C2FO raises massive $100M round for global expansion

March 1, 2018 | Bobby Burch

In what is believed to be the largest venture-backed funding round in the Kansas City area’s history, C2FO is lighting the fuse on its global expansion with a $100 million capital raise.

The Leawood-based financial tech firm’s round was led by Munich-based Allianz X and Abu Dhabi-based Mubadala Investment Company, and included participation from Temasek, Union Square Ventures and Mithril Capital.

The capital will support strategic initiatives including international growth, additional working capital solutions and greater development of the C2FO customer community, the company said in a release. It will also be used for secondary share purchases from earlier investors and associates.

The company created an online marketplace where buyers can negotiate with suppliers, earning quicker payments in exchange for discounts to free up cash that would be stuck in accounts receivable. C2FO customers include Costco, Amazon, Nordstrom, Chevron, Sysco and many other corporations.

“When we launched C2FO in 2010, our goal was to be the most convenient and lowest-cost source for business funding in the world,” said Sandy Kemper, C2FO founder and CEO. “Today, 99.5 percent of our customers tell us we have achieved that goal. We continue to deliver tremendous value to our global corporate buyer customers while helping their suppliers access working capital at a fair price. We are honored to have the support and confidence in C2FO from Allianz X, Mubadala and all our investors.”

At the end of 2017, C2FO said it reached a milestone of providing $1 billion of funding per week to businesses in more than 100 countries. That metric effectively makes C2FO one of the largest non-bank providers of working capital in the world. C2FO expects to be providing about $1 billion per day by 2021.

The $100 million round is the largest venture-backed round in the Kansas City area’s history. The closest in value in recent memory were previous $40 million rounds by Farmlink and C2FO.

Kansas City area venture capital investors were wowed by the news, not for its value but its significance to the firm’s growth.

“More importantly than the size of the round is who is in the round,” said Darcy Howe, managing director of the KC Rise Fund. “Top-tier institutional fin tech investors and strategic investing in a Kansas City company that can find enough talent to grow in Kansas City is huge. The lesson for founders is to choose the most strategic investors you can whose networks and muscle are additional leverage to accelerate quickly.

C2FO’s huge round lends credence to Kansas City and its business community for several reasons, said John Fein, managing director of Firebrand Ventures.

“It shows a homegrown Kansas City company can build a team and grow their business to the point of raising a nine-figure round. It also brings more attention and credibility to KC,” he said. “The numbers are important. Many investors need to see the potential for $1 billion exits. For example, Indianapolis didn’t gain that credibility until ExactTarget exited for $2.5 billion. C2FO is well positioned for that at some point.”

The round also sets a good example for Kansas City startups by holding true to the mission and by building a quality team, Fein added.

“C2FO has earned their funding via traction — $1B is flowing through their platform per week,” Fein said. “A long-term mindset is paying off versus accepting a quicker acquisition offer. Many Midwest startups exit too soon — before they can become this big. … Sandy is phenomenal but he can’t do it all himself. He’s built an amazing team around him, all in KC.”

If or when C2FO has a big exit, it would have a massive impact on Kansas City’s startup community, Fein added.

“It’ll hopefully spawn other great new startups and facilitate more capital flowing back into the Kansas City ecosystem,” he said. “This is another big reason why the numbers matter: It takes really big exits to create the virtuous cycle of an ecosystem becoming self-sufficient — see San Francisco, Boston, New York City, Chicago, Austin and Boulder. If anything, I’m probably most excited about this possibility.”

Founded in 2008, C2FO employs about 200 people and has raised about $200 million to date. The company was named a Startland News Top Startup to Watch in 2016.

2018 Startups to Watch

stats here

Related Posts on Startland News

AI-generated bedtime stories are just the first chapter in JQ Sirls epic venture to make the publishing industry more inclusive

Every great children’s story deserves the opportunity to be published, JQ Sirls said, adding his own footnote that more people are qualified than they think to create them. “I could put 1,000 people in one room and tell them all to write a short story about their childhood. While many of them may have a…

‘When puppets talk people listen’: It’s not just storytelling anymore for one of KC’s most beloved children’s theaters

A Kansas City arts institution known for years as the Mesner Puppet Theater is animated with new life, said Meghann Henry, detailing a mission pivot for the freshly sewn and rebranded What If Puppets. Evolution at the nonprofit has taken a turn toward early childhood education since the retirement of Paul Mesner in 2016 —…

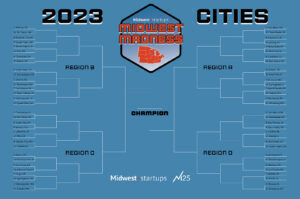

M25 drops Midwest Madness bracket for best startup hub: 4-seed KC faces up-hill battle (Here’s how to vote)

Bracket update: Since this story’s original publication, Kansas City has advanced to the Midwest Madness bracket’s Round of 32. Voting on Kansas City’s next match-up — against 5-seed Lafayette, Indiana — begins Tuesday, March 21. As sports fans fill out March Madness brackets this week, a Chicago-based venture capital firm is encouraging Midwestern founders, investors…

Startups, investors on ‘red alert’ as Silicon Valley Bank collapse ripples into new tech downturn fears

Editor’s note: This story was originally published by Missouri Business Alert, a member of the KC Media Collective, which also includes Startland News, KCUR 89.3, American Public Square, Kansas City PBS/Flatland, and The Kansas City Beacon. Click here to read the original story. Silicon Valley Bank collapsed in rapid fashion on Friday to become the second-largest bank…