Former Netchemia CEO, KC venture capitalist launch new fund for Midwest software firms

February 1, 2018 | Bobby Burch

Keith Harrington isn’t looking for hockey-stick growth companies.

With the new fund he’s co-leading — Novel Growth Partners — Harrington wants to invest in small, steadily-growing tech companies in the Midwest. But instead of a traditional venture capital model, Novel is employing a revenue-based finance model that should appeal to more entrepreneurs, Harrington said.

“We believe that the current financing ecosystem excludes the majority of companies seeking financing. We know that only a small percentage of companies get venture capital and most young companies are too small for private equity and can’t get meaningful bank financing,” said Harrington, a former managing director at Kansas Bioscience Authority and recent Kauffman Fellow graduate. “We also recognize that there is a very large set of early-stage companies with revenue and growth that can benefit from the unique combination of capital and operational expertise we deploy.”

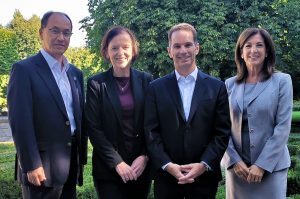

Harrington partnered with former Netchemia CEO Carlos Antequera to launch the fund. Antequera’s former firm sold to Vista Equity Partners in 2015.

With decades of business experience, the duo was inspired by challenges they recognized in firms’ ability to attract the appropriate type of funding — particularly in markets with limited access early-stage capital.

Here’s how Novel’s royalty-like model works:

Instead of taking portfolio company’s equity — thus requiring it to sell to generate a large return on the investment — Novel’s investment gets paid back at a set monthly percentage of the company’s revenue. The percentage is usually between 4 and 8 percent of the portfolio firm’s monthly revenue up to a predetermined return cap of up to five years. Novel provides developing software companies $100,000 to $500,000 in growth capital.

As a result, the entrepreneur is able to preserve ownership while growing the value of the company.

Novel plans to further add value to its portfolio firms by offering a boot camp focused on identifying and executing specific projects to accelerate revenue growth, Antequera said. During the boot camp, Novel props up new systems, automates processes and helps identify talent that will accelerate sales, Antequera said.

“We’re on a mission to provide capital to companies that have some revenue, customers and are focused on improving their business fundamentals, but in addition to capital, need improved sales systems, processes and talent to grow,” said Antequera. “Because venture requires rapid scaling, it is not the right type of capital for many companies. Equity venture investors cannot fund slow-growth opportunities. That’s where we come in, our model allows us to provide capital to companies with steady growth.”

Featured Business

2018 Startups to Watch

stats here

Related Posts on Startland News

Tea-Biotics opens ‘world’s-largest kombucha taproom’ with 32 flavors, Royals flare

The strength of Tea-Biotics’ new, world’s-largest kombucha taproom lies in its bold flavors — and a lot of them, said Lisa Bledsoe. “How good is fresh-pressed, organic blueberry? It’s great for you! It’s full of antioxidants,” said Bledsoe, founder of Tea-Biotics Kombucha, referencing just one of 32 variations on tap at the Olathe taproom. “How…

Global, KC investors charge Grandview-based battery innovator with 8-figure funding round

A Grandview-based leader in battery technology is building a charge for expansion as Spear Power Systems announced this week an eight-figure funding round with world-spanning reach and headline-grabbing international investors. “We are pleased with the quality and synergy of the syndicate,” said Jeff Kostos, president and CEO of Spear. “This investment enables Spear to scale…

Play It Forward reunites South Kansas City-inspired brands, startup leaders

A bright and sunny pre-autumn day silhouetted the shadows of basketball fans lining up last weekend to enter Smith-Hale Middle School. As the smells from a food truck and sounds of laughter filled the parking lot, players inside readied themselves for a South Kansas City showcase. “We wanted to involve many entities that are directly…

Climbing mountains in the Midwest? Exiting Pipeline leader eyes next big challenge

A desire to move mountains is driving Joni Cobb to move on from Pipeline — her family of 13 years. “I’ve been thinking about it for many years … not because I don’t love what I do. I love what I do [with Pipeline],” said Cobb, president and CEO of the Midwest-based accelerator and entrepreneur…