Flyover Capital celebrates $63 million sale of its second portfolio firm Agrible

August 9, 2018 | Startland Staff

In a deal that further validates the vibrancy of the Midwest tech scene, leaders at Kansas City-based Flyover Capital are lauding the sale of its second portfolio firm since its launch in 2014.

Flyover — a venture capital firm whose mission is to fuel the next generation of tech startups in the Midwest — is enjoying the sizable exit of Agrible, an Illinois-based ag tech startup, said Flyover partner Keith Molzer. Agrible sold to Nutrien, based in Loveland, Colorado, for $63 million.

“We are excited for the Agrible team,” Molzer said. “They have worked diligently to build a great company and having Nutrien acquire the company is a great testament to their team and the technology they have built.”

The sale is significant not only to Flyover and its partners but also the flyover region it serves, Molzer said. The deal is the second exit in Flyover’s portfolio, with the first being Kansas City-based ZOLOZ, formerly EyeVerify.

Flyover participated in three investment rounds in Agrible, he added.

“This is a great win for the Midwest and further validates Flyover’s goal of helping create the next generation of technology success story in flyover country,” Molzer said. “This exit provides a substantial return for the investors in Flyover Capital as well. As a first-time fund, we focus on finding early-stage technology companies that we can help grow and utilizes the natural resources in the region. In Agrible’s case, being in the heartland and close to the University of Illinois provided them access to the best ag tech talent and helped them accelerate their growth. It is a testament to the region, as Nutrien is keeping the Agrible team in Champaign, Illinois.”

Agrible created a platform that includes a variety of farmer advisory tools, data science capabilities, predictive analytics. Nutrien is a publicly-traded ag tech firm.

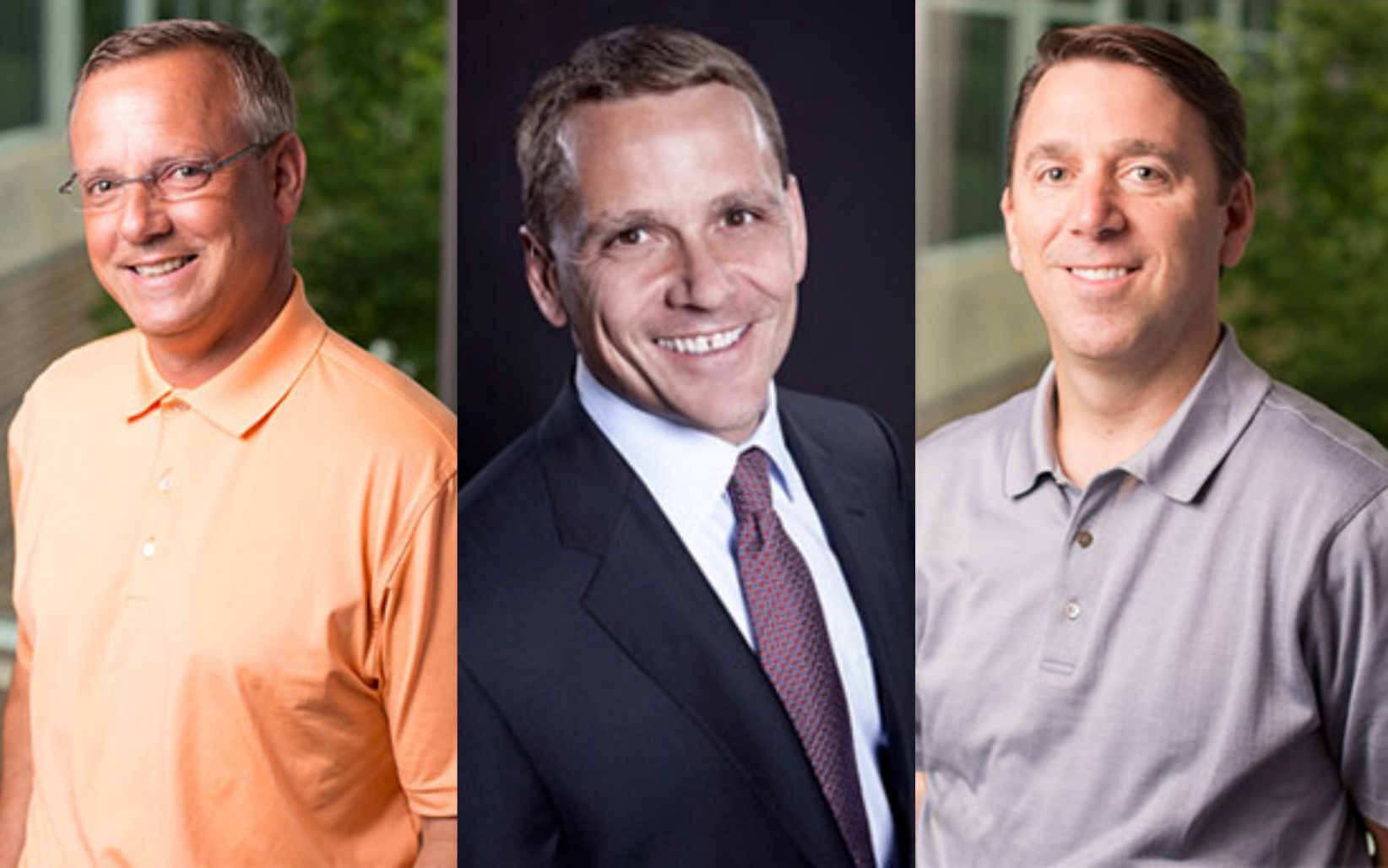

Flyover Capital launched in 2014 and features several Kansas City entrepreneurs among its leadership, including Molzer, Thad Langford and Marty Bicknell. The firm has invested in 13 companies in Kansas, Missouri, Nebraska, Texas, Illinois, Indiana, Wisconsin and Maryland.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Shawnee native sells another startup for over $1B with GM deal

General Motors is hoping to become the leader of self-driving car technology with the gargantuan acquisition of Cruise Automation, whose founder has a local tie. GM announced on March 11 that it purchased Cruise for more than $1 billion in a move that aims to accelerate the development of GM’s autonomous vehicle tech. Cruise…

Kansas’ angel tax credits score first victory but hurdles remain

A bill extending Kansas’ popular Angel Investor Tax Credits scored its first victory Thursday, but legislators must make quick work of the measure if the program is to survive. The Kansas House Committee on Taxation unanimously approved a measure to continue the program, which offers accredited investors a tax credit of up to $50,000 on…

Sharing economy labors over lawsuits, paradigm shift for cyber security law

Here’s this week’s dish on the sharing economy, the issues with backdoor encryption, and corporate-to-startup collaboration. Check out more in this series here. AustinInno – The gig economy is at a crossroads as lawsuits, innovative benefits expand As the sharing or “gig” economy expands with companies like Uber and Lyft, it’s not just permit…

Kansas City scores $50K to inject innovation into education

Kansas City recently snagged a $50,000 grant that aims to fuel the development of a passionate, 21st-century workforce. The City of Fountains was named one of eight winners of the national LRNG City Challenge. As a result, the KC Social Innovation Center will use the grant to implement new programming this summer. The LRNG platform…