Hunting access to capital? Do your homework first, Techweek panel says

October 11, 2018 | Elyssa Bezner

Imagining overnight startup success is as unrealistic as wanting to become a winning athlete or megastar musician overnight — it all takes time and practice, said Juan Campos.

“If you actually have the ambition to create a multimillion dollar company, then the people that are the most successful at that didn’t just wake up one day and say, ‘Hey, I have a multimillion dollar idea, what do I do next?’” said Campos, partner and vice president of Manos Accelerator, a Silicon Valley program for Latinx entrepreneurs, during a Techweek panel Wednesday that discussed access to angel and venture capital.

The mid-week diversity and inclusion track at Techweek explored topics from securing funding, to bridging the inclusivity gap in Kansas City, and even locating and building the right company culture.

Campos was joined by Stefanie Thomas, senior associate of investments at Washington D.C- based Impact America Fund, and Craig Fowler, managing director of Boston-based HarbourVest Horizons, on the panel that covered more than just accessing funds.

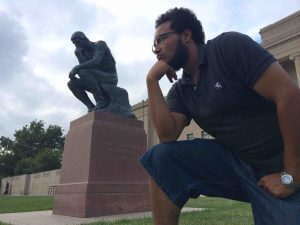

Juan Campos, Manos Accelerator

“[Being an entrepreneur] is pretty hard — you’re going to have to sacrifice a lot,” Thomas began. “I ask people, ‘What is your spiritual practice?’ sometimes because you have to have a certain centeredness about you that will keep you grounded through the ups and downs of an entrepreneurial journey.”

Aspiring entrepreneurs should focus on understanding the specific market and its needs, before attempting to receive funding, she said.

“You have to do that initial legwork. So, before you think about venture money, before you think about asking someone else to put up $50,000 or $100,000 to realize your vision, really go out and find the people who would actually understand the value of the product or the service you’re providing,” said Thomas.

Companies next need to complete due diligence on the funding sources with whom they’re meeting, added Fowler.

“You should do your homework, just like we do our homework on you when we’re evaluating you. You want to make sure you’re getting the right kind of capital,” he said. “They can add value and grow your business to a certain level, and they’re going to have an exit strategy. Before they’re investing in businesses, they have already decided, ‘OK, in three to five years, we are going to be exiting this business and here’s how we’re going to do it.’ You as the manager, needs to be aware of that. That should be all laid out in front.”

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Indie craft, maker fair Strawberry Swing returning Sunday with KC love

One of the largest indie craft fairs in the Midwest is expected to draw thousands of Kansas Citians to discover local makers and creators. Strawberry Swing’s summer event, set for Sunday at the Nelson-Atkins Museum of Art lawn, aims to showcase vendors from Kansas City, as well as parts of Arkansas, Iowa, Oklahoma and more.…

‘Software is eating the world,’ LaunchCode instructor appeals to aspiring techies

Ambitious techies in the Kansas City area might soon have an opportunity to realize their aspirations with a course coming soon from the nonprofit LaunchCode. Based in St. Louis but with an office in Kansas City, LaunchCode aims to grow the tech workforce of select communities by offering programs to educate those eyeing a career…

Events Preview: Gigabit City Summit, Celebrate entrepreneurs

There are a plethora of entrepreneurial events hosted in Kansas City on a weekly basis. Whether you’re an entrepreneur, investor, supporter, or curious community member — we recommend these upcoming events for you. Are you hosting a relevant community event? Feel free to add it to the FWD/KC calendar for increased exposure. Once your event…

Rack Performance beefs up with seed investment from former Perceptive Software execs

Lenexa-based Rack Performance has raised a seed investment round that will fuel the exercise tech startup’s sales and development. Rack Performance has raised $300,000 from perceptiveEQUITY, a new early-stage investment firm that’s managed by three former executives at Lenexa-based Perceptive Software, which was purchased by Lexmark International for $280 million in 2010. Lexmark recently sold…