Flyover Capital celebrates $63 million sale of its second portfolio firm Agrible

August 9, 2018 | Startland Staff

In a deal that further validates the vibrancy of the Midwest tech scene, leaders at Kansas City-based Flyover Capital are lauding the sale of its second portfolio firm since its launch in 2014.

Flyover — a venture capital firm whose mission is to fuel the next generation of tech startups in the Midwest — is enjoying the sizable exit of Agrible, an Illinois-based ag tech startup, said Flyover partner Keith Molzer. Agrible sold to Nutrien, based in Loveland, Colorado, for $63 million.

“We are excited for the Agrible team,” Molzer said. “They have worked diligently to build a great company and having Nutrien acquire the company is a great testament to their team and the technology they have built.”

The sale is significant not only to Flyover and its partners but also the flyover region it serves, Molzer said. The deal is the second exit in Flyover’s portfolio, with the first being Kansas City-based ZOLOZ, formerly EyeVerify.

Flyover participated in three investment rounds in Agrible, he added.

“This is a great win for the Midwest and further validates Flyover’s goal of helping create the next generation of technology success story in flyover country,” Molzer said. “This exit provides a substantial return for the investors in Flyover Capital as well. As a first-time fund, we focus on finding early-stage technology companies that we can help grow and utilizes the natural resources in the region. In Agrible’s case, being in the heartland and close to the University of Illinois provided them access to the best ag tech talent and helped them accelerate their growth. It is a testament to the region, as Nutrien is keeping the Agrible team in Champaign, Illinois.”

Agrible created a platform that includes a variety of farmer advisory tools, data science capabilities, predictive analytics. Nutrien is a publicly-traded ag tech firm.

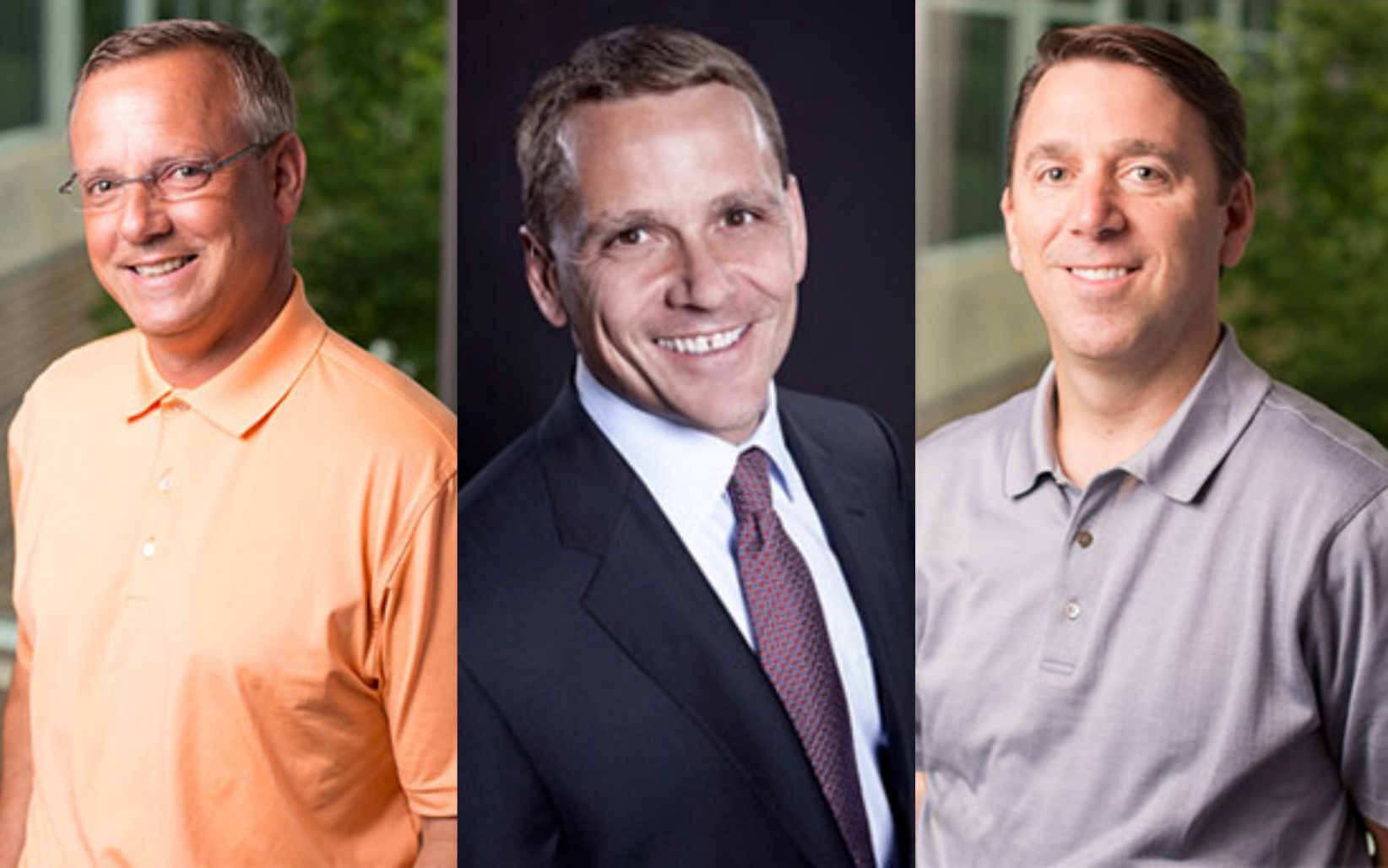

Flyover Capital launched in 2014 and features several Kansas City entrepreneurs among its leadership, including Molzer, Thad Langford and Marty Bicknell. The firm has invested in 13 companies in Kansas, Missouri, Nebraska, Texas, Illinois, Indiana, Wisconsin and Maryland.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

These shoes are made for girls combat sports; now you can buy a pair down the street

A Kansas woman’s mission to bring girls’ athletic gear to traditionally male sports scored a big win this week as Yes! Athletics announced its move from online-only sales to local store shelves. Furthering its reach beyond the Yes! Athletics website, the shoe brand can be purchased at three Jock’s Nitch Sports stores in Kansas —…

Katz cat grins again: KC icon returning to the streets — this time near Liberty Memorial

Editor’s note: The following story was originally published by CityScene KC, an online news source focused on Greater Downtown Kansas City. Click here to read the original story or here to sign up for the weekly CityScene KC email review. The Katz Drug Store sign, a one-time iconic streetscape fixture in Kansas City and beyond with its happy cat…

Pipeline opens application for 2023 fellowship, Pathfinder; boosts its own storytelling

Midwest entrepreneurs deserve the resources they need to scale into high-growth ventures, said Melissa Vincent, announcing the launch this week of applications for Pipeline’s latest fellowship and Pathfinder program for overlooked founders. Tapping into its network of more than 180 entrepreneurs who have generated over $2.2 billion in revenues, Pipeline’s support system ranges from intense…

2022 Kansas City’s VC-Backed Companies Report

The metro’s field of venture capital-backed companies is getting more crowded — their payrolls swelling with new employees — amid a bounce-back from the global pandemic and new signals of Kansas City’s momentum, according to data in a new report from Startland News. The 2022 Kansas City Venture Capital-Backed Companies Report provides an updated snapshot into…