Blooom reaches $1 billion in assets under management

September 28, 2017 | Meghan LeVota

Blooom announced Thursday that the Leawood-based financial tech firm has reached $1 billion in assets under management, becoming the fastest, independent robo advisor to pass that threshold.

Although it’s not the first robo advisor to reach $1 billion, Blooom did so by stretching its dollar much farther than Silicon Valley fintech counterparts, said co-founder Chris Costello.

“This is a source of great pride for us,” Costello said. “Here’s this company from Kansas that with just a tiny fraction of capital reached $1 billion dollars faster than either Betterment or Wealthfront, who have garnered almost all the headlines in the space.”

Blooom helps users grow their 401(k)s using a proprietary online tool that analyzes an individual’s 401(k) and shows its health through a flower in various growth stages. The firm then offers ongoing professional advice on how to allocate funds.

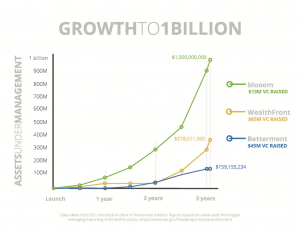

Blooom compared to other robo advisor competition. Data taken from SEC Historical Archive of Investment Advisor Reports based on when each first began managing AUM.

Since its launch in 2013, Blooom has raised more than $13 million, closing an oversubscribed Series B round of $9 million in February. Following the $1 billion milestone, the firm plans to crank up its public relations strategy to garner more national headlines.

Blooom deserves it, Costello said.

“When the story gets out more broadly that there’s this company that’s been flying under the radar that’s accomplished (the $1 billion assets under management milestone) a lot faster than most (robo advisor) companies, I think that’s going to cause more people to pay attention,” he said.

Aside from the milestone being a vehicle to share the Blooom story, it speaks to the firm’s fast-paced progress, Costello said. In 2016, the firm dubbed itself the “fastest-growing robo advisor ever” after reaching $300 million in assets under management in 20 months, years faster than New York City and Silicon Valley Competition.

Costello partially credits this to his decision to grow the firm in the affordable, friendly Kansas City.

“Kansas City has been wonderful to us about following our story,” Costello said. “All of our three co-founders were born and raised in the area and are now raising our families here. We will never move for the company.”

Blooom also taps a larger market than other robo advisors, targeting the average person. About 80 million people in the United States who use a 401k as their primary retirement account, he said.

“The space we’re in is enormous,” Costello said. “The reason why we’re so excited about what we’ve built and what this can turn into is that so many people need this. We’re not just building another service for the wealthy 1 percent. We’re building this for everyone else in America who’s been told that if you don’t have enough money, good luck, figure it out yourself.”

With about 11,000 clients currently, Costello said the company has a long way to go before it taps all 80 million Americans with a 401K.

“We haven’t arrived at the Promised Land yet,” he said. “But, we’re starting to see maybe a path that can get us there. I have a lot of confidence that we are really onto something special.”

In May, Blooom pivoted from a dual-focus on both B2B and B2C channels, laying off nearly a third of its staff. Former Blooom president Greg Smith — who focused on large enterprise partnerships — also resigned from the company.

“We weren’t doing either (B2B and B2C) at 100 percent capacity,” Costello told Startland News in May. “Dividing our attention across individuals and multiple intermediaries muddied — for a whole host of reasons — this singular aim of helping the people who need help the most.”

Blooom was recognized as one Startland News’ Top Startups to Watch in 2017.

2017 Startups to Watch

stats here

Related Posts on Startland News

Meet the KC Chamber’s Top 10 for 2022: One will be the next ‘Small Business of the Year’

From a rapidly expanding restaurant chain to a 24/7 daycare facility to a workforce training and information technology leader building a statewide footprint, the finalists for the 2022 Small Business of the Year award run the gamut of forward-thinking Kansas City ventures, said Joe Reardon. “Every year I become more and more impressed with our…

Three-way tie: Public vote mixes ‘Fan Favorite’ small business honors between meals and more

A trio of Kansas City small businesses is sharing the Honeywell Fan Favorite Award this week after wowing the public during the Chamber’s recent candidate showcase at Union Station. “The rules can be bent,” said Eric Wollerman, president of Honeywell Federal Manufacturing and Technologies, announcing the three-way tie in the lead-up to the Greater Kansas…

Avatar for hire (in a few years): Gamified career platform helps kids explore their future in the workforce

It’s a powerful question asked in classrooms every day, Jessica Munoz Valerio said, recalling her own experience with the common prompt and how tapping into and gamifying it could change lives. “When my daughter was young — as early as 5 years old — she got asked, ‘What do you want to be when you grow up?’”she…

C2FO helped women-, minority-owned biz access nearly $2B in 2021 alone; why that slice of $200B is set to grow as company approaches $1T funded

Customers of C2FO have accessed more than $200 billion in working capital, the company announced, touting its wide-ranging successes and highlighting pandemic-era growth that has solidified its place as a world leader in the financing space — and a pace-setter for deploying capital to underserved businesses. “From Day 1, C2FO has worked to fill the…