Firebrand Fein: KC needs more audacious startups, ‘crazy ideas’ to attract investors

January 19, 2019 | Elyssa Bezner

Kansas City companies need to buck the Midwestern, risk-averse mindset and sell audacious plans to investors, said John Fein.

“I would just love to see more crazy ideas, more big game type ideas,” said Fein, founder and managing partner at Firebrand Ventures. “We invest when [the startup] starts to generate revenue, so they have to also demonstrate that they can execute on a short term strategy, but long term, we would love to see startups, in general, just thinking bigger.”

“Maybe in the past startups haven’t been willing to do that because they didn’t think that investors would support it,” he added.

Click here to read John Fein’s tips for raising a round in the Midwest.

The venture firm invested in its 20th portfolio company in late 2018, said Fein, noting plans to dip into the firm’s second fund — an as-yet undisclosed amount — to augment its portfolio with an additional eight to 10 companies in 2019.

“We would love to add more Kansas City companies,” he said. “We obviously have to be disciplined to our investment criteria next year and they have to be a good fit for us, but I would like nothing better than to add to those four Kansas City companies that we’ve already invested in.”

Click here to read more about Firebrand’s initial, oversubscribed seed fund of $17.7 million.

Firebrand already supports KC-based firms FitBark, Sickweather, Super Dispatch, and Zohr, he added, with the rest of the 20 spread across “the greater Midwest” area. Zohr was recently selected as one of Startland’s Startups to Watch in 2019.

Super Dispatch was one of Startland’s Top Kansas City Startups to Watch in 2018. And FitBark made the list in 2017.

Firebrand was founded in 2016 to address the need for seed capital in the metro, said Fein, noting Kansas City has made marked improvement during the past three years.

“There are several new funds that all have sort of different approaches. In addition to the funds, you have individual angel investors and family offices — all of whom are much more active today than they were three years ago,” he said. “I just think that’s a huge positive for Kansas City and I think that has been reflected in its growth. I’ve been involved in the startup community since early 2012 and it is just leaps and bounds beyond where it was at that point.”

“It’s a completely different community,” he added.

Growing further comes down to investors and founders both taking more risks, said Fein, also noting a need for increased corporate engagement in the startup world.

“[Companies like Black and Veatch] have done a phenomenal job partnering with startups and I would love to see other corporations in Kansas City follow their lead and be a lot more proactive about partnering with startups,” he said.

Kansas City is only six or seven years into a 20-plus year entrepreneurial ecosystem cycle, he added.

“I’m personally impatient in nature, so I would love to see it happen tomorrow, but part of it is just — this is where we are in our maturation as a startup ecosystem,” said Fein. “All of these areas will continue to improve.”

Firebrand portfolio company and Austin-based tech firm ScaleFactor recently announced a $30 million Series B funding round, according to Fortune magazine.

“The VC that led this round — Bessemer Venture Partners —is the oldest in Silicon Valley and one of the largest funds. Firebrand is thrilled to co-invest with them as we all support ScaleFactor’s incredible growth,” said Fein.

Featured Business

2019 Startups to Watch

stats here

Related Posts on Startland News

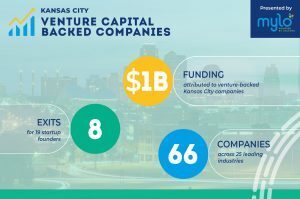

WATCH: Startland News Reports – Kansas City VC-Backed Companies

Join Startland News for another edition of Startland News Reports as findings from its 2021 Kansas City VC-Backed Companies Report — a collaboration between UMKC’s Tech Venture Studio and Startland News — inform candid conversations with Kansas City-based startup founders and venture capital experts.

Mixed Mutt fetches new home for doggie ice cream shop inside Crossroads pup space

Opportunity continues to bark for Mixed Mutt Creamery, Sherri Corwin said, announcing the dog-friendly ice cream shop will soon move from its Midtown storefront to join forces with another pet-focused small business in the Crossroads Arts District. “This is a huge opportunity for growth,” Corwin told Startland News, detailing a new partnership between Mixed Mutt…

Who’s getting funded in KC? The answer requires a long look in the mirror, analysts say

Editor’s note: Startland News asked industry experts to take an early look at the data behind the 2021 Kansas City Venture Capital-Backed Companies Report — the culmination of a three-month collaboration between UMKC’s Technology Venture Studio and Startland News, and presented by Mylo, a Lockton Company. Below are some of their leading takeaways, along with…