Blooom reaches $1 billion in assets under management

September 28, 2017 | Meghan LeVota

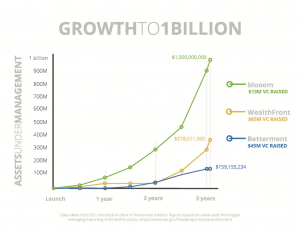

Blooom announced Thursday that the Leawood-based financial tech firm has reached $1 billion in assets under management, becoming the fastest, independent robo advisor to pass that threshold.

Although it’s not the first robo advisor to reach $1 billion, Blooom did so by stretching its dollar much farther than Silicon Valley fintech counterparts, said co-founder Chris Costello.

“This is a source of great pride for us,” Costello said. “Here’s this company from Kansas that with just a tiny fraction of capital reached $1 billion dollars faster than either Betterment or Wealthfront, who have garnered almost all the headlines in the space.”

Blooom helps users grow their 401(k)s using a proprietary online tool that analyzes an individual’s 401(k) and shows its health through a flower in various growth stages. The firm then offers ongoing professional advice on how to allocate funds.

Blooom compared to other robo advisor competition. Data taken from SEC Historical Archive of Investment Advisor Reports based on when each first began managing AUM.

Since its launch in 2013, Blooom has raised more than $13 million, closing an oversubscribed Series B round of $9 million in February. Following the $1 billion milestone, the firm plans to crank up its public relations strategy to garner more national headlines.

Blooom deserves it, Costello said.

“When the story gets out more broadly that there’s this company that’s been flying under the radar that’s accomplished (the $1 billion assets under management milestone) a lot faster than most (robo advisor) companies, I think that’s going to cause more people to pay attention,” he said.

Aside from the milestone being a vehicle to share the Blooom story, it speaks to the firm’s fast-paced progress, Costello said. In 2016, the firm dubbed itself the “fastest-growing robo advisor ever” after reaching $300 million in assets under management in 20 months, years faster than New York City and Silicon Valley Competition.

Costello partially credits this to his decision to grow the firm in the affordable, friendly Kansas City.

“Kansas City has been wonderful to us about following our story,” Costello said. “All of our three co-founders were born and raised in the area and are now raising our families here. We will never move for the company.”

Blooom also taps a larger market than other robo advisors, targeting the average person. About 80 million people in the United States who use a 401k as their primary retirement account, he said.

“The space we’re in is enormous,” Costello said. “The reason why we’re so excited about what we’ve built and what this can turn into is that so many people need this. We’re not just building another service for the wealthy 1 percent. We’re building this for everyone else in America who’s been told that if you don’t have enough money, good luck, figure it out yourself.”

With about 11,000 clients currently, Costello said the company has a long way to go before it taps all 80 million Americans with a 401K.

“We haven’t arrived at the Promised Land yet,” he said. “But, we’re starting to see maybe a path that can get us there. I have a lot of confidence that we are really onto something special.”

In May, Blooom pivoted from a dual-focus on both B2B and B2C channels, laying off nearly a third of its staff. Former Blooom president Greg Smith — who focused on large enterprise partnerships — also resigned from the company.

“We weren’t doing either (B2B and B2C) at 100 percent capacity,” Costello told Startland News in May. “Dividing our attention across individuals and multiple intermediaries muddied — for a whole host of reasons — this singular aim of helping the people who need help the most.”

Blooom was recognized as one Startland News’ Top Startups to Watch in 2017.

2017 Startups to Watch

stats here

Related Posts on Startland News

Events Preview: Entrepreneurial Sales Workshop

There are a boatload of entrepreneurial events hosted in Kansas City on a weekly basis. Whether you’re an entrepreneur, investor, supporter, or curious Kansas Citian, we recommend these upcoming events for you. WEEKLY EVENT PREVIEW Compute Midwest When: November 2 @ 8:00 am – 4:30 pm Where: Kauffman Performing Arts Center On November 2nd, remarkable…

Edison Spaces debuts real estate solution for growing startups

This story was originally published in MetroWireMedia, a Kansas City commercial real estate and development news source. As the former president and CFO of Freightquote, Matt Druten has become all too familiar with the unpredictable real estate needs of large companies and startups. When a startup picks up momentum, they grow in revenue and headcount and…

A chip on former Mizzou receiver Tommy Saunders’ shoulder fuels his fitness tech firm

Editor’s note: This content is sponsored by LaunchKC but independently produced by Startland News. “This is for everyone who doubted me.” That’s a phrase Tommy Saunders has been saying to himself for years. Saunders said it after being denied scholarship offers and earned a walk-on spot as a wide receiver for the University of Missouri.…