Passive investment approach is so 30 years ago, Drawbridge strategist says

December 11, 2018 | Austin Barnes

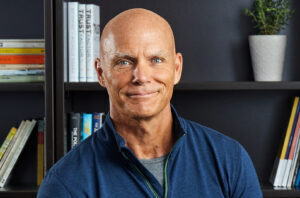

Transforming a systematic process into a company built on efficiency has Lee’s Summit-based Drawbridge Strategies ready to disrupt the world of finance, said Tim Fortier.

“A product is a means to an end, not the end itself. What is necessary is better investor education on the process behind the product,” said Fortier, Drawbridge Strategies CIO.

Built on Fortier’s 30 years in the financial trenches, Drawbridge Strategies — a portfolio building operation, comprised of three Fortier-fronted companies that includes Portfolio Cafe and Expectancy Distributors, LLC — uses exchange-traded funds and stocks to create quantitative models for investors, advisors, financial publishers, and institutions — simplifying a decades-old process, that’s become inefficient in the modern world of finance in the process, Fortier explained.

“Traditional, passive approaches, that are now so popular, are going to disappoint investors in the years to come,” he said. “What has worked for the last 30 plus years is not going to work the same way. Rates are rising, there is systemic leverage everywhere you look, and stock valuations are again at extremes.”

A realization that the industry is fueled by innovation led Fortier and his wife — Catherine Fortier, CEO — to ultimately form Drawbridge Strategies, which can be thought of as a bridge gapping tool for investors, he added.

Fruit of the Fortier’s labor, the company’s intellectual property has been newly licensed to an exchange traded fund (ETF), set to launch Dec. 19 on the New York Stock Exchange.

“As investors become unstuck in their old ways, we will be there educating them and providing solutions that work as expected,” Fortier said of what’s to come in the company’s near future. “We have a second ETF planned for Q219, a digital platform, and a suite of insurance and note products.”

Observed as a step forward for the Lee’s Summit-headquartered company, Fortier said his experience with the 1990s market boom, witnessing the tech bubble, and working through the 2008 market crash and recovery have uniquely molded him for process solutions development.

“We are seeing more AI and references to smart learning approaches [institutions have been doing this for years],” he said of Drawbridge Solutions role in the rapidly changing finance industry. “[Part of our mission] is to give investors a better way to invest — a way that utilizes smarter approaches.”

2018 Startups to Watch

stats here

Related Posts on Startland News

Chatterbox speaks the language of reluctant learners: games featuring global cast of AI tutors

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro. WICHITA — A Kansas-built language-learning app takes a gamified approach to fluency — inspired by travel and the simple joys of players feel when competing in traditional board games, said…

C2FO hits its first billion-dollar day; marks $400B in funding to customers as global finance shifts

A record-breaking year for C2FO serves as a proof point itself, said Sandy Kemper, revealing the Kansas City-built fintech surpassed $400 billion in lifetime funding to its customers in 2024 and achieved $1 billion of daily funding for the first time. “The success of the past year only demonstrates the tremendous need for more efficient…

KC-based Jayhawk startups earn cut of $570K from Oread Angel Investors pitch event

LAWRENCE, Kansas — Four Kansas City-area startups with ties to the University of Kansas recently took home funding infusions from a newly formed network of Sunflower State investors — part of a rapidly advancing initiative led by KU Innovation Park. Members of the Oread Angel Investors network, which launched in September and now has about…

Meet 5 new startups bolstering KC innovation (now with a funding boost from Digital Sandbox)

Just-announced funding for a handful of fresh tech ventures is expected to help Kansas City founders who already are poised to make a significant impact in their industries, from health care to government to education. Digital Sandbox KC has accepted five new startups into its program. Each is expected to receive up to $20,000 in…