Flyover Capital celebrates $63 million sale of its second portfolio firm Agrible

August 9, 2018 | Startland Staff

In a deal that further validates the vibrancy of the Midwest tech scene, leaders at Kansas City-based Flyover Capital are lauding the sale of its second portfolio firm since its launch in 2014.

Flyover — a venture capital firm whose mission is to fuel the next generation of tech startups in the Midwest — is enjoying the sizable exit of Agrible, an Illinois-based ag tech startup, said Flyover partner Keith Molzer. Agrible sold to Nutrien, based in Loveland, Colorado, for $63 million.

“We are excited for the Agrible team,” Molzer said. “They have worked diligently to build a great company and having Nutrien acquire the company is a great testament to their team and the technology they have built.”

The sale is significant not only to Flyover and its partners but also the flyover region it serves, Molzer said. The deal is the second exit in Flyover’s portfolio, with the first being Kansas City-based ZOLOZ, formerly EyeVerify.

Flyover participated in three investment rounds in Agrible, he added.

“This is a great win for the Midwest and further validates Flyover’s goal of helping create the next generation of technology success story in flyover country,” Molzer said. “This exit provides a substantial return for the investors in Flyover Capital as well. As a first-time fund, we focus on finding early-stage technology companies that we can help grow and utilizes the natural resources in the region. In Agrible’s case, being in the heartland and close to the University of Illinois provided them access to the best ag tech talent and helped them accelerate their growth. It is a testament to the region, as Nutrien is keeping the Agrible team in Champaign, Illinois.”

Agrible created a platform that includes a variety of farmer advisory tools, data science capabilities, predictive analytics. Nutrien is a publicly-traded ag tech firm.

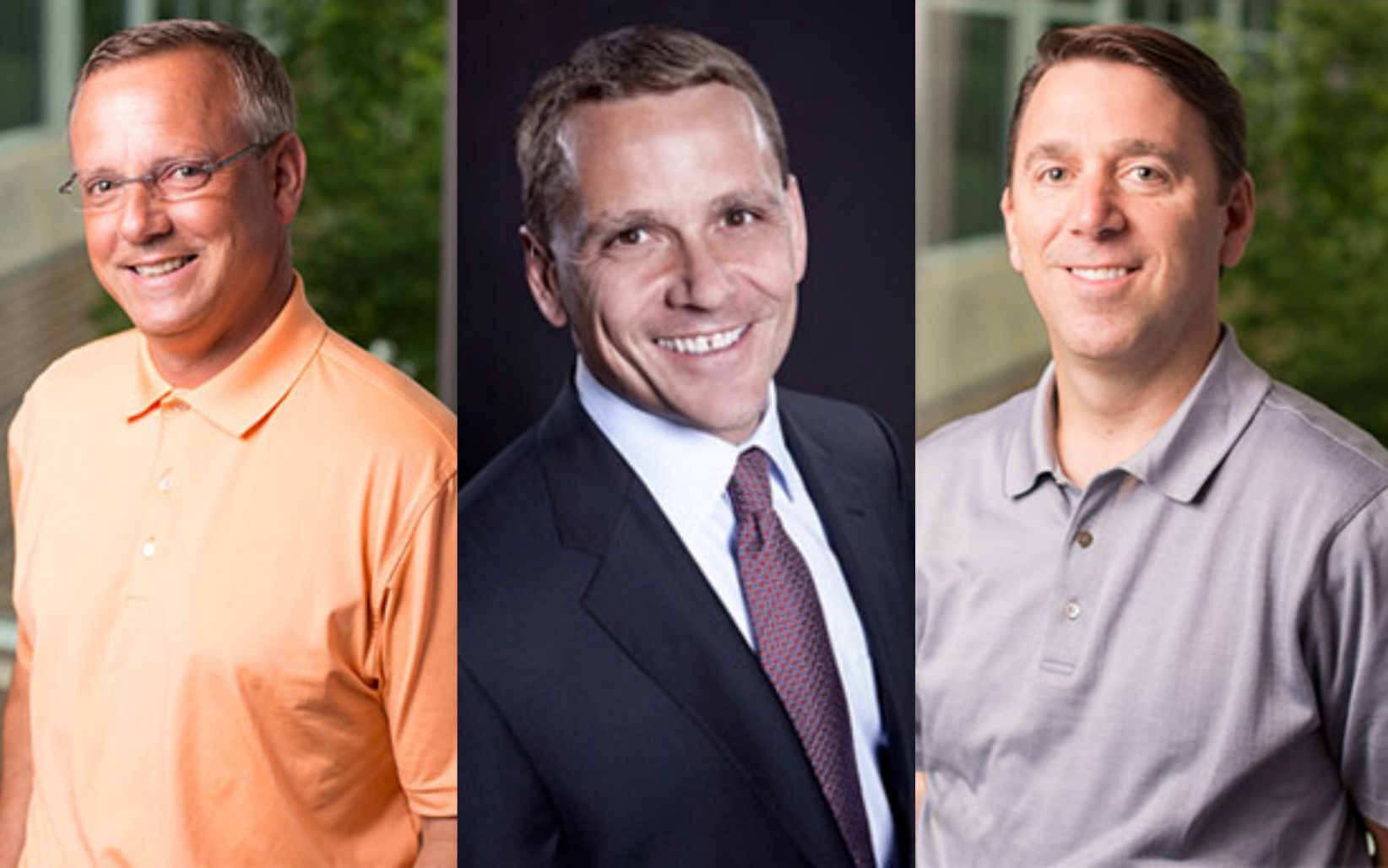

Flyover Capital launched in 2014 and features several Kansas City entrepreneurs among its leadership, including Molzer, Thad Langford and Marty Bicknell. The firm has invested in 13 companies in Kansas, Missouri, Nebraska, Texas, Illinois, Indiana, Wisconsin and Maryland.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Here’s how a new data dashboard could help KCMO redirect funds to small businesses

A new data dashboard built to better understand Kansas City’s business needs — and guide the city’s response — is not only revolutionary for the metro, said Nia Richardson, it could be the first of its kind, period. Small business advocates already are calling it a win. “I don’t know of any other city or playbook…

Modern world requires entrepreneurs to think like creatives, says KU’s Innovator in Residence

Editor’s note: The University of Kansas’ School of Business is a partner of Startland News. LAWRENCE, Kansas — Building a skill set around creativity is critical to entrepreneurship — especially at a time when careers can be short-lived, said Josh Wexler. “Jobs are no longer for life,” explained the Innovator in Residence at the University…

Grantmaking reboot ‘just one piece of the larger puzzle’ in Kauffman Foundation reset, CEO says

Overhauling the Kauffman Foundation’s grantmaking strategy aligns with a broader, holistic reset for the influential Kansas City organization, said Dr. DeAngela Burns Wallace, emphasizing org-wide moves to deepen the impact and dialogue sparked by its giving. “We’re still engaged in the work happening locally, regionally, and nationally,” said Burns-Wallace, president and CEO of the Ewing…