Flyover Capital celebrates $63 million sale of its second portfolio firm Agrible

August 9, 2018 | Startland Staff

In a deal that further validates the vibrancy of the Midwest tech scene, leaders at Kansas City-based Flyover Capital are lauding the sale of its second portfolio firm since its launch in 2014.

Flyover — a venture capital firm whose mission is to fuel the next generation of tech startups in the Midwest — is enjoying the sizable exit of Agrible, an Illinois-based ag tech startup, said Flyover partner Keith Molzer. Agrible sold to Nutrien, based in Loveland, Colorado, for $63 million.

“We are excited for the Agrible team,” Molzer said. “They have worked diligently to build a great company and having Nutrien acquire the company is a great testament to their team and the technology they have built.”

The sale is significant not only to Flyover and its partners but also the flyover region it serves, Molzer said. The deal is the second exit in Flyover’s portfolio, with the first being Kansas City-based ZOLOZ, formerly EyeVerify.

Flyover participated in three investment rounds in Agrible, he added.

“This is a great win for the Midwest and further validates Flyover’s goal of helping create the next generation of technology success story in flyover country,” Molzer said. “This exit provides a substantial return for the investors in Flyover Capital as well. As a first-time fund, we focus on finding early-stage technology companies that we can help grow and utilizes the natural resources in the region. In Agrible’s case, being in the heartland and close to the University of Illinois provided them access to the best ag tech talent and helped them accelerate their growth. It is a testament to the region, as Nutrien is keeping the Agrible team in Champaign, Illinois.”

Agrible created a platform that includes a variety of farmer advisory tools, data science capabilities, predictive analytics. Nutrien is a publicly-traded ag tech firm.

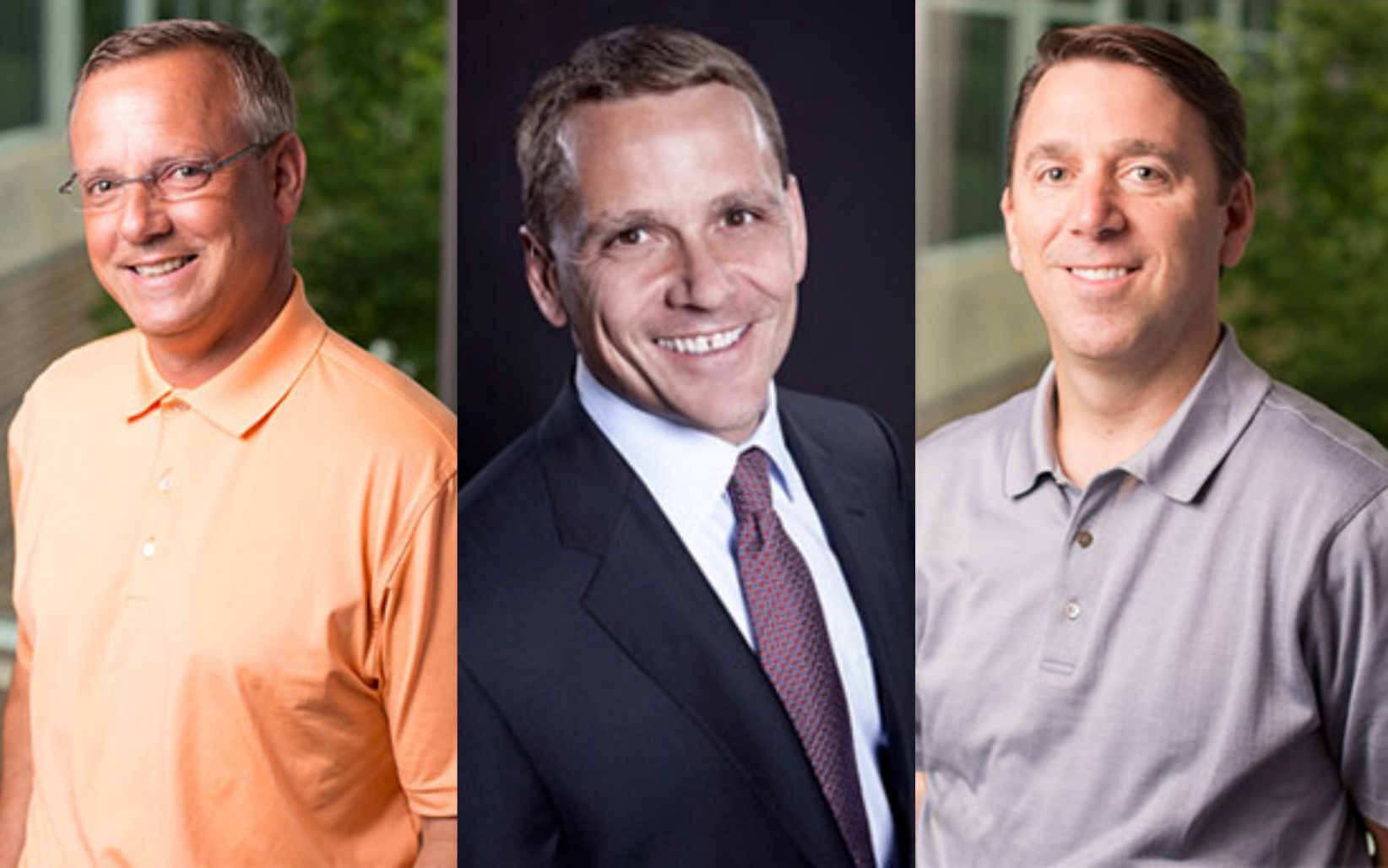

Flyover Capital launched in 2014 and features several Kansas City entrepreneurs among its leadership, including Molzer, Thad Langford and Marty Bicknell. The firm has invested in 13 companies in Kansas, Missouri, Nebraska, Texas, Illinois, Indiana, Wisconsin and Maryland.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Google Fiber hops to new, pricier plans for businesses

All good things — or in this case inexpensive things — must come to an end. Google Fiber will soon nix early-access pricing for its gigabit business service and will more than double its costs for new customers in August. Google Fiber — which first arrived in Kansas City in 2012 with residential service —…

Amazon to bring 1,000 jobs, huge facility to KCK

Online retail giant Amazon will open a massive new facility in Kansas City, Kan. The Seattle-based company announced Monday that it will create more than 1,000 full-time jobs and construct an 855,000-square-foot fulfillment facility near the Turner Diagonal on I-70 in Kansas City, Kan. “These aren’t just any jobs. They are the best entry-level jobs our…

Survey: KC is sticky for startups with equity funding

A majority of Kansas City startups choose to maintain their hometown roots after they raise capital — even when the funds come from outside investors, a recent survey found. Of the companies that raised money in 2013 and 2014, 74 percent of them are still active and headquartered in the City of Fountains, according to…

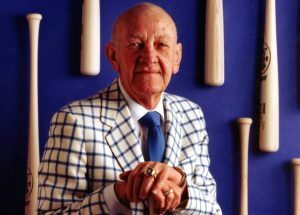

A marriage of Mr. K’s passions, ‘E Day at the K’ returns July 19

To say one of Kansas City’s greatest entrepreneurs — Ewing Marion Kauffman — loved baseball would be an understatement. The founder of Marion Laboratories Inc., Kauffman purchased the Royals in 1968 to bring America’s pastime to his beloved hometown, Kansas City. Along with boosting civic pride, the Royals became a model franchise, employing “moneyball” statistical…