Flyover Capital celebrates $63 million sale of its second portfolio firm Agrible

August 9, 2018 | Startland Staff

In a deal that further validates the vibrancy of the Midwest tech scene, leaders at Kansas City-based Flyover Capital are lauding the sale of its second portfolio firm since its launch in 2014.

Flyover — a venture capital firm whose mission is to fuel the next generation of tech startups in the Midwest — is enjoying the sizable exit of Agrible, an Illinois-based ag tech startup, said Flyover partner Keith Molzer. Agrible sold to Nutrien, based in Loveland, Colorado, for $63 million.

“We are excited for the Agrible team,” Molzer said. “They have worked diligently to build a great company and having Nutrien acquire the company is a great testament to their team and the technology they have built.”

The sale is significant not only to Flyover and its partners but also the flyover region it serves, Molzer said. The deal is the second exit in Flyover’s portfolio, with the first being Kansas City-based ZOLOZ, formerly EyeVerify.

Flyover participated in three investment rounds in Agrible, he added.

“This is a great win for the Midwest and further validates Flyover’s goal of helping create the next generation of technology success story in flyover country,” Molzer said. “This exit provides a substantial return for the investors in Flyover Capital as well. As a first-time fund, we focus on finding early-stage technology companies that we can help grow and utilizes the natural resources in the region. In Agrible’s case, being in the heartland and close to the University of Illinois provided them access to the best ag tech talent and helped them accelerate their growth. It is a testament to the region, as Nutrien is keeping the Agrible team in Champaign, Illinois.”

Agrible created a platform that includes a variety of farmer advisory tools, data science capabilities, predictive analytics. Nutrien is a publicly-traded ag tech firm.

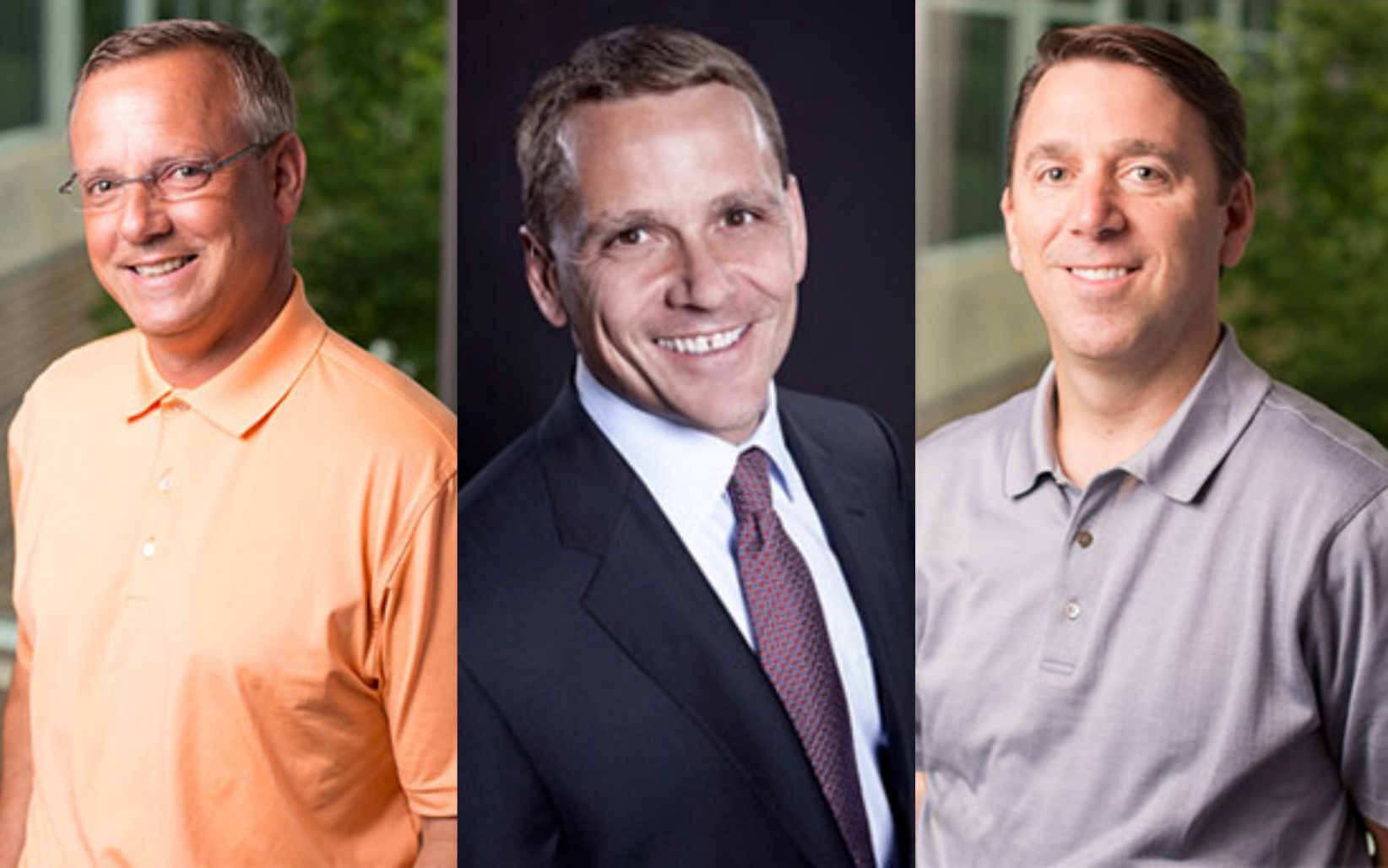

Flyover Capital launched in 2014 and features several Kansas City entrepreneurs among its leadership, including Molzer, Thad Langford and Marty Bicknell. The firm has invested in 13 companies in Kansas, Missouri, Nebraska, Texas, Illinois, Indiana, Wisconsin and Maryland.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Events Preview: ECJC, America Hack night

There are a boatload of entrepreneurial events hosted in Kansas City on a weekly basis. Whether you’re an entrepreneur, investor, supporter, or curious Kansas Citian, we’d recommend these upcoming events for you. WEEKLY EVENT PREVIEW ECJC Summer Venture Lounge When: Wednesday, July 8 @ 4:30 PM-6:30 PM Where: Enterprise Center of Johnson County Investors, entrepreneurs and…

1 Million Cups presenters have shot at $10K

One of the Ewing Marion Kauffman Foundation’s most popular programs, 1 Million Cups, will soon be offering entrepreneurs more than its typical morning refreshments. Program leaders announced Wednesday that it’s launching the “One in a Million” competition, in which former presenters in the program could snag $10,000. Now in more than 70 cities worldwide, 1…

DivvyHQ raises $1.8M for marketing tech

Kansas City-based DivvyHQ is ready to hit the gas after its latest investment round that will more than double its team. The marketing tech firm recently closed on a $1.8 million Series A round to boost its staff headcount and marketing outreach. Investors in the round include Dallas-based venture capital firm DAN Fund, Dundee Venture…