Curb appeal attracts investors to $850K round for real estate tech firm RealQuantum

November 29, 2018 | Austin Barnes

A year of steady growth will help Kansas City real estate tech firm RealQuantum end 2018 with the close of its first round of seed funding — securing $850,000 in investments, revealed Mark Davis.

Mark Davis, RealQuantum

“We closed a couple of times actually — people just kept showing up at the last minute wanting in,” Davis, RealQuantum’s CEO, said of the company’s inaugural investment round that formally closed in mid-October after a launch in late July.

Touting a product that makes tedious real estate appraisals easy, RealQuantum is a web-based narrative appraisal software and cloud-hosted comps database that modernizes the real estate appraisal industry. Capabilities of the product have excited metro investors, Davis added.

“We thought we were going to bootstrap through the entire journey,” Davis said. “[We realized] if we want to go fast, we have to have some acceleration [in terms of] capital.”

Originally leery of taking on outside support, investors — including lead backers Brad Bradley, co-founder of NIC; Steve Tesdahl; and Ned O’Connor, founder of Waterford Property Company — started reaching out to Davis and his team with interest in RealQuantum six months after the company’s launch, making the decision to open a funding round a no brainer, he said.

“[Its encouraging] when experts in the industry are willing to put up their own money for your venture even before you have a product available,” Davis said amazed and encouraged.

The round was led by Dan Craig and Tim Keller, two people Davis credits with making the company’s growth possible. Lead investors will serve as partners who bring value to the company either in expertise, access to new markets or both, he explained.

The company participated this summer in the Enterprise Center of Johnson County’s Pitch Perfect boot camp, as well as presenting on the 1 Million Cups Kansas City stage.

A 2018 LaunchKC grants competitor, RealQuantum is set to end the year with funding exceeding the $1 million mark — between bootstrapping and angel investments — an accomplishment that’s so far positioned the company to grow its development team.

“I didn’t have to jump on any airplanes and we didn’t have to deal with 200 pitches,” Davis said as a testament to local support for RealQuantum. “We were able to close without ever doing much [formal] pitching at all.”

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

DevOpsDays brings two-day grassroots tech conference back to Kansas City

DevOpsDays KC is returning this week with an open spaces concept wherein audience members at the two-day conference vote on the topics to cover in real time, said Ryan McNair. Topics with the most votes create zones in the space in which the audience can flow freely from each area. “If you don’t like it,…

Privacy in practice: Responding to daily cyber threats sharpens Polsinelli tech team

Editor’s note: The following content is sponsored by Polsinelli PC but independently produced by Startland News. We see the fallout nearly every day. Another company, government or celebrity that’s been technologically compromised, prompting officials to scramble on how to best calm customers, citizens and stakeholders. And when you lead one of the nation’s top cybersecurity…

Pint-sized perspective: KC’s Little Hoots takes nostalgia-capturing tech to MIT

From the cute and comedic to the whimsical and wise, every parent can pinpoint a Little Hoots moment that relates to their personal adventure in child-rearing, said Lacey Ellis, founder and CEO of the Kansas City-birthed mobile app that recently turned heads at MIT. “If a picture is worth a thousand words, a hoot is…

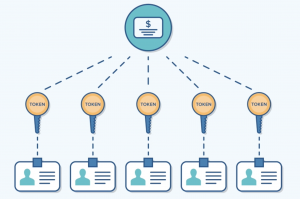

LaunchKC winner bringing cryptocurrency into the investment game with Liquifi

A blockchain-enabled solution from Venture360, called Liquifi, aims to unfreeze startups paralyzed by a lack of access to capital, Rachael Qualls said with excitement. “The main reason more people don’t invest in private companies is there is no way to get money out,” said Qualls, CEO of Venture360. “On average money is tied up for…