Beth Ellyn McClendon: If you want investors, skip LLCs and form a C-Corp

May 11, 2018 | Beth Ellyn McClendon

Editor’s note: Beth Ellyn McClendon is a seed-stage investor with board and advisory board experience. She previously worked in design and product management for Google Mapping, Android, YouTube, Cisco and Netscape. The opinions expressed in this commentary are the author’s alone.

So, you’re planning a startup, you’ve got a good lawyer and now you’re thinking about how to incorporate your business.

If you’re just starting out, it’s tempting to go for the flexibility and simplicity of an LLC. But if you plan to raise venture capital, forming a C-Corporation may be a better place to start.

In simple terms, if you incorporate as an LLC, your startup doesn’t pay taxes. The profits and losses “pass-through” the business to you and are reported on your personal tax return. If there are several co-owners, or “members,” the LLC generates a K-1 tax form for every member, listing the profits and losses that need to be reported.

If you’re a founder, that sounds great — straightforward and simple. But if you’re an active startup investor, it probably adds more complications than it’s worth.

Investing in a C-Corp startup generally creates only one tax event for an investor and it isn’t triggered until the investment “resolves” in some way. For example:

- When a startup is sold, investors report and pay tax on the profit.

- When a startup goes under, investors report and deduct the loss.

- When a startup IPOs, investors sell their stock and report the sale.

- Theoretically, dividends would also generate a tax event but they don’t come into play much in startup investing. C-Corp startups tend to pour profits back into the growth of the company.

On the other hand, when startup investors put money into an LLC, they become “members” and take on a yearly tax obligation. Investors must wait for the LLC to generate a K-1 and include it in their personal tax return, each and every year for as long as they hold the investment.

Further complicating things, if the investor isn’t a co-resident in the LLC’s location, they may become subject to filing yearly taxes in a different state or a different country. Investors are also obligated to report and pay taxes on an LLC’s profits whether or not the LLC chooses to distribute earnings.

Because of this, LLCs do distribute earnings to “members” to cover their tax liability, which can bleed money off a startup that might otherwise be poured back into its growth.

If that sounds like a small price to pay — scale it up. For VCs and active angel investors with multiple investments per year, this quickly adds up to a substantial and recurring burden. Some venture funds, depending on the composition of their limited partners, aren’t even able to consider an LLC for funding.

LLC founders often pitch me by saying, “We’ve written a lot of provisions into our LLC to make it behave like a C-Corp” and that may be true, but it won’t make fundraising easier. If you’re trying to make your LLC behave like a C-Corp, it probably needs to be a C-Corp.

Startup investors like ‘standard’ paperwork. They like to invest in C-Corps, particularly Delaware C-Corps, because it’s a well-worn path. Federal and state law does most of the heavy lifting by default. It limits shareholder liability. It makes equity compensation and stock ownership fairly straightforward. It roughly defines what corporate governance must look like and requires a Board of Directors. It provides some specific tax benefits and keeps the tax complexity of investment down to a minimum.

As with all things in business, you should walk through your options with a good legal advisor and, if you don’t need to raise funds, do whatever suits you. But if you plan to raise money, operating as an LLC may limit your pool of interested investors, so choose wisely.

Beth Ellyn McClendon is a seed stage investor with board and advisory board experience. She previously worked in design and product management for Google Mapping, Android, YouTube, Cisco and Netscape. She holds patents in mapping, navigation and monetization.’ Follow her on Twitter @bemcclendon.

2018 Startups to Watch

stats here

Related Posts on Startland News

AI smart sensor startup Particle Space earns ‘Top 50 Tech Companies’ distinction

A virtually hardware-free property and building management platform from Particle Space earned the Kansas City-based startup high honors this month at Intercon in Las Vegas. “The future is bright, all buildings will communicate every interworking detail,” said David Biga, founder of Particle Space, which uses artificial intelligence and smart sensors for its residential and commercial…

Why are college students dropping out? EdSights targets higher ed retention rates

Only 56 percent of students who began college in 2012 actually graduated within the next six years, said startup founders Claudia Recchi and Carolina Recchi. The sisters’ own struggles as first-generation U.S. college students reinforced the challenge posed by such statistics, they said, prompting them to found EdSights, a startup using artificial intelligence to collect…

Friendmedia moving San Fran HQ to Kansas City; planning $1.5M funding round for hiring

San Francisco-based tech firm Friendmedia is expected to relocate its headquarters to Kansas City in 2020 amidst $1.5 million funding round, said Nick Magruder. “Our goal is to take advantage of all the great things that Kansas City brings to the table with all the great people, the low cost of living and everything that…

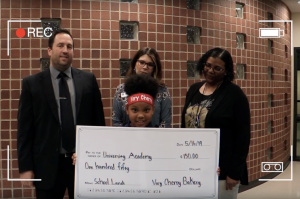

Cherry on top: 9-year-old baking entrepreneur cuts check to pay off KC students’ negative lunch balances

Baking is the perfect recipe for spreading joy — owning a small business should be too, said 9-year-old Ire Cherry, recalling the moment she stood before administrators at University Academy in Kansas City, holding a check wider than she is tall. “My mom and her sister were talking about people in Virginia who couldn’t pay their…