After $2.95M round, corporate deal ensures word-of-mouth marketing for RiskGenius

November 7, 2017 | Meghan LeVota

RiskGenius’ $2.95 million series A extension funding round is worth more than its face value, said CEO Chris Cheatham.

The round was led by QBE Ventures, an Australia-based firm known as being among the world’s top 20 insurance companies. In addition to the funds, QBE North America will be the first division to fully implement the RiskGenius platform. The company is expected to upload about 125,000 policy documents by 2018.

“The large enterprise contract is a huge win,” Cheatham said. “It’s really exciting and it’s frankly leading to a lot of other opportunities as well. In insurance, once you have one large user that’s willing to vouch for you, a lot of other parties can then decide that they want to do something with you, too.”

Founded in 2012, RiskGenius — previously known as ClaimKit — grew from an initial concept focused on improving insurance claim documentation to now an artificial intelligence platform for policy automation.

Although the firm still offers its previous ClaimKit service, Cheatham is focused on expanding the RiskGenius offering, which delivers insights into coverage plans, uses automation to review policies and makes it easier to develop policy language, he said.

“RiskGenius has a bigger market potential,” he said. “ClaimKit solved a niche problem for people, but RiskGenius is focused on a huge, nasty problem that is literally costing people hundreds of millions of dollars, and we are the only people out there solving it.”

Bob James, group head of transformation at QBE, is delighted to bring on Risk Genius as its first, major partnership, he said.

“QBE North America completed a proof-of-concept of the RiskGenius platform earlier this year, and saw great results leveraging the company’s proprietary, machine learning product to compare policies as part of our product development process,” James said in a release. “From that proof-of-concept, we’ve now signed a multi-year commercial use agreement, and plan on implementing the RiskGenius platform across all our business units in North America during the first half of 2018.”

The $2.95 million round also included funds from Flyover Capital, Cheatham said.

“Flyover has been awesome,” Cheatham said. “They have given us the room to create the product we needed to build. One of the reasons I was excited to see them join this round is because they’ve invested in the previous round we did. We were attracted to them because they are former entrepreneurs and understand the process we have to go through to get a product right.”

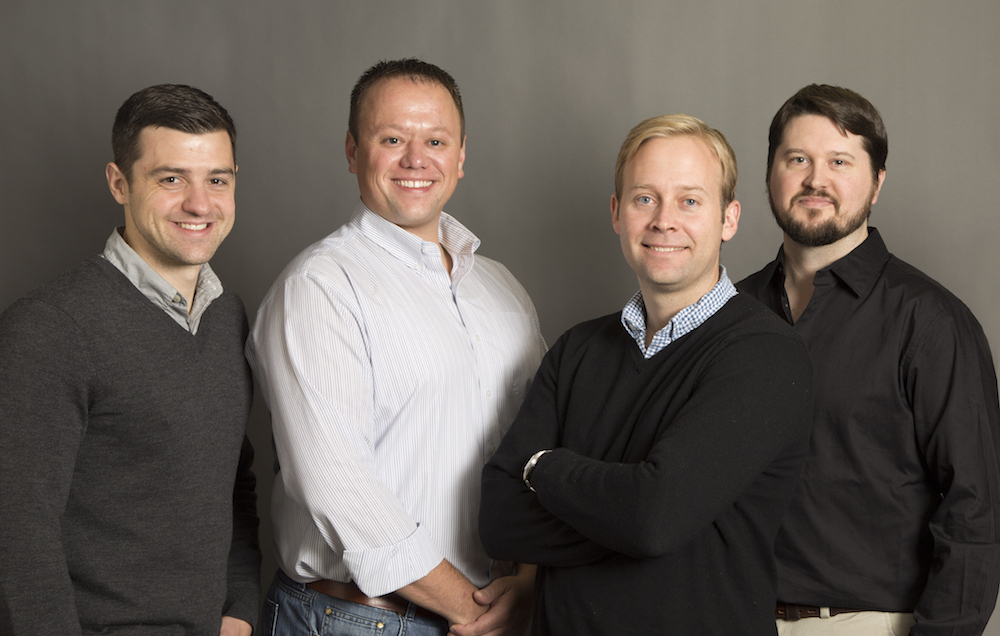

With a current team of 12, RiskGenius raised $2.78 million in 2016 to accelerate the development of its tech. Following on the most recent funds, the firm plans to focus on acquiring customers.

“That’s our biggest focus, without a doubt,” Cheatham said. “Customer happiness and customer success. Thanks to QBE, we now have a really great base of users. Now, we just want them to be really happy.”

Cheatham is excited about the budding opportunity for technology startups in the Kansas City region, he added.

“EyeVerify (now Zoloz) sold for a bunch of money doing artificial intelligence for financial services, and now we are doing artificial intelligence for insurance,” Cheatham said. “I think that there is a lot of opportunity in Kansas City in artificial intelligence. … There are a lot of interesting and important solutions coming out of the Midwest.”

RiskGenius was named an under-the-radar startup by Startland News in 2017. In September, Cheatham was named Entrepreneur of the Year at the Entrepreneurial Insurance Symposium.

Featured Business

2017 Startups to Watch

stats here

Related Posts on Startland News

Startup stakeholders: Opportunity zones could prompt culture shift on redevelopment

Startup community stakeholders think opportunity zones in some of Kansas City’s poorest areas could work, but only with collaboration between the government and private sector. A number of low-income communities in Kansas City are eligible for designation as opportunity zones — areas in which investors may defer paying capital gains taxes over a certain period…

OP-based motion capture startup DARI Motion sells to Omaha firm

DARI Motion, an Overland Park-based startup that created a motion capture platform that provides biomechanical analysis of athletes, patients and more, recently was acquired by a Nebraska firm. DARI, which stands for Dynamic Athletic Research Institute, was purchased for an undisclosed amount by Omaha-based Scientific Analytics Inc. With the acquisition, the firm aims to transform how…

Axing the status quo: Swell Spark builds experiences from West Bottoms HQ

Human interaction is about more than texting and social media posts, said Matt Baysinger, co-founder and CEO of Swell Spark. “One of the best things in life is sharing a meal together, but sharing a meal together is only as good as the conversation you get to have over that meal,” Baysinger said. “If you…