Flyover Capital celebrates $63 million sale of its second portfolio firm Agrible

August 9, 2018 | Startland Staff

In a deal that further validates the vibrancy of the Midwest tech scene, leaders at Kansas City-based Flyover Capital are lauding the sale of its second portfolio firm since its launch in 2014.

Flyover — a venture capital firm whose mission is to fuel the next generation of tech startups in the Midwest — is enjoying the sizable exit of Agrible, an Illinois-based ag tech startup, said Flyover partner Keith Molzer. Agrible sold to Nutrien, based in Loveland, Colorado, for $63 million.

“We are excited for the Agrible team,” Molzer said. “They have worked diligently to build a great company and having Nutrien acquire the company is a great testament to their team and the technology they have built.”

The sale is significant not only to Flyover and its partners but also the flyover region it serves, Molzer said. The deal is the second exit in Flyover’s portfolio, with the first being Kansas City-based ZOLOZ, formerly EyeVerify.

Flyover participated in three investment rounds in Agrible, he added.

“This is a great win for the Midwest and further validates Flyover’s goal of helping create the next generation of technology success story in flyover country,” Molzer said. “This exit provides a substantial return for the investors in Flyover Capital as well. As a first-time fund, we focus on finding early-stage technology companies that we can help grow and utilizes the natural resources in the region. In Agrible’s case, being in the heartland and close to the University of Illinois provided them access to the best ag tech talent and helped them accelerate their growth. It is a testament to the region, as Nutrien is keeping the Agrible team in Champaign, Illinois.”

Agrible created a platform that includes a variety of farmer advisory tools, data science capabilities, predictive analytics. Nutrien is a publicly-traded ag tech firm.

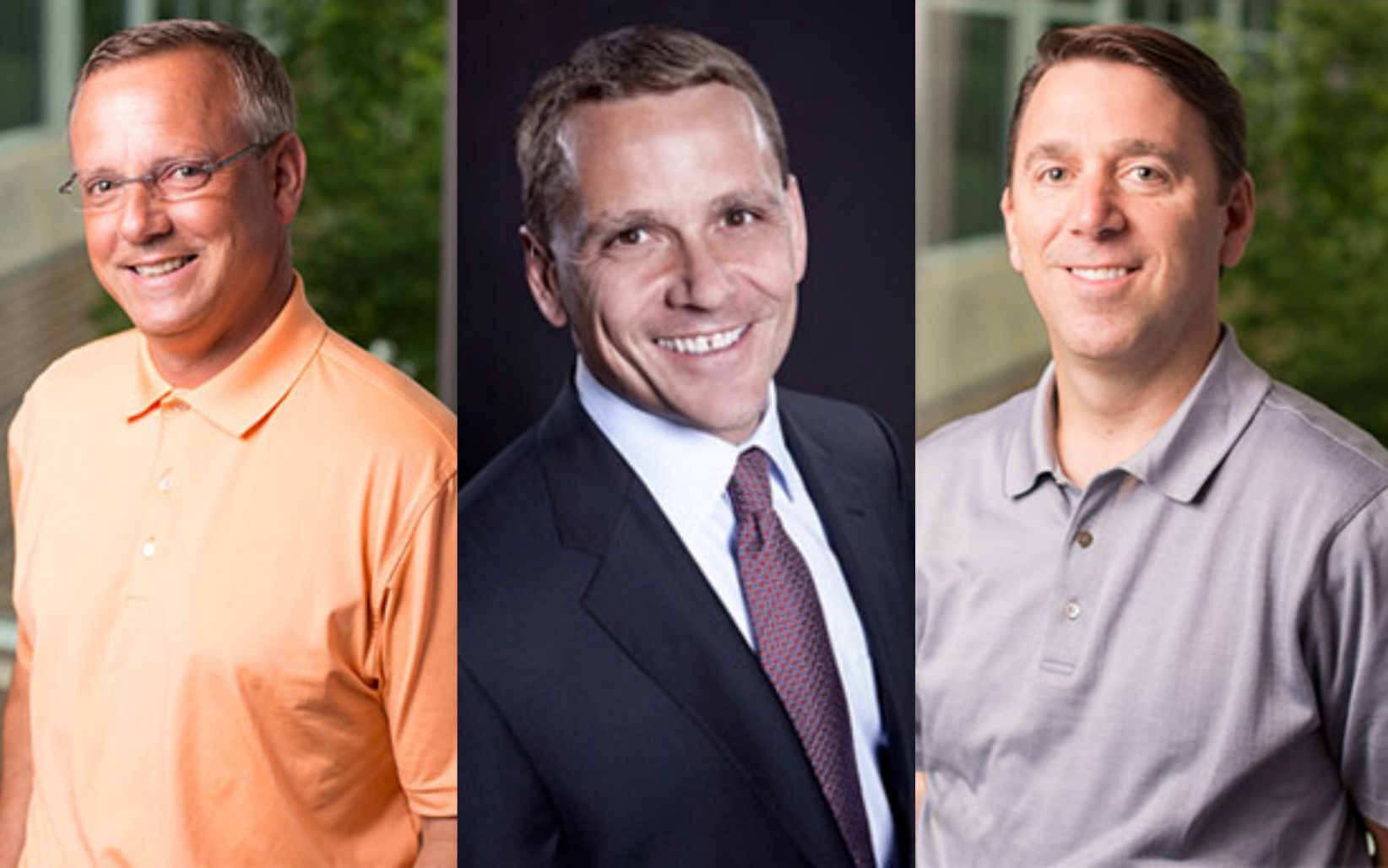

Flyover Capital launched in 2014 and features several Kansas City entrepreneurs among its leadership, including Molzer, Thad Langford and Marty Bicknell. The firm has invested in 13 companies in Kansas, Missouri, Nebraska, Texas, Illinois, Indiana, Wisconsin and Maryland.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

One Kansas City startup survives national Kauffman contest

After about a month of public deliberation, the 1 in a Million pitch competition has narrowed participating startups down to a top five — and one hails from Kansas City. Although five area companies advanced to the top 40, The Grooming Project is last startup standing from Kansas City. A panel of Kauffman fellows will…

Not in Kansas anymore: Mycroft opens Kansas City, Silicon Valley offices

Editor’s note: This content is sponsored by LaunchKC but independently produced by Startland News. After a recent seed round that was topped off with a $50,000 LaunchKC grant, artificial intelligence startup Mycroft is moving from Lawrence to the City of Fountains. Mycroft — which developed an open-source, artificial intelligence device similar to Amazon Echo — not…

AOL founder Steve Case says innovators must become policy savvy

Get familiar with public policy or your company will get left behind. That was the forward-looking message that AOL founder Steve Case had for a group of about 200 investors and entrepreneurs at the 2016 Kauffman Fellows summit in Kansas City. Now the CEO of Revolution, Case argued that investors, entrepreneurs and policymakers will have…

Venture capitalist Keith Harrington opens up on KC investment culture

For most of the 200 Kauffman Fellows attending the Reunion VC Summit, it is their first time visiting Kansas City. To help them get a taste of the metro’s entrepreneurial ecosystem, Keith Harrington, Kauffman fellow and partner at Kansas City-based Fulcrum Global Capital, presented some cultural highlights at the summit Tuesday. Like many Midwestern cities,…