Eyeing added impact, AltCap expands its KC service area

July 13, 2018 | Startland Staff

AltCap — a Kansas City-based community development financial institution that focuses on underserved populations — is expanding its footprint.

In response to small businesses’ growing demand for capital, AltCap will now serve the entire Kansas City metro, including the Kansas counties of Wyandotte, Johnson, and Leavenworth. The move will allow AltCap to finance more small businesses and projects to create stronger, more economically inclusive communities, said Ruben Alonso, president of AltCap.

“We are thrilled to further our mission as a CDFI and deliver our impact capital to small businesses and communities throughout the Kansas City metro,” Ruben Alonso said. “At AltCap we believe that access to capital is fundamental to an inclusive, sustainable and thriving economy. That’s why we focus our efforts on capital-starved small businesses and communities that historically have had challenges accessing capital or have been overlooked by traditional financial institutions.”

Founded in 2008, AltCap offers alternative debt financing for job-creating small businesses, non-profit social service providers and real estate development projects in Jackson, Clay, Platte, and Cass counties in Missouri. The organization offers a variety of financing products, including new markets tax credits, microloans and business development services.

AltCap will help bolster the Kansas City, Kan. community, said David Alvey, mayor and CEO of the Unified Government of Wyandotte County, and Kansas City, Kansas.

“We look forward to welcoming AltCap to Kansas City, Kansas,” Alvey said. “Small businesses and entrepreneurs are the heart of our economy and with AltCap’s support, we hope to strengthen and diversify our entrepreneurial ecosystem in a way that promotes thriving, economically empowered communities.”

AltCap recently received a $55 million new markets tax credit award from the U.S. Department of the Treasury. The award enables AltCap to continue financing high-impact investments and projects in economically challenged parts of Kansas City, said Ruben Alonso, president of AltCap.

A minority-controlled financial institution, AltCap has deployed nearly $160 million in tax credits to stimulate private investments in economically distressed communities throughout Kansas City. The organization also has deployed nearly $7 million in debt financing with microloans up to $50,000.

To learn more about the organization, click here. AltCap’s new coverage area is depicted below.

2018 Startups to Watch

stats here

Related Posts on Startland News

KC-brewed FairWave chases aromas east, adding Baltimore-area roaster to its coffee collective

Working with a larger, experienced leadership team and collaborating with new specialty coffee friends throughout the FairWave coffee collective will be a total game changer for Maryland-based Ceremony Coffee Roasters, said Ronnie Haas. Ceremony on Monday announced it had joined the family of brands under FairWave Specialty Coffee Collective, which is headquartered in Kansas City…

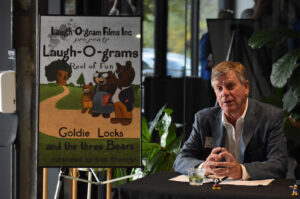

Disney preservationists launch $4M campaign, add key collaborators to save iconic animator’s KC studio

The legacy of Walt Disney’s foundational time in Kansas City — and the structure the famed animator left behind on Troost Avenue — must be preserved frame by frame, said supporters of an ambitious redevelopment project at the former Laugh-O-gram Studios. A newly launched “Dreams Start Here” campaign aims to secure a future for the historic…

His family-fried waffle spot is open for cheat day (but not breakfast); How Dennis Alazzeh played chicken with restaurant trends and won

Kansas City-battered Chick-In Waffle is expanding into Johnson County; its owner — a son from within Jerusalem Cafe’s founding family — gives the classic American chicken-and-waffle combo a global twist with flavors like Asian chili, tikka masala, and queso After slogging away in his father’s restaurants while in school, Dennis Alazzeh swore off the industry…