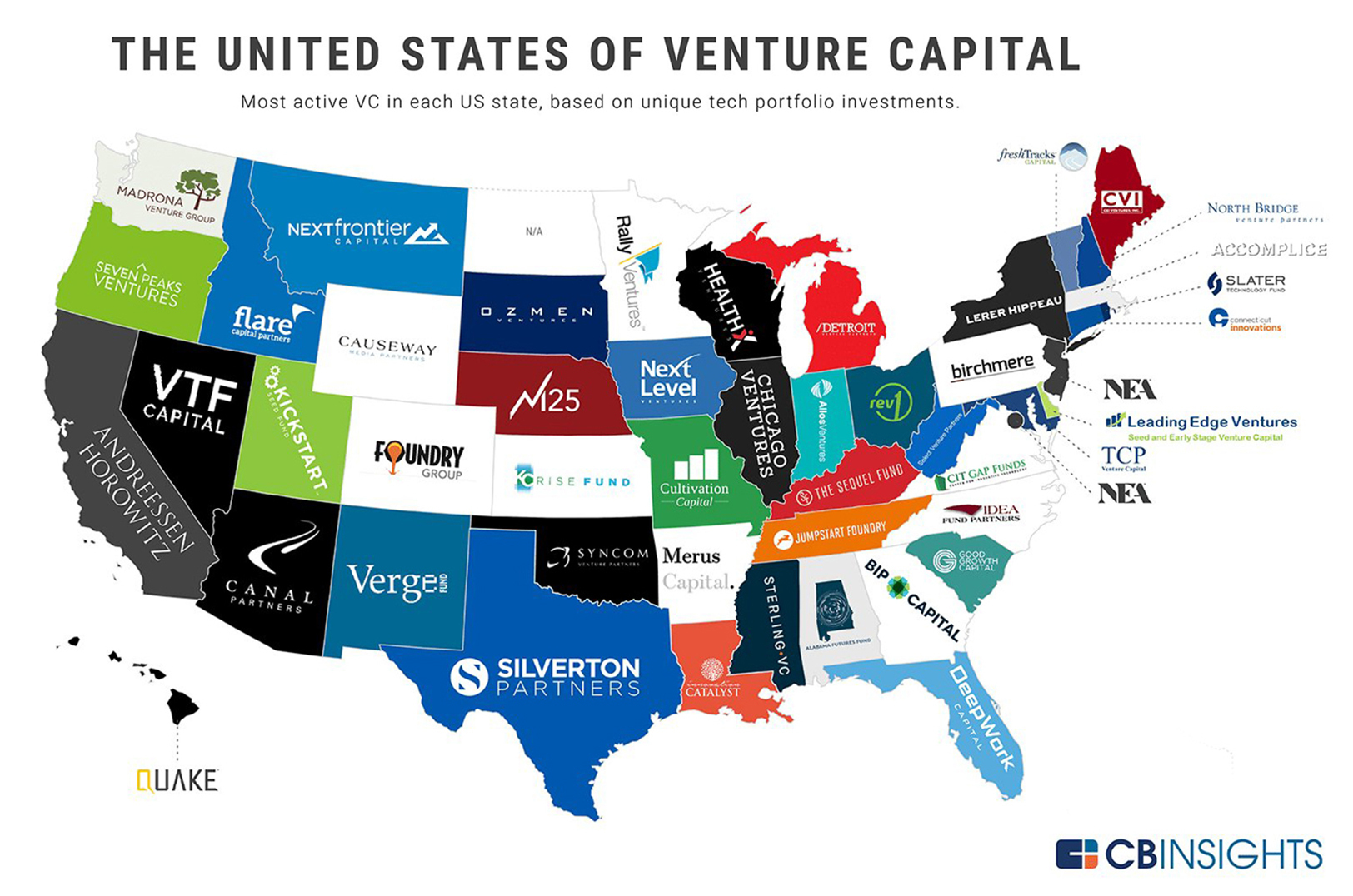

An investment in such a mindset has come with big returns for the KCRise Fund, newly proclaimed the most active venture capital fund in the Sunflower State, according to CB Insights.

Darcy Howe, KCRise Fund

“Perhaps overused but Margaret Mead’s quote, ‘Never doubt that a small group of thoughtful, committed citizens can change the world,’” Howe said in response to the distinction.

Deposited into Kansas City’s startup scene in 2016, the KCRise Fund was born when civic leaders came together in attempt to solve economic malaise in the metro, calling for more support behind the KC Rising initiative — a 20 year vision plan for Kansas City prosperity and economic growth, launched in 2014 — Howe explained.

“They asked business and civic folks to come problem solve together,” she said of what sets the KCRise Fund and Kansas City apart from other VC matching firms.

Notable KCRise portfolio companies in Kansas include: ShotTracker, SquareOffs, and Life Equals –– all companies that earned spots on Startland’s list of 12 Kansas City Startups to Watch in 2019, based largely on their likelihood of big news this year.

Click here to read more about Startups to Watch in 2019, which also included the fund’s portfolio firm Pepper IoT on the Missouri side of the state line.

“Promising entrepreneurs are coming to us every day with disruptive ideas in sectors like transportation, logistics, agriculture tech and IoT – verticals where KC already has a national reputation. We know KCRise can continue to be a conduit to capital nationwide and open doors for the next generation of KC startups,” added Ed Frindt, KCRise fund principal.

KCRise Fund additionally boasts such KCMO success stories as Backlot Cars — which posted an $8 million Series A funding round in late 2018 — and PayIt, named a GovTech 100 company three years running, the fund said.

“This is not only a testament to KCRise Fund, but to the many innovative companies being built by inspiring entrepreneurs in the KC region,” said Chad Feather, KCRise Fund analyst. “I am excited not only about the future of KCRise Fund, but the future of the entire KC entrepreneurial ecosystem.”

St. Louis-based Cultivation Capital was named the most active fund in Missouri, the report said.

2019 Startups to Watch

stats here

Related Posts on Startland News

Brew Bank raises the bar for craft beer, cocktails from this history-making Kansas taproom

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro. TOPEKA — Kansas’ premier digital self-serve, craft beer bar is consistently pushing the envelope, said Ryan Cavanaugh, making Brew Bank a culinary and drinking destination like no other. “We’re always…

On-demand stylist app brings the salon to your door, books gigs for beauty professionals

The luxury of on-demand salon services in the convenience of your own home is now available to the Kansas City community, Ruth Shrauner shared. The Poshed On The Go app officially launched July 18 after a “wild, awesome, crazy ride” of a year for the Shawnee-based founder and CEO and her team. “Exciting, surreal, scary,…

Four-day For the Culture Fest arrives in Topeka to celebrate African-American history in Kansas

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro. TOPEKA — Kansas’ capital city has a rich African-American history, Alonzo Harrison said, and it’s time for the community to come together to celebrate the past, present and future. “The Black…

EquipmentShare named to Y Combinator top companies list as it expands across Heartland, opens Ohio center

COLUMBIA, Missouri — Burgeoning construction tech giant EquipmentShare continues to announce plans for growth and expansion in the wake of its $290 million Series E funding round this spring. RELATED: EquipmentShare digs massive $290M round, deepening US footprint, its T3 tech platform Founded in 2015 by brothers Jabbok and Willy Schlacks, EquipmentShare connects contractors with…