Flyover Capital celebrates $63 million sale of its second portfolio firm Agrible

August 9, 2018 | Startland Staff

In a deal that further validates the vibrancy of the Midwest tech scene, leaders at Kansas City-based Flyover Capital are lauding the sale of its second portfolio firm since its launch in 2014.

Flyover — a venture capital firm whose mission is to fuel the next generation of tech startups in the Midwest — is enjoying the sizable exit of Agrible, an Illinois-based ag tech startup, said Flyover partner Keith Molzer. Agrible sold to Nutrien, based in Loveland, Colorado, for $63 million.

“We are excited for the Agrible team,” Molzer said. “They have worked diligently to build a great company and having Nutrien acquire the company is a great testament to their team and the technology they have built.”

The sale is significant not only to Flyover and its partners but also the flyover region it serves, Molzer said. The deal is the second exit in Flyover’s portfolio, with the first being Kansas City-based ZOLOZ, formerly EyeVerify.

Flyover participated in three investment rounds in Agrible, he added.

“This is a great win for the Midwest and further validates Flyover’s goal of helping create the next generation of technology success story in flyover country,” Molzer said. “This exit provides a substantial return for the investors in Flyover Capital as well. As a first-time fund, we focus on finding early-stage technology companies that we can help grow and utilizes the natural resources in the region. In Agrible’s case, being in the heartland and close to the University of Illinois provided them access to the best ag tech talent and helped them accelerate their growth. It is a testament to the region, as Nutrien is keeping the Agrible team in Champaign, Illinois.”

Agrible created a platform that includes a variety of farmer advisory tools, data science capabilities, predictive analytics. Nutrien is a publicly-traded ag tech firm.

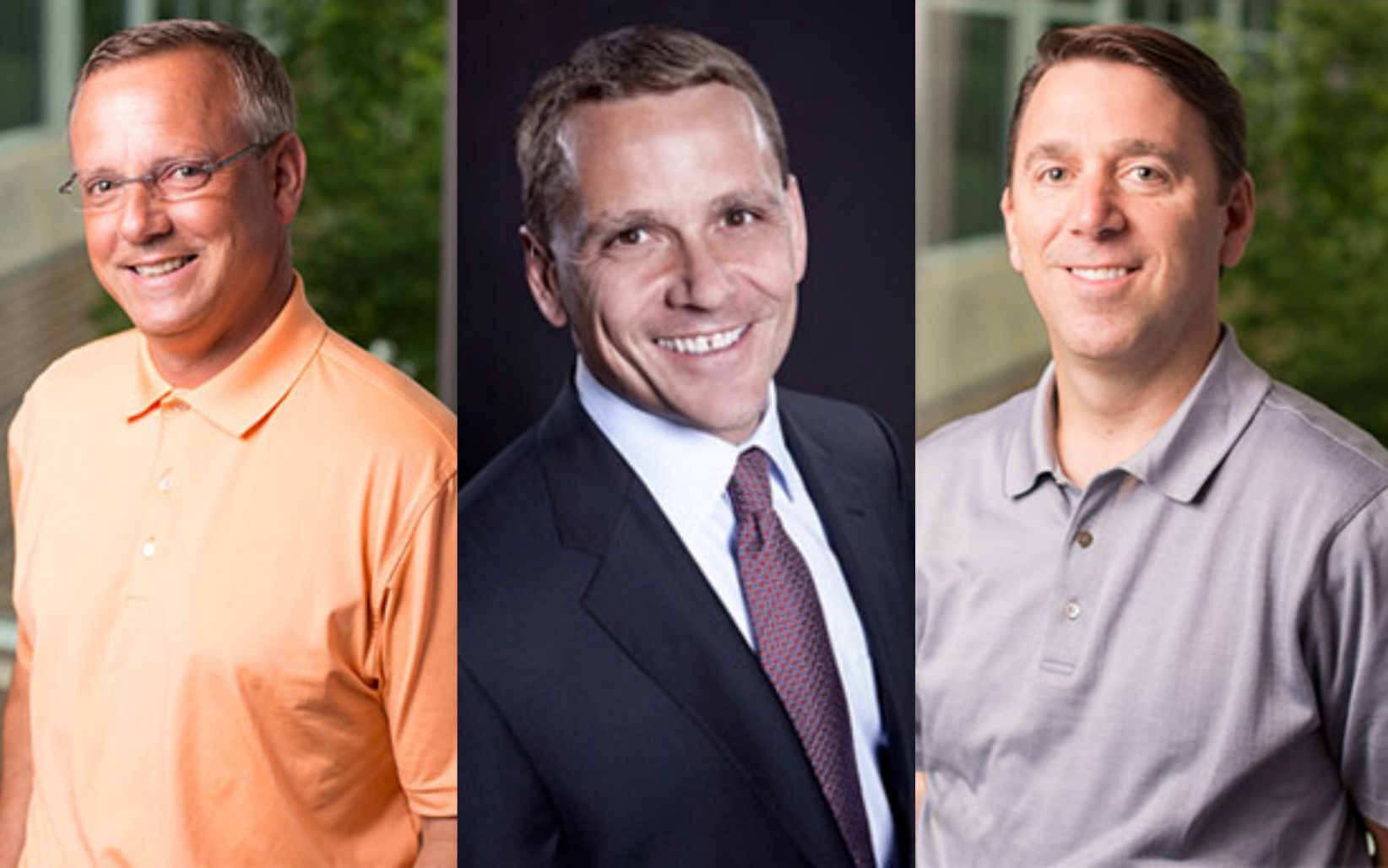

Flyover Capital launched in 2014 and features several Kansas City entrepreneurs among its leadership, including Molzer, Thad Langford and Marty Bicknell. The firm has invested in 13 companies in Kansas, Missouri, Nebraska, Texas, Illinois, Indiana, Wisconsin and Maryland.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Profit and purpose: Innovators share 5 social entrepreneurship lessons

It’s been said that the best things in life are free. But what social entrepreneurs know well, is that it’s not that simple — nearly everything in life comes at a cost, including the positive impact they’re trying to make. And at Thursday’s Conquer for Good conference, a variety of innovators shared how they’re working…

KC tech innovators deliver mindset and personal development advice

For many, starting a business may sound like the dream — being your own boss, making your own rules and devising your own schedule. But the reality is that the entrepreneurial life isn’t all sunshine and roses. Like most good things in life, it comes with risk and challenges. And on Wednesday a panel of…

Darcy Howe’s hustle grows, guides KCRise Fund in first year

Kansas City may not realize its good fortune with the tenacious manager of a relatively new fund that’s investing in early-stage firms. Self-described as a builder that’s competitive and impatient, Darcy Howe is weaving her years of determined leadership into the KCRise Fund, which just wrapped up its first year with $14 million in the…

Deadlines approach for BetaBlox, EY awards; LaunchKC opening soon

Kansas City abounds with growth opportunities for startups and entrepreneurs — sometimes the trick is just finding them. To that end, here are a variety of opportunities for founders and supporters of Kansas City’s entrepreneurial ecosystem whose deadlines are approaching. Thanks to our friends at KCSourceLink for aggregating these opportunities! BetaBlox Deadline: March 1 Kansas City-based accelerator…