New investor report: Women-led startups more likely to get angel support than VC backing

October 30, 2018 | Austin Barnes

Angel investors support 10-times more women-led companies than venture capital-backed investors, revealed a first-of-its-kind report by the Kansas City-based Angel Capital Association.

“It didn’t shock us,” said Marianne Hudson, executive director of the ACA, the world’s largest cohort of angel investors.

Hudson cited previous ACA research that indicated 21 percent of angel investors had been identified as women.

“We could really see some growth there,” she said. “Any events and activities that were giving women momentum had a lot of interest.”

Newly released, the pilot for the ACA’s Angel Funders Report polls 26 angel groups from 17 states and examined factors that impact investor returns and overall entrepreneurial success.

“[Angel Groups] are very excited about this. They can see some real, potential benefits,” Hudson said.

Other highlights of the report include angel investors eager to support first-time entrepreneurs, investment opportunities located in more than twice the number of states as angel investors, and multiple angel investors collaborating to infuse startups with investments in the million-dollar range, Hudson revealed.

Click here to view the full Angel Funders Report.

“I think [collaboration] is a growing trend in that it really shows that angel groups need to work with each other to invest in entrepreneurs so they get the capital that they need,” she said.

Moving forward, the ACA plans to release the report quarterly, Hudson said. Beyond the release of the pilot report, an official launch timeline has not yet been determined.

“An angel investment is only successful if the company is successful,” she added. “I think over time this will give us the kinds of insights that everyone can learn from.”

Routine study of trends in angel investment will further cultivate the entrepreneurial ecosystem, by alerting investors and entrepreneurs to new opportunities in the startup space, Hudson said.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

DevOpsDays brings two-day grassroots tech conference back to Kansas City

DevOpsDays KC is returning this week with an open spaces concept wherein audience members at the two-day conference vote on the topics to cover in real time, said Ryan McNair. Topics with the most votes create zones in the space in which the audience can flow freely from each area. “If you don’t like it,…

Privacy in practice: Responding to daily cyber threats sharpens Polsinelli tech team

Editor’s note: The following content is sponsored by Polsinelli PC but independently produced by Startland News. We see the fallout nearly every day. Another company, government or celebrity that’s been technologically compromised, prompting officials to scramble on how to best calm customers, citizens and stakeholders. And when you lead one of the nation’s top cybersecurity…

Pint-sized perspective: KC’s Little Hoots takes nostalgia-capturing tech to MIT

From the cute and comedic to the whimsical and wise, every parent can pinpoint a Little Hoots moment that relates to their personal adventure in child-rearing, said Lacey Ellis, founder and CEO of the Kansas City-birthed mobile app that recently turned heads at MIT. “If a picture is worth a thousand words, a hoot is…

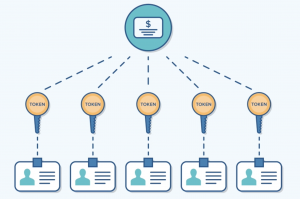

LaunchKC winner bringing cryptocurrency into the investment game with Liquifi

A blockchain-enabled solution from Venture360, called Liquifi, aims to unfreeze startups paralyzed by a lack of access to capital, Rachael Qualls said with excitement. “The main reason more people don’t invest in private companies is there is no way to get money out,” said Qualls, CEO of Venture360. “On average money is tied up for…