LendingStandard plans innovation upgrade with $2.5M investment from Flyover Capital

November 5, 2018 | Austin Barnes

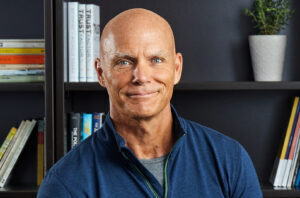

An investment in innovation has landed Kansas City-based LendingStandard $2.5 million in investment funds following the close of a Series A funding round led by Flyover Capital, CEO Andy Kallenbach said.

“These are folks that are well-known in Kansas City and have had software businesses in the past, and that’s a really rare combination,” Kallenbach said of Flyover Capital.

LendingStandard — a series of software based products and services, developed to create efficiency in the multi-family lending business — is the fund’s 16th, early-stage investment since it was launched in 2015. Flyover’s portfolio also includes Zoloz, Risk Genius and Site 1001.

“The other piece [to working with Flyover Capital] is this is a local capital source that has a decent number of partners, that all have software and technology expertise,” Kallenbach added.

The lead investor was impressed by the founder and his team’s tenacity, said Keith Molzer, managing partner of Flyover Capital.

“They are addressing a big pain point within the HUD space and are on track to be a major player supporting the large and ever-growing multi-family lending space,” Molzer said.

An unspecified number of undisclosed, secondary investors also took part in the round, a LendingStandard release explained.

Following the close of the funding round, the cash infusion provided by the investment will enable LendingStandard to look toward scaling, Kallenbach said.

“This product that we’ve built, we’re looking to continue that innovation — to help more multi-family properties get better financing,” he said. “There’s 2.5 million properties across the United States, many of which do not get good financing terms and I think that there’s a lot that we can do to change the way the market operates and get those properties appropriate financing and really kind of help meet housing needs across the U.S.”

Additionally, funds will allow LendingStandard to continue modernizing the multi-family lending space, improve the company’s LOS platform, and expanding its executive team. The company recently welcomed Chris Weber, chief technology officer, and Craig Hughey, vice president of product, Kallenbach added.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Mayor proposes $1M in off-duty LEO pay; River Market eyes ‘witching hours’ security to combat crime wave

An ordinance pushed by Mayor Quinton Lucas would fund extra security services in KCMO business districts through collaboration with regional law enforcement agencies — a move aimed at preventing more thefts, break-ins and vandalism incidents targeted at Kansas City small businesses. Lucas’ proposal would invest up to $1 million to increase the presence of off-duty deputies…

How this Andre’s Valentine collaboration celebrates the friendship that sparked Kate Spade

The favorite hometown chocolate of one Kansas City’s best-known fashion designers and entrepreneurs serves as just one ingredient in a new Valentine’s Day collaboration from André’s Confiserie Suisse. The local chocolatier just rolled out a limited edition line alongside Frances Valentine to mark the holiday, as well as celebrate the friendship between Elyce Arons and…

Electric Americana: How singer Teri Quinn broke from the pack (and found her own in KC)

Members of the Kansas City-based band Teri Quinn & The Coyotes are carving a distinctive space within the local music scene. From Appalachian banjo riffs to punk-inspired beats, their sound reflects diverse influences — howling loudest from the woman in front. Attendees at Startland News’ Jan. 23 reception for the Kansas City Startups to Watch…

C2FO hits its first billion-dollar day; marks $400B in funding to customers as global finance shifts

A record-breaking year for C2FO serves as a proof point itself, said Sandy Kemper, revealing the Kansas City-built fintech surpassed $400 billion in lifetime funding to its customers in 2024 and achieved $1 billion of daily funding for the first time. “The success of the past year only demonstrates the tremendous need for more efficient…