Eyeing Midwest startups, Firebrand Ventures adds to advisory board

September 22, 2017 | Meghan LeVota

A Kansas City-based venture fund announced the addition of another distinguished advisory board member.

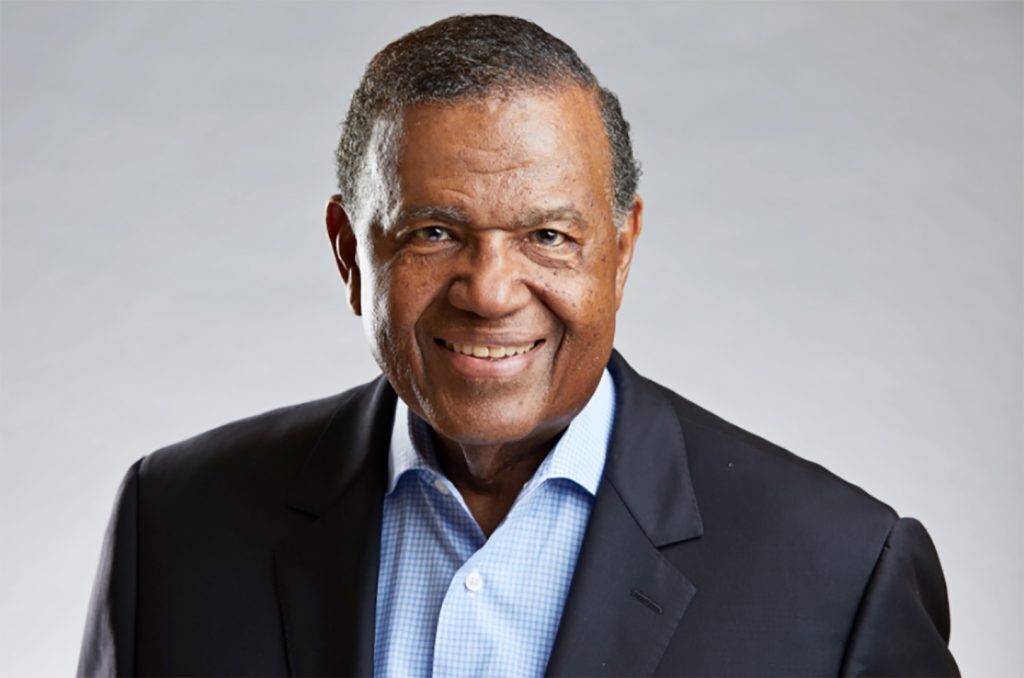

Joining the team alongside Techstars CEO David Cohen, Kansas Citian Keith Harrington, who’s the managing director for Novel Growth Partners, and Brian McClendon, former Uber vice president of maps, Tom Ball is expected to bring his Austin-based investor experience to Firebrand Ventures.

Tom Ball

Cultivating a rockstar team of advisors is paramount to a fund’s success, said John Fein, managing director of Firebrand Ventures.

“Tom is going to be another important piece for Firebrand,” he said. “For one, he’s our first advisor based in Austin. It will be great to keep in touch with the startups that are doing well in that community.”

Fein was introduced to Ball — co-founder of Next Coast Ventures — via the Techstars network, with which Fein was previously employed. He was attracted to Ball’s 20-year work history.

“His experience as an entrepreneur and early-stage investor gives us another set of eyes and ears on the deals that we’re looking at,” Fein said. “Being able to draw from my advisors’ experience is amazing. Together, they’ve helped me evaluate every aspect, such as product, technology, market, and team. … The value they add to Firebrand is huge.”

Firebrand Ventures launched in 2016 to fill the need for venture capital, not only in Kansas City, but in the Midwest as a whole. Fein defines the greater Midwest as the area between San Antonio to Minneapolis and Boulder, Colorado to Columbus, Ohio.

“It’s hard to believe a year has already flown by,” he said. “I started Firebrand because back when I was running the Sprint Accelerator program (powered by Techstars), for the first two years (2014 and 2015) we didn’t have any teams from the program that were able to raise local money. I found that very odd. These companies were very fundable.”

The Firebrand Ventures fund will invest $7 million in about 30 Midwest startups through the next three years, Fein said, with an average check size of $150,000. The fund’s portfolio currently includes seven companies. Fein said he expects to add about four more companies by the end of 2017.

“Of course, since I am here, I would love it if we could invest in more Kansas City companies,” Fein said. “But as a fund, we’re going to go out there and invest in as many exceptional Midwestern founders as we can, no matter where they are located.”

Comparing Kansas City’s entrepreneurial ecosystem to Boulder, Colorado or Austin, Texas isn’t realistic or fair, he said.

“The cycle of a startup ecosystem is generally 15 to 20 years and Boulder and Austin are much farther along than Kansas City at this point,” Fein said. “However, I am really pleased with how Kansas City has been coming along the past 12 to 18 months. I’ve seen many startups about two to three years old gaining some real traction and results here. I can’t wait to be able to invest in more of Kansas City’s exceptional founders.”

He added that Kansas City’s startup community needs improvement in two areas: available capital and corporate engagement. Fein said that Midwestern culture is partially to blame, alleviating the problem by making an effort to be proactive and accessible.

“I’m always checking my email to whoever reaches out to me,” Fein said. “What gets me out of bed in the morning is meeting great founders. I just love spending time with awesome founders who inspire me so much on a weekly basis. My job is incredible.”

Firebrand Ventures is expected to hire an associate later this year. As the fund and the team continues to grow, Fein aims to be as helpful to the community as possible, he said. In January, Fein shared with Startland readers tips to hooking a venture capitalist.

Related Posts on Startland News

KC investors power $4.5M round for OP startup poised to ‘unlock billions’ for its customers

Overland Park-based Realto has closed a $4.5 million funding round — thanks in large part to the backing of Kansas City-based investors. “We’re excited to welcome these important investors as we continue to expand our robust trading capabilities across the universe of alternative products,” Brian King, co-founder and CEO, said in announcement of the funding round which…

Firebrand Ventures closes $40M seed fund for ‘authentic’ founders in emerging communities; adds Leo Morton as advisor

A year after two prominent venture capital firms announced their merger, the consolidated Firebrand Ventures II is officially closed — reaching its $40 million target and having already invested in startups from Detroit, Seattle and Toronto. “Several years ago we raised our first funds — Boulder-based Blue Note Ventures and Kansas City-based Firebrand Ventures I —…

Overland Park startup secures $41M as infrastructure gets new focus amid COVID, Biden presidency

A massive round of Series B funding will boost Replica’s data platform as it changes how cities are planned and operated — especially in the wake of a global pandemic and a renewed emphasis on infrastructure spending from the federal level down, said Nick Bowden. The $41 million round was led by Founders Fund and…

$40M Firebrand II fund strengthened by Kansas City VC’s merger with Boulder firm, leaders say

Merging two venture capital funds focused on one startup-rich portfolio is expected to create a larger platform for founders in up-and-coming markets, said Chris Marks. “While a merger is unique in the venture world, this feels very natural based on our overlap in values, our shared commitment to supporting authentic leaders, and our similar focus…