2018 Top VC-Backed Companies in Kansas City List

August 22, 2018 | Tommy Felts

The Top Venture Capital-Backed Companies in Kansas City List recognizes the growing cohort of growth-stage, venture-backed companies in the Kansas City metro — further illustrating the impact of the countless efforts aimed at boosting entrepreneurship in the region and creating a productive dialogue. The list is expected to be updated and published annually.

The 2018 Top VC-Backed Companies list is sponsored by WeWork Corrigan Station and supported by Startland’s data partner, the Economic Development Corporation of Kansas City.

More on KC’s

Top VC-Backed

Companies

• Think globally, invest locally: Are KC dollars worth more than outside capital?

• Kansas-vs-Missouri investment record tied to state support for innovation, experts say

• Startland list reflects big wins across KC — but don’t get comfortable, warns founder

It is important to note that this is not a top 10 list but a comprehensive data set of self-reported information from every company that meets the following criteria and responded to our call for data:

- Raised at least $1 million;

- Raised capital from at least one institutional venture investor;

- Raised a round of capital within the past three years (since July 1, 2015); and

- Headquartered in the 18-county greater Kansas City region as defined by the KCADC.

We have attempted to remove as much subjectivity from the list as possible, allowing the numbers to speak for themselves. Additionally, we have provided some statistical insights (check out the bulleted details below the list) that help craft a more complete picture of the data collected, as well as three analysis stories featuring Kansas City experts who reviewed the data.

Finally, the default order for the list is the KC Growth Index (also explained below the list) which is our effort to create a fair and significant way to order the companies.

NOTE: On desktop or laptop, feel free to sort by the different columns, click the “expand” icon next to each company name for a company summary and click “view larger version” in the bottom right corner for a full-screen view. On mobile, click on each company for a company summary.

Note: QM Power and Orbis Biosciences qualify for this list but we were unable to confirm their information prior to publishing.

Notable statistics

- 46 total companies, 24 in Kansas, 22 in Missouri.

- The 46 companies average 25 employees, $12.39 million raised, 54 percent raised from KC-area investors, 338 percent two-year annual growth rate and are 5 years old.

- The 46 companies employ 1,149 people.

- Kansas companies are on average two years older than Missouri companies.

- Kansas companies have raised more than four times as much capital on average than Missouri companies. (NOTE: If you exclude C2FO — a Kansas company that has raised more than six-times as much venture capital and has twice as many employees as second most — Kansas companies have still on average raised more than double Missouri companies.)

- Missouri companies have raised 15 percent more of their funding from Kansas City-area investors than Kansas companies, 62 percent to 47 percent respectively.

- Kansas companies have twice as many employees as Missouri companies. (56 percent more if you exclude C2FO.)

- 52 percent of all the companies (24) were founded between 2012 and 2014. (24 percent before and 24 percent after.)

- Of the 11 companies founded in or after 2015, nine are Missouri based.

- Of the four companies founded before 2012, all are Kansas based.

- 23 companies have raised 50 percent or more of their capital from KC-area investors, 23 have raised less than 50 percent.

- Companies that have raised less than 50 percent of their funding from KC-area investors have raised more than three times as much capital and are a year and a half older than those that have raised more than 50 percent from KC-area investors.

Explaining the KC Growth Index

We established the KC Growth Index to organize this list in a fair and significant way. Our evaluation system doesn’t solely prioritize capital raised, but instead creates a more comprehensive snapshot of venture-backed companies in the region. We also considered ordering alphabetically, but ultimately felt that would be too arbitrary.

The index is on a 35-point scale and is a formula that rates each company relative to its peers based on the self-reported data provided to Startland. The index takes into account four data points from each company and the scale for each data category is set by the highest amount reported in the list.

- Total funding raised (15-point scale);

- Current number of employees (10-point scale);

- Two-year average annual revenue growth rate (5-point scale); and

- Longevity (5-point scale).

For example, the most reported funding raised was $199.68 million by C2FO. Within the index, $199.86 is now 15 points and $0 is zero points. Thus, on a scale of zero to 15 — with $199.86 million being 15 — Spinal Simplicity (as an example) with $16 million raised has a 1.134 funding score.

As a second example, the highest two-year average annual revenue growth rate was 1,800 percent by PayIt. Within the index, 1,800 percent is now 5 points and zero percent is zero points. Thus, on a scale of zero to 5 — with 1,800 percent being 5 — Farmobile (as an example) with a 389 percent growth rate has a 1.081 revenue growth score.

Each company’s four category score is combined to compute their KC Growth Index.

NOTE: Companies that didn’t disclose certain information received zero points in that particular category.

More on KC’s Top VC-Backed Companies

• Think globally, invest locally: Are KC dollars worth more than outside capital?

• Kansas-vs-Missouri investment record tied to state support for innovation, experts say

• Startland list reflects big wins across KC — but don’t get comfortable, warns founder

Sponsored by

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Prestio founder dissolves headaches of business closings, pivots with Liquify Group

Closing a brick-and-mortar space is difficult enough, said Glen Dakan. Why should entrepreneurs be forced to endure the pains of offloading expensive equipment too? Such a predicament prompted Dakan and his partners to create a remedy for the common pain point: Liquify Group, a newly launched service that helps businesses liquidate their assets through a simple,…

Once a near-throwaway startup idea, TicketRX sells to Overland Park fintech firm MSTS

From bootstrapped to exit, Kansas City citation solutions platform TicketRX on Monday announced its sale to an Overland Park fintech company with global reach. “I’m excited to bring our mobile, AI-driven technology under the MSTS umbrella,” said Bryan Shannon, TicketRX founder and CEO. “MSTS’s long history and leadership experience in the transportation industry will ensure…

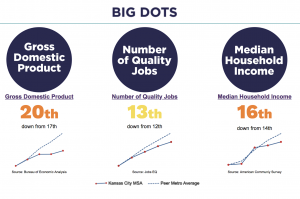

KC Rising update: Kansas City falling short in economic race with peer markets

Bill Gautreaux sounded the alarm with a mixed refrain meant as a KC Rising call to action: “We’re good, but we’re not good enough.” Throughout a recent KC Rising update on the region’s economic growth, Gautreaux and other KC Rising leaders championed Kansas City’s efforts to move the needle, while also lamenting the slow speed…