Strategic investment from Five Elms Capital comes with new CEO for RFP360

January 16, 2019 | Startland News Staff

A freshly announced strategic growth investment is expected to boost RFP360’s sales, marketing and product development, as well as paving the way for added leadership at the Kansas City-based tech startup.

Financial details of the deal with Five Elms Capital were not disclosed, but the move comes in conjunction with the arrival of former Perceptive Software executive David Lintz at RFP360, a cloud-based RFP software provider previously known as RFP365.

Click here for more about RFP360’s recent rebranding.

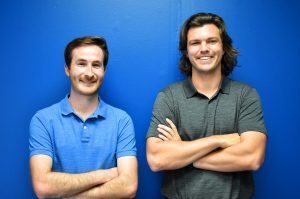

“The investment from Five Elms will allow us to develop innovative new technologies to help organizations overcome long-standing challenges,” said Lintz, now RFP360 CEO. “I’m looking forward to working closely with [founders David Hulsen and Stuart Ludlow], and the rest of the RFP360 team as we continue to support our valuable customers.”

Lintz most recently served as chief revenue officer for Tonic Health.

The infusion from Five Elms Capital reflects the investor’s commitment to fast-growing B2B software businesses that users love, the company said in a press release. RFP360 made headlines in 2018 for partnering with such firms as Lockton Companies to deliver streamlined RFPs, requests for information (RFIs), requests for quotations (RFQs), due diligence questionnaires (DDQs), and more to support strategic procurement and bidding processes.

“The RFP process is undergoing a desperately needed digital transformation,” said Hulsen, RFP360 co-founder and COO. “We take pride in offering solutions that address real needs for a large number of organizations.”

Co-founder Ludlow continues to serve as CTO.

Five Elms sees those solutions as disruptive to a market that’s traditionally relied on outdated processes, said Thomas Kershisnik, managing director at the leading growth equity firm.

“RFP360 changes the way companies think about what has historically been a painful process by providing a unique solution that creates a competitive advantage for their customers,” he said. “Their offerings, company culture, and leadership set the stage for continued growth, and we’re very excited to partner with them as they make that journey.”

Offering the only full-circle RFP management solution designed for issuers and responders, RFP360 was selected as one of Startland’s Kansas City Startups to Watch in 2018.

Featured Business

Related Posts on Startland News

Site confirmed for ASTRA innovation district; Why the project ‘sends a signal to startups’ and beyond

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro. This series is possible thanks to the Ewing Marion Kauffman Foundation, which leads a collaborative, nationwide effort to identify and remove large and small barriers to new business creation. One…

Techstars arrival: Find that ‘ride or die’ investor who answers your 3 am calls, founder says

Even in a startup’s early stages, founders need both a roadmap and destination, said Zerryn Gines. “You don’t need to know exactly what you’re doing every step of the way, but if you know where you want to go — then you can connect to the right people and ask the right questions,” explained Gines,…

New in KC: How two OU alumni secured over $1M from NASA, US Air Force for 3D printing startup

Editor’s note: New in KC is an ongoing profile series that highlights newly relocated members of the Kansas City startup community, their reasons for a change of scenery, and what they’ve found so far in KC. This series is sponsored by C2FO, a Leawood-based, global financial services company. Click here to read more New in KC profiles. Replicating the founding…

Flyover Capital closes its Tech Fund II over $60M, targeting new seed, post-seed startups

Tech startups raising seed and post-seed funding will benefit most from the close of Flyover Capital Fund II, the venture capital firm said, announcing Thursday its oversubscribed close. “The oversubscribed fund brings Flyover Capital’s total assets under management to approximately $110 million,” the Overland Park-based venture capital firm said in a release, outlining plans for…