Flyover Capital celebrates $63 million sale of its second portfolio firm Agrible

August 9, 2018 | Startland Staff

In a deal that further validates the vibrancy of the Midwest tech scene, leaders at Kansas City-based Flyover Capital are lauding the sale of its second portfolio firm since its launch in 2014.

Flyover — a venture capital firm whose mission is to fuel the next generation of tech startups in the Midwest — is enjoying the sizable exit of Agrible, an Illinois-based ag tech startup, said Flyover partner Keith Molzer. Agrible sold to Nutrien, based in Loveland, Colorado, for $63 million.

“We are excited for the Agrible team,” Molzer said. “They have worked diligently to build a great company and having Nutrien acquire the company is a great testament to their team and the technology they have built.”

The sale is significant not only to Flyover and its partners but also the flyover region it serves, Molzer said. The deal is the second exit in Flyover’s portfolio, with the first being Kansas City-based ZOLOZ, formerly EyeVerify.

Flyover participated in three investment rounds in Agrible, he added.

“This is a great win for the Midwest and further validates Flyover’s goal of helping create the next generation of technology success story in flyover country,” Molzer said. “This exit provides a substantial return for the investors in Flyover Capital as well. As a first-time fund, we focus on finding early-stage technology companies that we can help grow and utilizes the natural resources in the region. In Agrible’s case, being in the heartland and close to the University of Illinois provided them access to the best ag tech talent and helped them accelerate their growth. It is a testament to the region, as Nutrien is keeping the Agrible team in Champaign, Illinois.”

Agrible created a platform that includes a variety of farmer advisory tools, data science capabilities, predictive analytics. Nutrien is a publicly-traded ag tech firm.

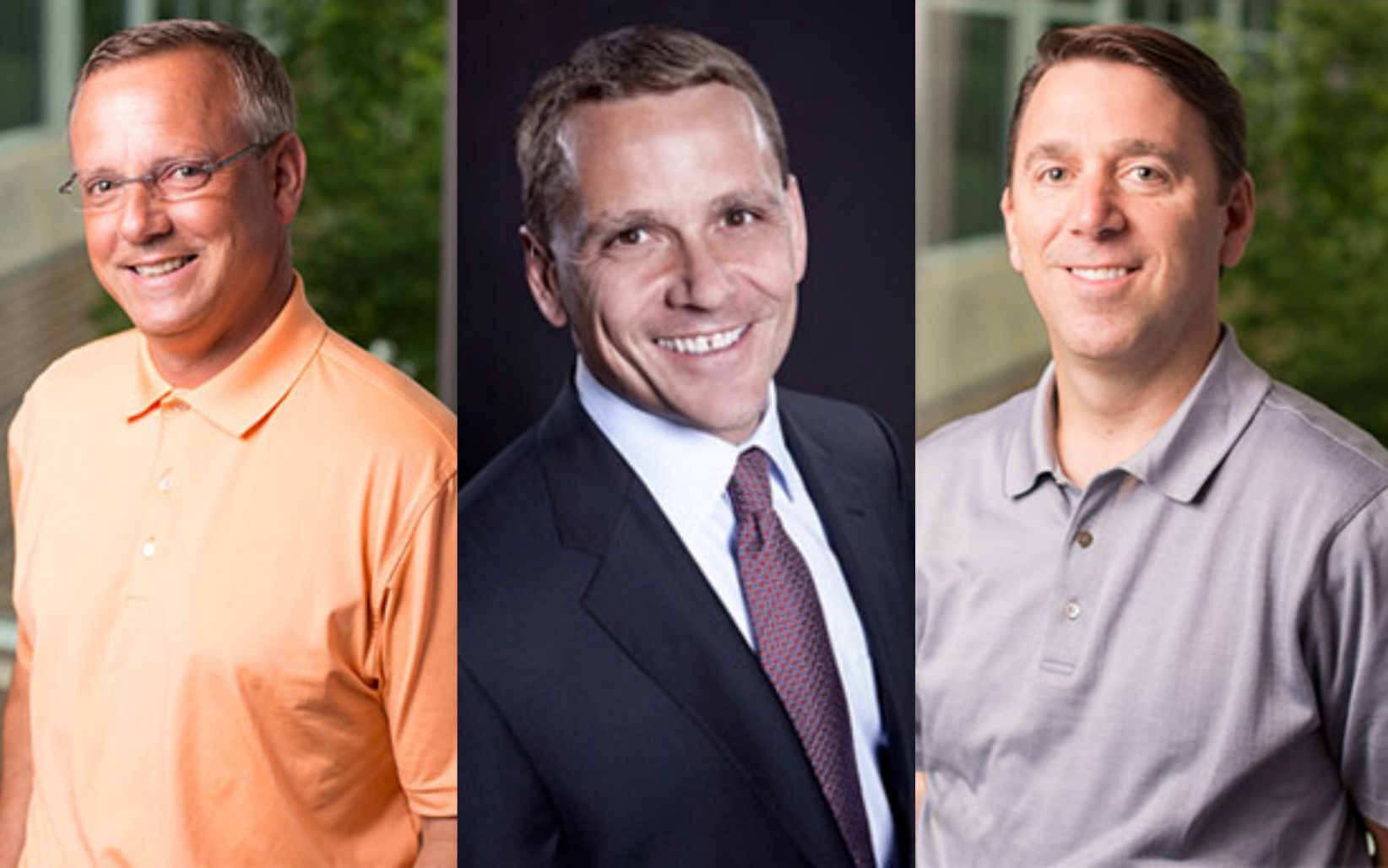

Flyover Capital launched in 2014 and features several Kansas City entrepreneurs among its leadership, including Molzer, Thad Langford and Marty Bicknell. The firm has invested in 13 companies in Kansas, Missouri, Nebraska, Texas, Illinois, Indiana, Wisconsin and Maryland.

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Meet KC’s cowpunk basement guitar hero: This DIY dreamer is demanding more from himself

Kansas City’s DIY music scene has long been a hub for raw, creative talent — with eclectic frontman Kole Waters quickly becoming one of its standout names. As the lead guitarist and co-vocalist for post-country phenomenon Big Fat Cow and the centerpiece of synth-infused Dreamist, Waters blends influences ranging from folk storytelling to cathartic soundscapes.…

Build to barrel: Inside Holladay Distillery’s ironclad plan to boost bourbon production by one-third

WESTON, Missouri — Holladay Distillery is breaking ground with Rickhouse D — its first new barrel-aging warehouse in 75 years — marking a major step in expanding bourbon production from the historic plant. Renowned as the only Missouri operation to age bourbon in ironclad rickhouses, Weston-based Holladay Distillery is increasing capacity to meet surging demand,…

So you think you’re CEO material? UMKC’s ‘CEO Academy’ puts that ambition to the test

Aspiring executives with an eye on the C-suite need to be ready well before the opportunity arises, said Dan Hesse, leaning on his years of past experience as president and CEO of Sprint. It’s not about just being the boss, he emphasized. “Of all the roles, that of the CEO is so different than any…