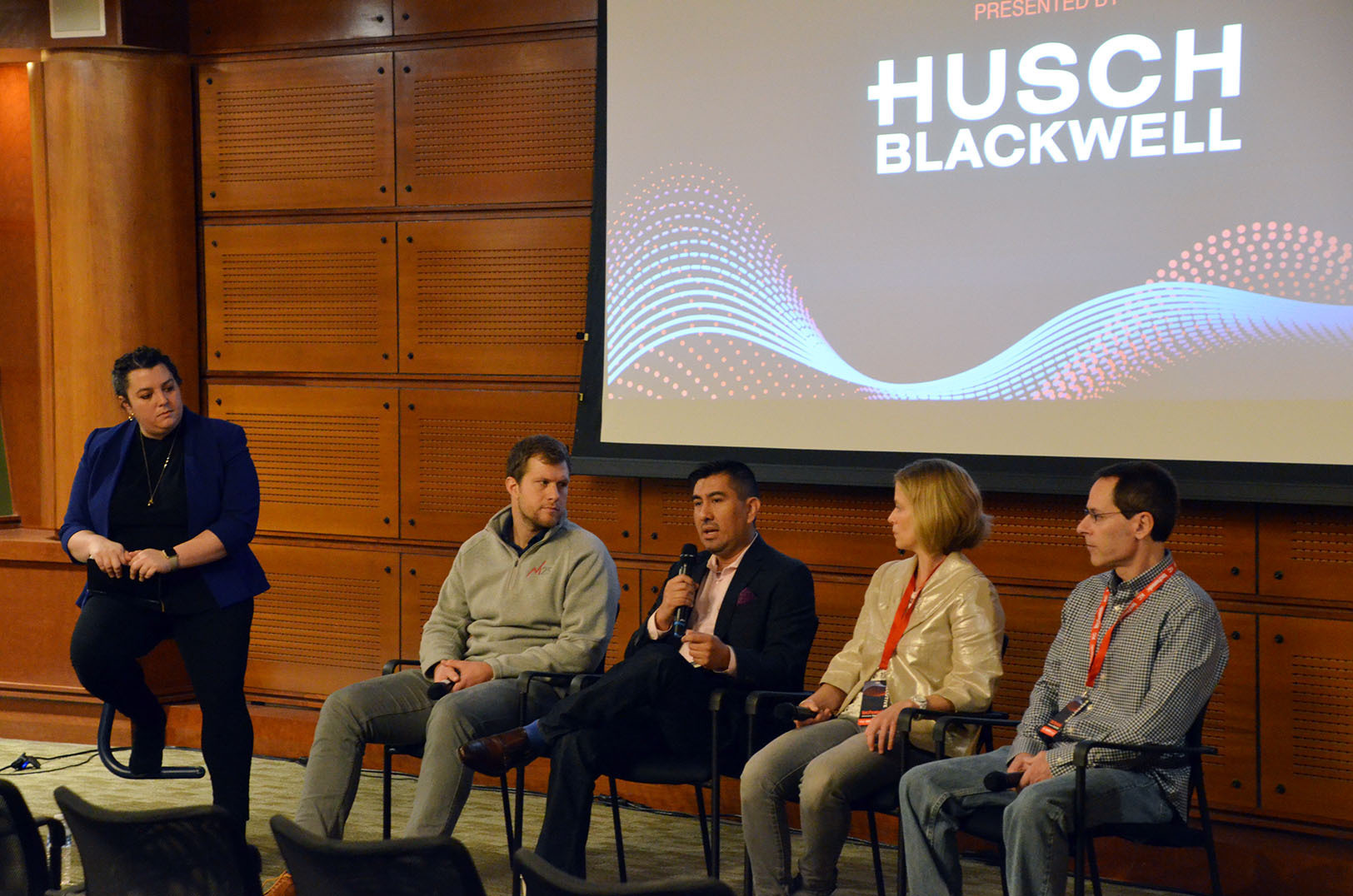

Be fearlessly honest about diversity gap, Atlanta expert tells KC Techweek panelists (Photos)

October 11, 2018 | Tommy Felts

Building an inclusive startup community begins with being unafraid to directly state the problem — a diversity gap — free of coded language related to race and gender, said Rodney Sampson.

“I am unapologetically about being ‘color-brave’ and ‘race-brave’ — rather than being ‘color blind’ — because when you say ‘color blind,’ you’re saying you don’t see me,” said Sampson, chairman and CEO of Opportunity Hub in Atlanta. “You don’t see everything I bring to the table. You don’t see the pain and the struggle.”

A panel of Kansas City leaders turned to Sampson Wednesday at Techweek during a conversation about bridging the inclusivity gap, seeking to learn how locals can potentially replicate the success of his social venture in Atlanta. Heavy-hitter panelists ranged from Philip Gaskin, director of entrepreneurial communities and chief of staff for entrepreneurship at the Ewing Marion Kauffman Foundation, to Leo Morton, chancellor emeritus at the University of Missouri-Kansas City.

“Data has shown it dramatically increases return on investment when you have women and people of color at the table,” Sampson said.

Opportunity Hub, the largest multi-campus entrepreneurship center and technology hub in the U.S., reflects Sampson’s commitment to “Kingonomics” — taking the economic principles of Dr. Martin Luther King Jr. to build an inclusive innovation and investment model to address poverty and the wealth gap.

Bob Langenkamp, Economic Development Corporation of Kansas City, Missouri

Programs like CodeStart, #YesWeCodeFund, #100BlackAngels and HBCU@SXSW resulted from community input about the services Atlanta needed Opportunity Hub to provide, Sampson said.

“There was a sense of urgency,” he said. “People wanted a safe space to learn code, to work on their business, write a business plan, build their tech.”

In late 2015, Opportunity Hub merged its coworking operations with TechSquare Labs, a corporate innovation lab and venture fund that has invested in more than 30 companies that have raised more than $300 million in follow on capital, are valued at more than $1 billion dollars, generate $75 million in annual recurring revenue and growing and employ nearly 1,000 people, according to the company.

“We joke that around the city, and around the country, we’re known as ‘the black WeWork,’” Sampson said. “We don’t want blacks only, by the way, we just have that market and we attracted people that we wanted to help change their lives.”

Check out photos from Wednesday’s Techweek events below.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Pipeline announces 2016 fellowship class

The Pipeline Entrepreneurial Fellowship announced Thursday night during its annual Innovator of the Year gala the tenth class of fellows in its leadership development program. The Kansas City-based organization is welcoming 13 entrepreneurs from the region, including six innovators from Missouri, five from Nebraska and two from Kansas. This year’s fellowship will hold program events…

Events Preview: IOTY tonight, Think Big Anniversary

There are a boatload of entrepreneurial events hosted in Kansas City on a weekly basis. Whether you’re an entrepreneur, investor, supporter or curious Kansas Citian, we’d recommend these upcoming events for you. WEEKLY EVENT PREVIEW Lean Lab Happy Hour When: January 21 @ 4:30 pm – 6:00 pm Where: Sprint Accelerator Join us every month to…

Addressing a market gap, $25M seed fund arrives in Kansas City

Nearly a year after identifying an early-stage funding need in the area, a $25 million seed fund will open a Kansas City office that aims to boost local startups. With a Wednesday night intro at Polsinelli, the Royal Street Investment & Innovation Center will soon move into the Kansas City metro for its second fund. Founded…

Mid-America Angels’ injects $2.8M into nine startups during 2015

The Mid-America Angels, a Kansas City area-based angel investor network, closed 2015 on a high note with more than $2.8 million invested in nine ventures. The 2015 investment total is a near-20 percent increase in capital from 2014’s roughly $2.3 million invested. Rick Vaughn, the MAA’s managing director, said last year also was the most…