We Create KC report: Startup investment soared to $540M in 2017

April 6, 2018 | Tommy Felts

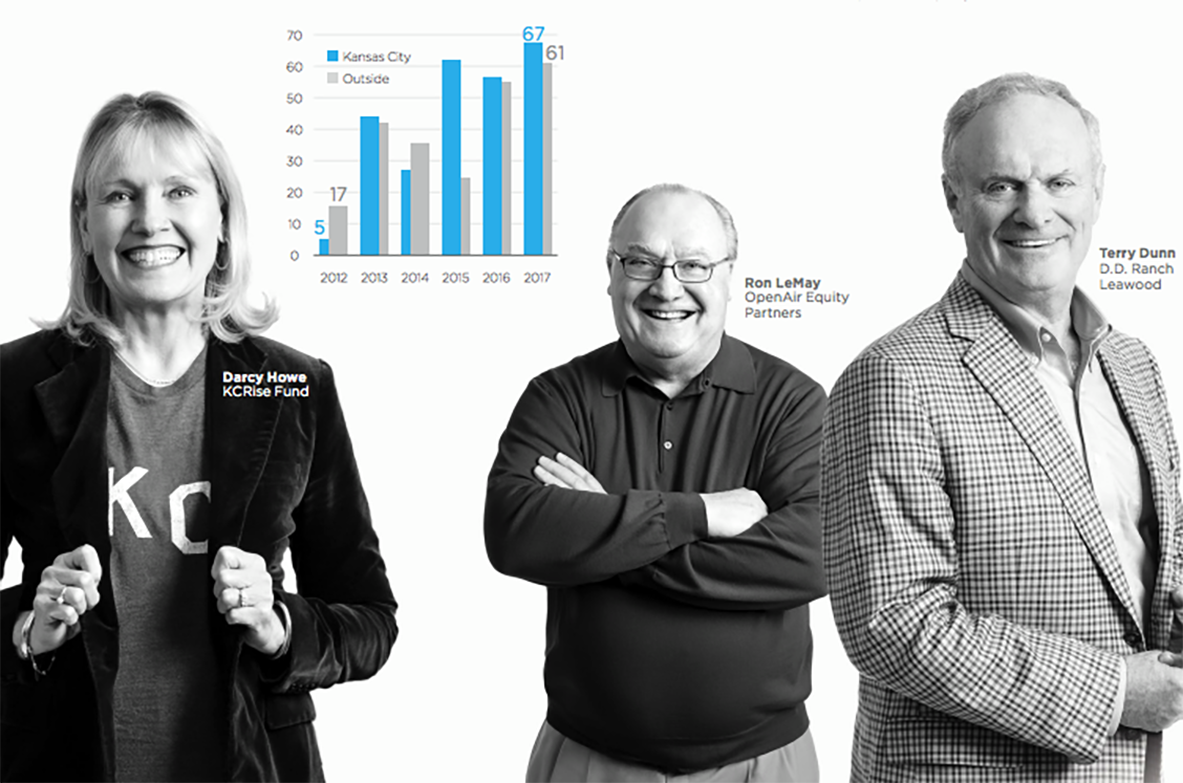

A startling statistic for those who think capital merely flies over the Midwest: Kansas City saw a 69 percent increase in startup investment from 2016 to 2017, according to KCSourceLink’s We Create KC report.

All told, early-stage businesses classified by KCSourceLink as startups — typically defined as those with 20 or fewer employees — nabbed about $540 million in 2017 (compared to $319 million in 2016), the study said.

Such totals include traditional investments, as well as funding via Small Business Innovation Research (SBIR), National Institutes of Health (NIH), Launch KC and Digital Sandbox KC grants, KCSourceLink officials said.

“We are trending in the right direction. We see an increase in capital, and we are working to fill holes in funding resources all across the capital continuum,” said Maria Meyers, founder of KCSourceLink and executive director of the UMKC Innovation Center. “Our role at KCSourceLink is to continue to respond to the needs of our entrepreneurs, helping them connect with resources to get deal-ready and connect with the right type of funding at the right time.”

Almost half of the capital resources for early-stage entrepreneurs are new since 2013, according to KCSourceLink’s research.

The startup investment surge dovetails with other data points in the We Create report, including those noting a 290 percent increase in access to capital in the past five years, and an average of 16,376 jobs created annual by first-time (startup) employers in Kansas City.

KCSourceLink’s report not only details such trends, it seeks to illustrate the role the network plays in supporting entrepreneurs through access to capital, the idea pipeline, awareness and corporate engagements. Check out the full report here.

The organization made 9,425 connections via its hotline and email in 2017 (up by more than 2,000 from 2016), according the report, and 70 percent of companies that received funding in 2017 were assisted in some manner by the KCSourceLink network.

“We know that the right connections matter to entrepreneurs and that entrepreneurs matter to Kansas City’s economic growth,” Meyers said. “Having the right resource at your back is critical for the survival and growth of Kansas City startups and small businesses.”

2018 Startups to Watch

stats here

Related Posts on Startland News

Teach for America KC celebrating 10 years building entrepreneurs to fight education inequity

Dividends from Teach for America KC swelled Rachel Foster’s development as a teacher and community member invested in Kansas City, the leader in innovation-driven education said. “I owe everything, it feels like, to Teach for America,” said Foster, Young Entrepreneurial Spirit program leader at Lee A. Tolbert Community Academy. “The fruits keep coming in for…

Lenexa-based Aloe soothes health insurance enrollment pains with human touch

A patient’s “wow” moment shouldn’t be when he or she opens a medical bill and discovers procedures that unexpectedly aren’t covered by insurance, said Andrew Belt, co-founder of Aloe. “People are frustrated — frustrated because they don’t understand how their coverage works or what’s included, and it doesn’t seem like anyone they talk to understands,”…

LendingStandard plans innovation upgrade with $2.5M investment from Flyover Capital

An investment in innovation has landed Kansas City-based LendingStandard $2.5 million in investment funds following the close of a Series A funding round led by Flyover Capital, CEO Andy Kallenbach said. “These are folks that are well-known in Kansas City and have had software businesses in the past, and that’s a really rare combination,” Kallenbach…