Flyover Capital celebrates $63 million sale of its second portfolio firm Agrible

August 9, 2018 | Startland Staff

In a deal that further validates the vibrancy of the Midwest tech scene, leaders at Kansas City-based Flyover Capital are lauding the sale of its second portfolio firm since its launch in 2014.

Flyover — a venture capital firm whose mission is to fuel the next generation of tech startups in the Midwest — is enjoying the sizable exit of Agrible, an Illinois-based ag tech startup, said Flyover partner Keith Molzer. Agrible sold to Nutrien, based in Loveland, Colorado, for $63 million.

“We are excited for the Agrible team,” Molzer said. “They have worked diligently to build a great company and having Nutrien acquire the company is a great testament to their team and the technology they have built.”

The sale is significant not only to Flyover and its partners but also the flyover region it serves, Molzer said. The deal is the second exit in Flyover’s portfolio, with the first being Kansas City-based ZOLOZ, formerly EyeVerify.

Flyover participated in three investment rounds in Agrible, he added.

“This is a great win for the Midwest and further validates Flyover’s goal of helping create the next generation of technology success story in flyover country,” Molzer said. “This exit provides a substantial return for the investors in Flyover Capital as well. As a first-time fund, we focus on finding early-stage technology companies that we can help grow and utilizes the natural resources in the region. In Agrible’s case, being in the heartland and close to the University of Illinois provided them access to the best ag tech talent and helped them accelerate their growth. It is a testament to the region, as Nutrien is keeping the Agrible team in Champaign, Illinois.”

Agrible created a platform that includes a variety of farmer advisory tools, data science capabilities, predictive analytics. Nutrien is a publicly-traded ag tech firm.

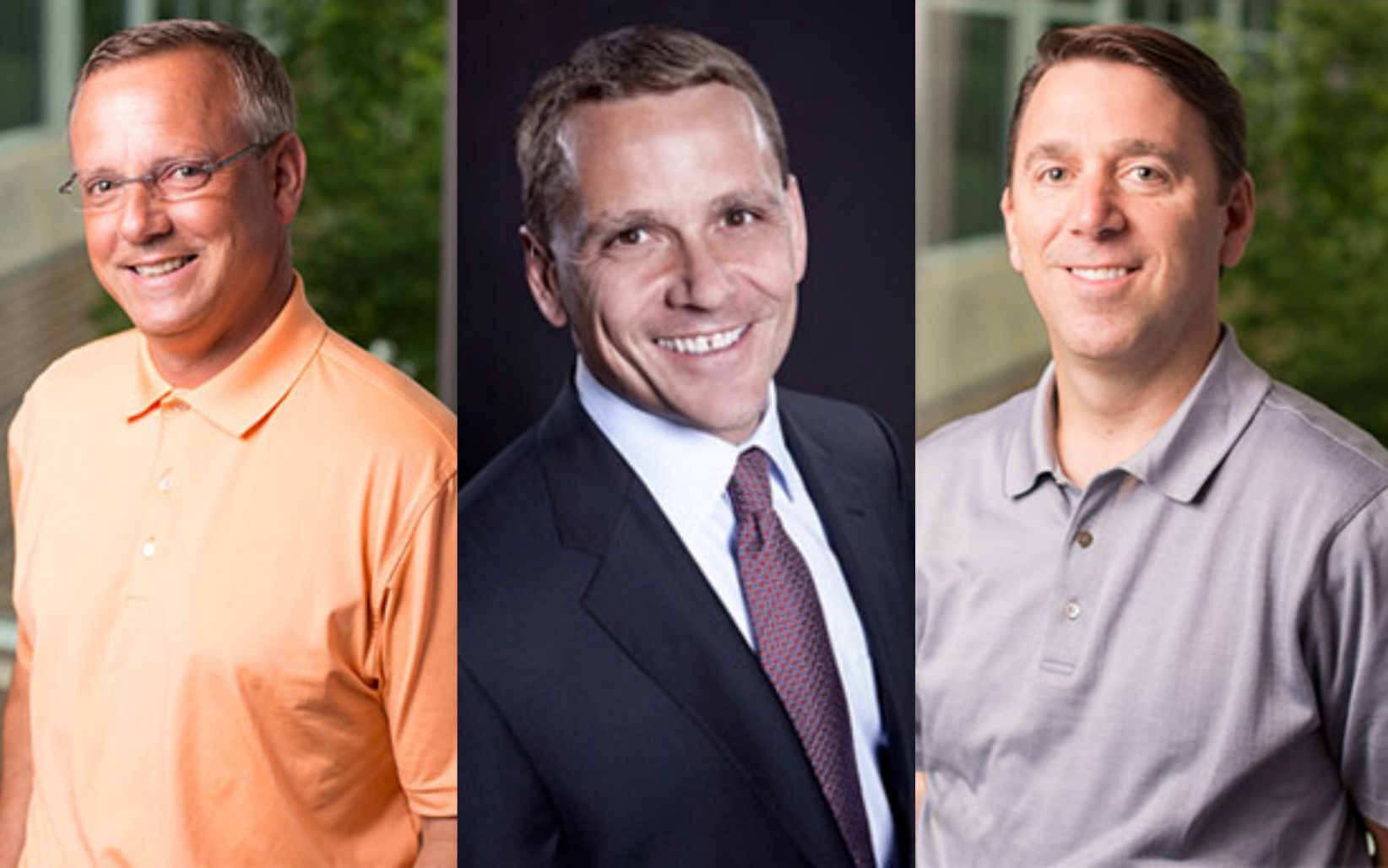

Flyover Capital launched in 2014 and features several Kansas City entrepreneurs among its leadership, including Molzer, Thad Langford and Marty Bicknell. The firm has invested in 13 companies in Kansas, Missouri, Nebraska, Texas, Illinois, Indiana, Wisconsin and Maryland.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Entrepreneur duo uses KC Current blueprint to acquire Danish football, build multi-club portfolio

A just-announced deal to purchase a premier women’s football club in Denmark reflects Angie and Chris Long’s unwavering commitment to investing in women’s soccer at the highest level, the couple said, noting they’ll continue their work to raise the bar for players, supporters, and communities both nationally and internationally. Ballard Capital, a sports entertainment-focused investment…

How tech can put humanity back in hiring: Interview app brings beta test to Kansas City

Automation in the hiring process is leaving critical details — and quality, diverse talent — out of the jobs market, said Chelsea Parker, a Kansas City human resources innovator whose new Interview app aims to reconnect recruiters and applicants on a human level. “Interview is the TikTok of LinkedIn,” said Parker, the HR trendsetter behind creating an…