Flyover Capital celebrates $63 million sale of its second portfolio firm Agrible

August 9, 2018 | Startland Staff

In a deal that further validates the vibrancy of the Midwest tech scene, leaders at Kansas City-based Flyover Capital are lauding the sale of its second portfolio firm since its launch in 2014.

Flyover — a venture capital firm whose mission is to fuel the next generation of tech startups in the Midwest — is enjoying the sizable exit of Agrible, an Illinois-based ag tech startup, said Flyover partner Keith Molzer. Agrible sold to Nutrien, based in Loveland, Colorado, for $63 million.

“We are excited for the Agrible team,” Molzer said. “They have worked diligently to build a great company and having Nutrien acquire the company is a great testament to their team and the technology they have built.”

The sale is significant not only to Flyover and its partners but also the flyover region it serves, Molzer said. The deal is the second exit in Flyover’s portfolio, with the first being Kansas City-based ZOLOZ, formerly EyeVerify.

Flyover participated in three investment rounds in Agrible, he added.

“This is a great win for the Midwest and further validates Flyover’s goal of helping create the next generation of technology success story in flyover country,” Molzer said. “This exit provides a substantial return for the investors in Flyover Capital as well. As a first-time fund, we focus on finding early-stage technology companies that we can help grow and utilizes the natural resources in the region. In Agrible’s case, being in the heartland and close to the University of Illinois provided them access to the best ag tech talent and helped them accelerate their growth. It is a testament to the region, as Nutrien is keeping the Agrible team in Champaign, Illinois.”

Agrible created a platform that includes a variety of farmer advisory tools, data science capabilities, predictive analytics. Nutrien is a publicly-traded ag tech firm.

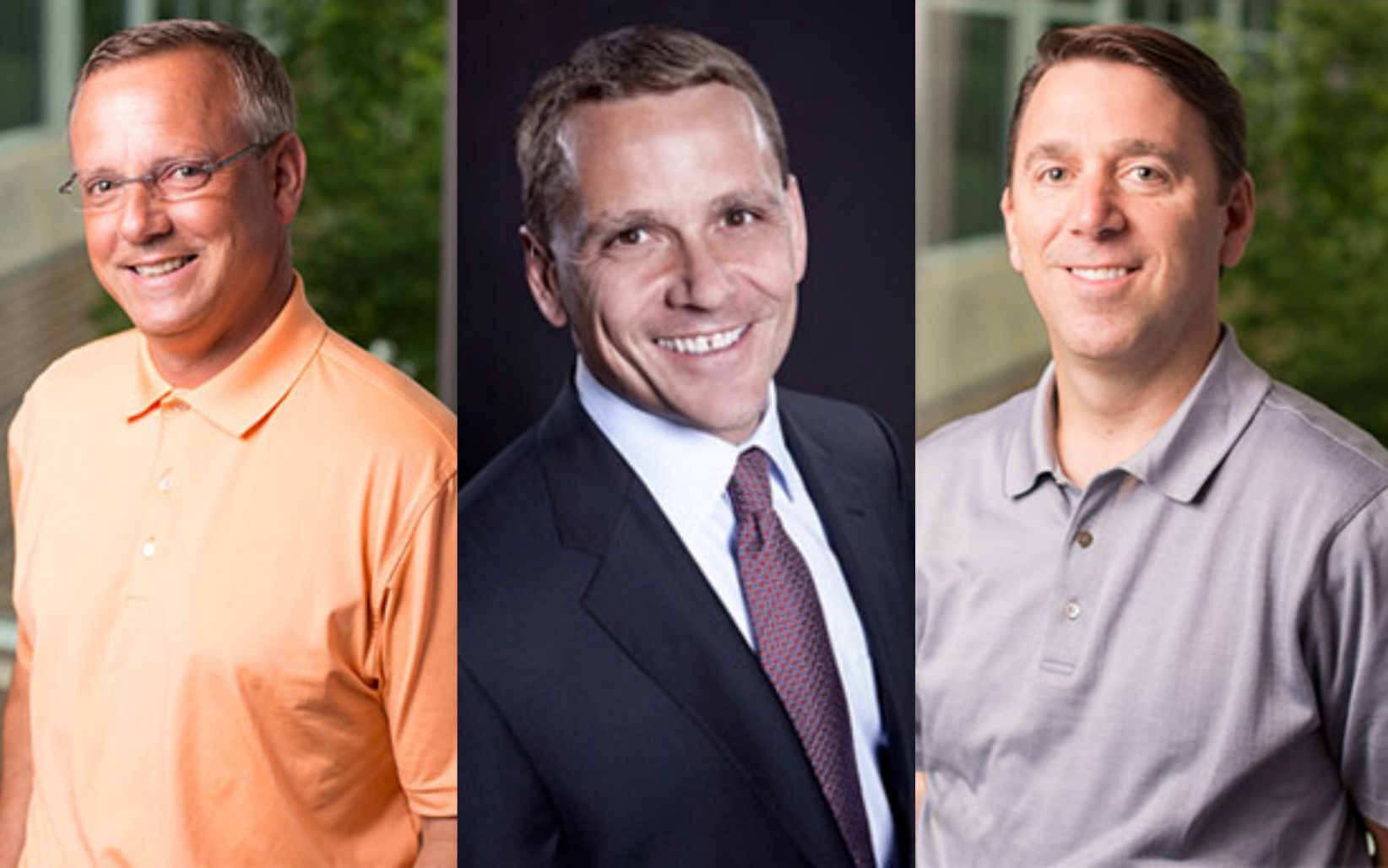

Flyover Capital launched in 2014 and features several Kansas City entrepreneurs among its leadership, including Molzer, Thad Langford and Marty Bicknell. The firm has invested in 13 companies in Kansas, Missouri, Nebraska, Texas, Illinois, Indiana, Wisconsin and Maryland.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Innovation Stockyard feeds effort to protect food chain

When feeding the world, being proactive on animal health technology is vital, Ronan Molloy said. “The reality is, its importance will only hit home when we have a significant event, like a swine flu,” Molloy, president of Innovation Stockyard, said. “Then all of the sudden people will say ‘Oh, why is my fillet now $40…

Students bump shoulders with architects at STEAM Studio

Most children won’t have experience working in a professional environment until they land their first job or internship, Mandi Sonnenberg said. “Some kids may have popped into their mom or dad’s work and have gone to a professional space at least a couple times in their life,” Sonnenberg said. “But for kids in the urban…

Smart City Living Lab opens, targets growing pains of a swelling city

The much-anticipated “Kansas City Living Lab” — a platform for application development that taps the Kansas City Smart City initiative — is now welcoming new tech partners. Using smart city infrastructure, the Living Lab allows innovators to test and commercialize technologies that can solve problems in Kansas City. The project is led by Think Big…

JE Dunn spinout Site 1001 raises millions more from local investors

A Kansas City-based tech firm that’s created a smart buildings platform recently raised another significant batch of venture capital funding. Site 1001 — a technology spin out from Kansas City construction giant JE Dunn Construction — raised $6 million to boost its engineering, research and sales efforts. The round was led by JE Dunn Construction…