Flyover Capital celebrates $63 million sale of its second portfolio firm Agrible

August 9, 2018 | Startland Staff

In a deal that further validates the vibrancy of the Midwest tech scene, leaders at Kansas City-based Flyover Capital are lauding the sale of its second portfolio firm since its launch in 2014.

Flyover — a venture capital firm whose mission is to fuel the next generation of tech startups in the Midwest — is enjoying the sizable exit of Agrible, an Illinois-based ag tech startup, said Flyover partner Keith Molzer. Agrible sold to Nutrien, based in Loveland, Colorado, for $63 million.

“We are excited for the Agrible team,” Molzer said. “They have worked diligently to build a great company and having Nutrien acquire the company is a great testament to their team and the technology they have built.”

The sale is significant not only to Flyover and its partners but also the flyover region it serves, Molzer said. The deal is the second exit in Flyover’s portfolio, with the first being Kansas City-based ZOLOZ, formerly EyeVerify.

Flyover participated in three investment rounds in Agrible, he added.

“This is a great win for the Midwest and further validates Flyover’s goal of helping create the next generation of technology success story in flyover country,” Molzer said. “This exit provides a substantial return for the investors in Flyover Capital as well. As a first-time fund, we focus on finding early-stage technology companies that we can help grow and utilizes the natural resources in the region. In Agrible’s case, being in the heartland and close to the University of Illinois provided them access to the best ag tech talent and helped them accelerate their growth. It is a testament to the region, as Nutrien is keeping the Agrible team in Champaign, Illinois.”

Agrible created a platform that includes a variety of farmer advisory tools, data science capabilities, predictive analytics. Nutrien is a publicly-traded ag tech firm.

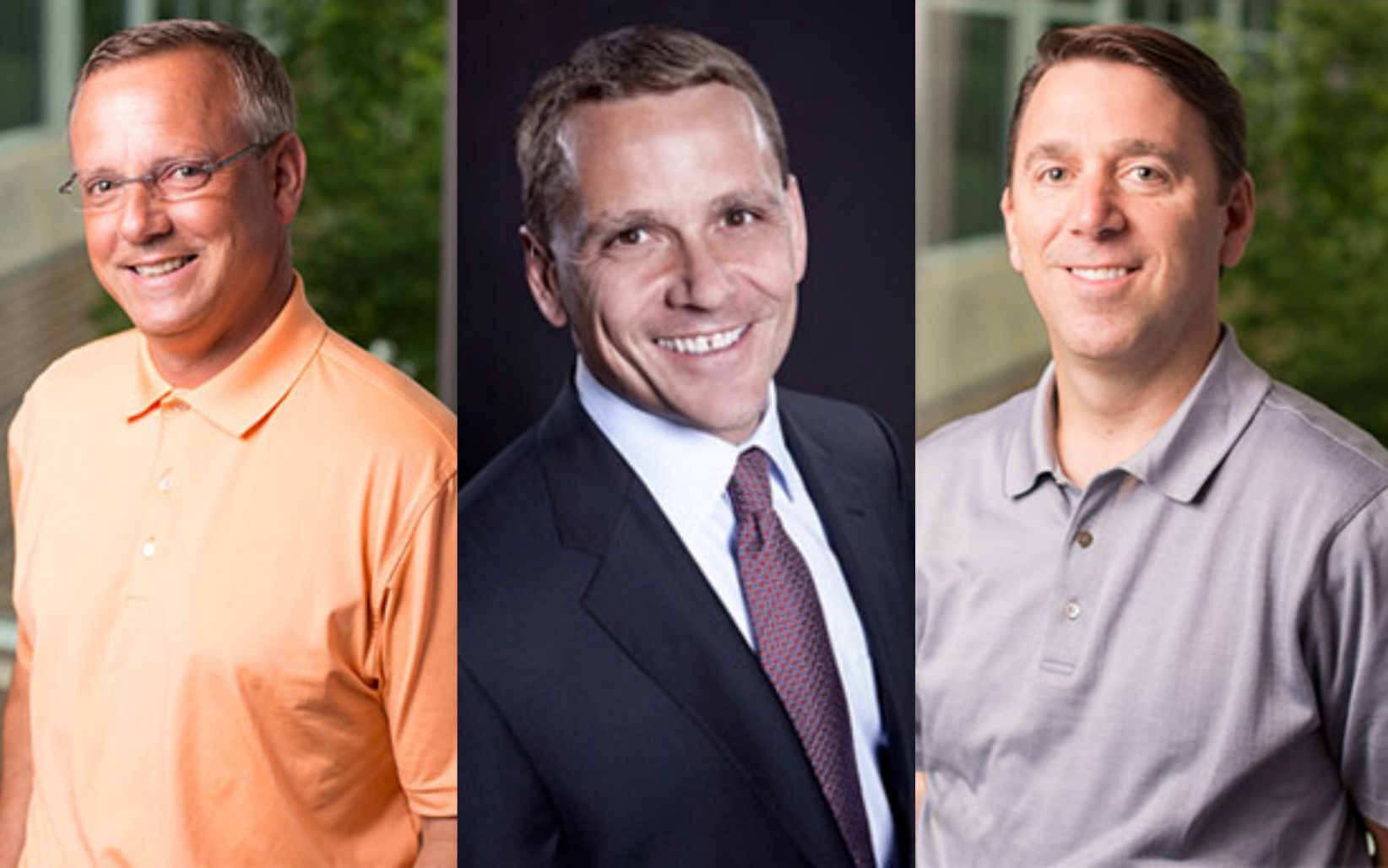

Flyover Capital launched in 2014 and features several Kansas City entrepreneurs among its leadership, including Molzer, Thad Langford and Marty Bicknell. The firm has invested in 13 companies in Kansas, Missouri, Nebraska, Texas, Illinois, Indiana, Wisconsin and Maryland.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Retro-inspired activewear brought this stay-at-home mom out of isolation; why it’s go-go time for Molly Heise’s budding business

Molly Heise’s earliest memories go back to playing marbles on her great-grandma’s avocado-colored shag carpet, captivated by the various floral patterns that surrounded her, she recalled. Today, those memories inspire her personal style and activewear line, GoGoBloom. “I’ve loved the retro style for as long as I can remember,” she shared. “But in the past…

They fought to end Lee’s Summit’s neon ban; now they’re relighting a grinning, spinning Katz face in KC

How a Lee’s Summit duo is reviving eye-catching signs of KC’s past The iconic face of Katz Drug Store — the famed retail operation that grew from the streets of Kansas City to eventually become CVS — is set to return to its hometown thanks, in part, to a pair of unlikely neon sign restorationists. …

PlaBook to compete for $1M in prizes at world’s largest pitch competition for edtech startups

Fresh off its selection to Pipeline’s latest fellowship, a Kansas City edtech startup is now set to compete at The Elite 200 as a semifinalist in The GSV Cup — representing top pre-seed and seed stage startups in digital learning across the “Pre-K to Gray” space. KC-based PlaBook is set to vie for $1 million…

C2FO closes $140M funding round amid record growth, expanded focus on underserved companies

Editor’s note: C2FO is a financial supporter of Startland News’ nonprofit newsroom. Kansas City fintech powerhouse C2FO grows best when it’s accelerating access to capital for those traditionally underserved by the banking industry, said Sandy Kemper, announcing a $140 million funding round for the Leawood-based company. Led by Third Point Ventures — a multi-stage investor…