Flyover Capital celebrates $63 million sale of its second portfolio firm Agrible

August 9, 2018 | Startland Staff

In a deal that further validates the vibrancy of the Midwest tech scene, leaders at Kansas City-based Flyover Capital are lauding the sale of its second portfolio firm since its launch in 2014.

Flyover — a venture capital firm whose mission is to fuel the next generation of tech startups in the Midwest — is enjoying the sizable exit of Agrible, an Illinois-based ag tech startup, said Flyover partner Keith Molzer. Agrible sold to Nutrien, based in Loveland, Colorado, for $63 million.

“We are excited for the Agrible team,” Molzer said. “They have worked diligently to build a great company and having Nutrien acquire the company is a great testament to their team and the technology they have built.”

The sale is significant not only to Flyover and its partners but also the flyover region it serves, Molzer said. The deal is the second exit in Flyover’s portfolio, with the first being Kansas City-based ZOLOZ, formerly EyeVerify.

Flyover participated in three investment rounds in Agrible, he added.

“This is a great win for the Midwest and further validates Flyover’s goal of helping create the next generation of technology success story in flyover country,” Molzer said. “This exit provides a substantial return for the investors in Flyover Capital as well. As a first-time fund, we focus on finding early-stage technology companies that we can help grow and utilizes the natural resources in the region. In Agrible’s case, being in the heartland and close to the University of Illinois provided them access to the best ag tech talent and helped them accelerate their growth. It is a testament to the region, as Nutrien is keeping the Agrible team in Champaign, Illinois.”

Agrible created a platform that includes a variety of farmer advisory tools, data science capabilities, predictive analytics. Nutrien is a publicly-traded ag tech firm.

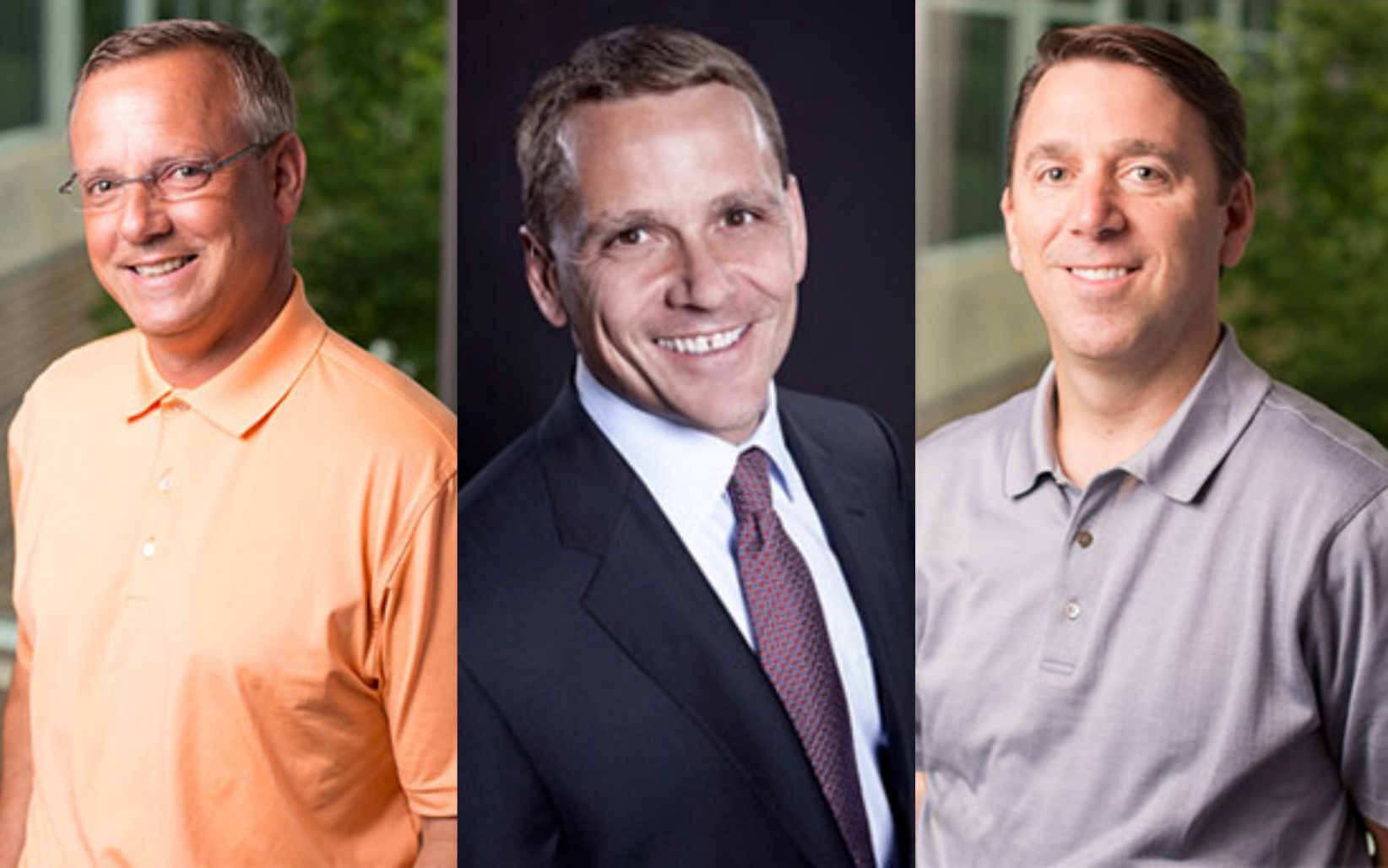

Flyover Capital launched in 2014 and features several Kansas City entrepreneurs among its leadership, including Molzer, Thad Langford and Marty Bicknell. The firm has invested in 13 companies in Kansas, Missouri, Nebraska, Texas, Illinois, Indiana, Wisconsin and Maryland.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Flint Group’s new strategic partner invests in taking the home services platform national

SEATTLE — A newly announced strategic investment from the global firm General Atlantic is expected to help a home services platform with Kansas City leadership enhance its business offerings and accelerate its growth, ultimately toward scaling the company nationally. Founded in 2019 by industry veterans Collin Hathaway and Trevor Flannigan, Flint Group has quickly expanded…

Biotech startup’s $6.5M Series A expected to cultivate expanded workforce, research capabilities

Ronawk’s Bio-Block Universe has already revolutionized cell and tissue production, Tom Jantsch said, and the recent investment of $6.5 million is set to further research and development. “We have really changed the paradigm of how not only cell culture is done, but how researchers are able to scale. They can go from the bench, all…

J Rieger continues its international push, adding whiskey distribution to northern neighbors

Fresh off its win as the KC Chamber’s top international small business, J. Rieger & Co. announced its expansion into Nova Scotia — a milestone as the Kansas City-based distiller enters the Canadian market. “We are thrilled to bring our range of artisanal spirits to Canada for the first time,” said Ryan Maybee, co-founder of J.…

Mid x Midwest returning in November with renewed vision to connect KC founders, VCs

The pilot Mid x Midwest event in fall 2022 supported the idea that early-stage tech founders and investors are hungry for more conversations post pandemic, Dan Kerr and Maggie Kenefake shared, spurring the return of the invite-only meetup in November. “We both showed up that morning to Hotel Kansas City and we walked into the…