We Create KC report: Startup investment soared to $540M in 2017

April 6, 2018 | Tommy Felts

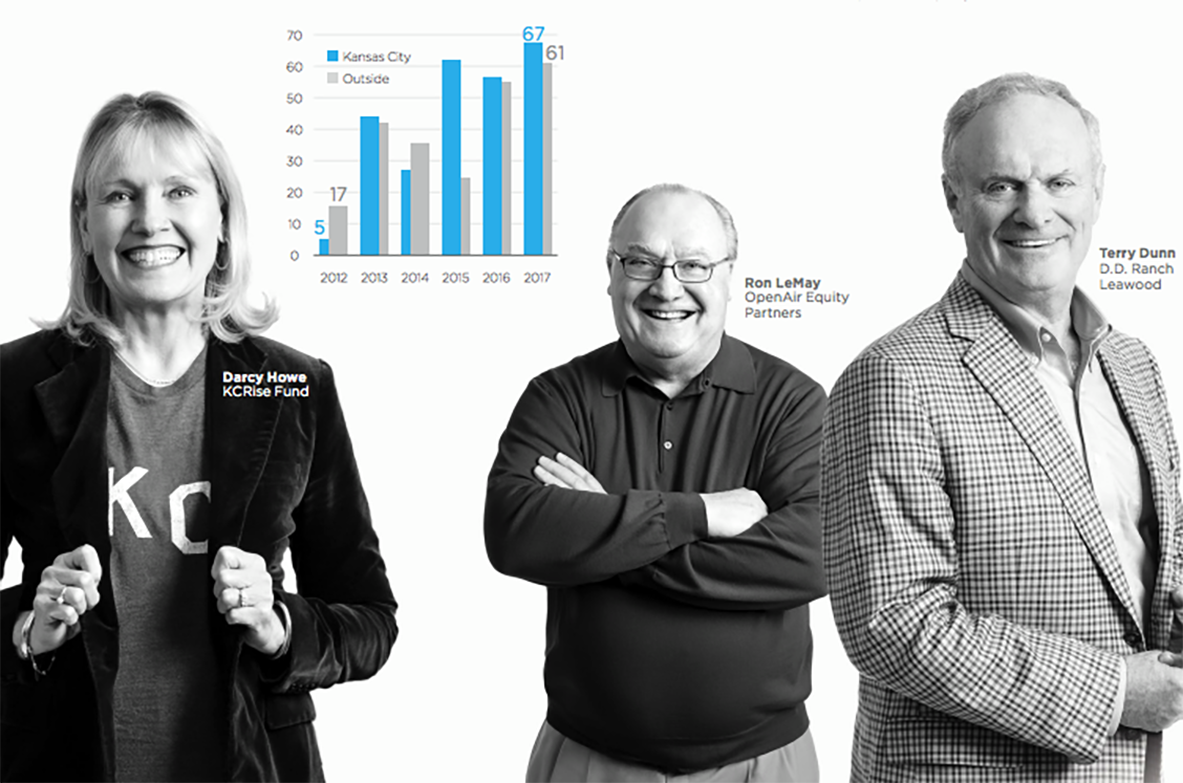

A startling statistic for those who think capital merely flies over the Midwest: Kansas City saw a 69 percent increase in startup investment from 2016 to 2017, according to KCSourceLink’s We Create KC report.

All told, early-stage businesses classified by KCSourceLink as startups — typically defined as those with 20 or fewer employees — nabbed about $540 million in 2017 (compared to $319 million in 2016), the study said.

Such totals include traditional investments, as well as funding via Small Business Innovation Research (SBIR), National Institutes of Health (NIH), Launch KC and Digital Sandbox KC grants, KCSourceLink officials said.

“We are trending in the right direction. We see an increase in capital, and we are working to fill holes in funding resources all across the capital continuum,” said Maria Meyers, founder of KCSourceLink and executive director of the UMKC Innovation Center. “Our role at KCSourceLink is to continue to respond to the needs of our entrepreneurs, helping them connect with resources to get deal-ready and connect with the right type of funding at the right time.”

Almost half of the capital resources for early-stage entrepreneurs are new since 2013, according to KCSourceLink’s research.

The startup investment surge dovetails with other data points in the We Create report, including those noting a 290 percent increase in access to capital in the past five years, and an average of 16,376 jobs created annual by first-time (startup) employers in Kansas City.

KCSourceLink’s report not only details such trends, it seeks to illustrate the role the network plays in supporting entrepreneurs through access to capital, the idea pipeline, awareness and corporate engagements. Check out the full report here.

The organization made 9,425 connections via its hotline and email in 2017 (up by more than 2,000 from 2016), according the report, and 70 percent of companies that received funding in 2017 were assisted in some manner by the KCSourceLink network.

“We know that the right connections matter to entrepreneurs and that entrepreneurs matter to Kansas City’s economic growth,” Meyers said. “Having the right resource at your back is critical for the survival and growth of Kansas City startups and small businesses.”

2018 Startups to Watch

stats here

Related Posts on Startland News

Retro-inspired activewear brought this stay-at-home mom out of isolation; why it’s go-go time for Molly Heise’s budding business

Molly Heise’s earliest memories go back to playing marbles on her great-grandma’s avocado-colored shag carpet, captivated by the various floral patterns that surrounded her, she recalled. Today, those memories inspire her personal style and activewear line, GoGoBloom. “I’ve loved the retro style for as long as I can remember,” she shared. “But in the past…

They fought to end Lee’s Summit’s neon ban; now they’re relighting a grinning, spinning Katz face in KC

How a Lee’s Summit duo is reviving eye-catching signs of KC’s past The iconic face of Katz Drug Store — the famed retail operation that grew from the streets of Kansas City to eventually become CVS — is set to return to its hometown thanks, in part, to a pair of unlikely neon sign restorationists. …

PlaBook to compete for $1M in prizes at world’s largest pitch competition for edtech startups

Fresh off its selection to Pipeline’s latest fellowship, a Kansas City edtech startup is now set to compete at The Elite 200 as a semifinalist in The GSV Cup — representing top pre-seed and seed stage startups in digital learning across the “Pre-K to Gray” space. KC-based PlaBook is set to vie for $1 million…

C2FO closes $140M funding round amid record growth, expanded focus on underserved companies

Editor’s note: C2FO is a financial supporter of Startland News’ nonprofit newsroom. Kansas City fintech powerhouse C2FO grows best when it’s accelerating access to capital for those traditionally underserved by the banking industry, said Sandy Kemper, announcing a $140 million funding round for the Leawood-based company. Led by Third Point Ventures — a multi-stage investor…